Investors spend countless hours online trying to find the next hot stock, only to lose money and miss their financial goals.

Follow a simpler process of No Sweat Investing for better returns and less stress.

I have a love-hate relationship with the media when it comes to financial news and investments. As an investment analyst for nearly a decade, I make a good living analyzing and providing advice on stocks and other assets. I’m also ashamed of the direction many websites and TV shows take investing advice and the sleepless nights it causes many investors.

If you’ve ever put money to an investment account outside of your company’s 401k or a managed fund, you’ve probably thought about looking for that next hot stock. Five minutes online or clicking through the financial “news” channels and you’re likely to come across someone pitching a get-rich-quick investment or leaning on a button and screaming, “Buy, Buy, Buy!”

If you’re like most investors that fall for the slick pitch of buy-low, sell-high and big money dreams, you are probably not doing as well as you could. Even worse, the poor performance of your investments is probably causing you more than a little stress and a few sleepless nights.

Is there a better way to manage your own investments? Is there a way that can help you reach your financial goals with less stress?

Are You A Stock Picker?

I’ve worked as an analyst for financial advisors, venture capital firms and real estate developers. Over nearly ten years, I’ve written at least a few hundred reports and investment opinions on individual stocks. I’ve spent years studying corporate financial statements, earning a professional designation and have even appeared on Bloomberg as a panel expert on emerging market investing.

The truth though is that even the professionals have a hard time beating the market. Fund managers regularly underperform a passive investment strategy, especially after fees are removed from returns. The best advice most can offer, something I try to stress in my reports, is how a specific stock can add improve a portfolio through diversification.

If people that spend their lives following the markets have a tough time, how does the average arm-chair investor do?

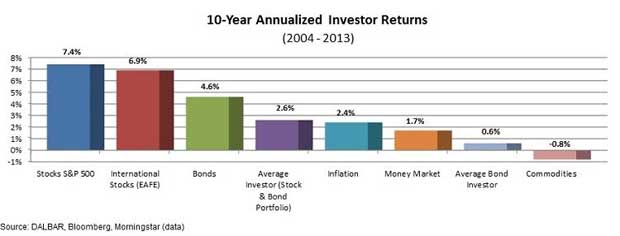

The graphic below shows the return for the average investors, managing their own portfolio with a mix of stocks and bonds, against returns on different asset classes over the ten years to 2013.

Even after a halving of prices during the stock market crash, stocks have done well with a 7.4% annual gain over the period. Even relatively safe bonds have provided a 4.6% annualized return.

But investors with a mix of stocks and bonds have only enjoyed average returns of 2.6% over the period because of poor investing behaviors and trading fees. Listening to the pundits on TV has them rushing to jump in to the newest overpriced sensation. When people stop talking about the investment, the price tanks and investors panic, selling at a loss. Besides the poor returns, investors end up losing much of their money to fees charged every time they buy and sell a stock.

The constant losses on stocks and the underwhelming returns leaves a lot of investors bitter and stressed out that they’ll ever be able to retire.

There is a better way to invest your money and meet your financial goals. The method provides good returns but more importantly, it offers a no stress and no sweat alternative to the popular method of stock-picking.

The No Sweat Investing Method To Meet Your Financial Goals

First, understand that investing isn’t about finding stocks or bonds that will make you tons of money. Investing is about YOU and your financial needs. Start with an understanding three basic concepts:

- How long until you need money from your investments, your time horizon. A longer time horizon means you can hold more in stocks without worrying that a recession is going to wipe out your investments right when you go to retire.

- How much volatility are you comfortable with in your portfolio? Your investment risk tolerance is an important but usually overlooked concept. Stocks provide better returns than bonds over the long-term but values can jump and fall quickly. If you get skittish and stressed every time your investments fall a little, you’d be better off sticking with safer bonds.

- What rate of return do you need to meet your financial goals? If you’ve already got a significant portfolio and do not need much more than 4% or 5% growth a year, do you really need to be chasing that hot tech stock or should you protect your portfolio with investment in safer, mature companies?

These three questions will help you decide on what mix of assets is right for your portfolio.

Assets are broad investment categories like stocks, bonds, real estate and commodities. Holding a mix of stocks, bonds and real estate in your portfolio means that your wealth won’t be destroyed when interest rates jump or the next market crash comes. The mix of these three assets will change as you get older. You may start off in your 20s or 30s with mostly stocks and a small percentage in bonds or real estate. As you get older, you will want to shift more to the safety of bonds and real estate for income.

You can get exposure to these three asset classes easily through exchange traded funds (ETFs), investments like mutual funds but bought and sold like stocks. These funds are managed to mimic the return on a group of stocks or an asset class but charge much lower fees compared to mutual funds.

Some good examples for consideration are:

- SPDR S&P 500 ETF (NYSE: SPY) provides exposure to all the stocks in the S&P 500 with one purchase. These are the largest and most stable companies listed on the U.S. markets and a good start for individual investors. Shares pay a 1.87% dividend yield and have returned an annualized 7.9% over the last ten years.

- iShares Core U.S. Aggregate Bond (NYSE: AGG) holds 3,779 bonds to mimic the return of the U.S. bond market including government and corporate bonds. Shares pay a 2.28% dividend yield and have returned an annualized 4.2% over the last ten years.

- Vanguard REIT ETF (NYSE: VNQ) holds shares of 145 real estate investment trusts (REITs), funds that hold individual properties. The fund is one of the easiest and safest ways to earn real estate passive income without the hassle of managing your own properties. Shares pay a 3.76% dividend yield and have returned an annualized 7.4% over the last ten years.

You may consider adding a few more ETFs that provide exposure to international stocks and bonds as well.

Save your investment money and only buy shares every three months to avoid spending too much on trading fees. Since the funds provide a diversified exposure to stocks, bonds and real estate there really is no need to attempt to time the markets.

Invest regularly and resolve to hold the funds until retirement or when you need the money.

A No Sweat Investing strategy may not soar like an investment in the next hot tech company but it will get you where you need to be and you won’t have to worry about crashing markets. Your diversification across different assets will smooth the volatility in your portfolio and will help you sleep at night when other investors are wondering where their money went.

Avoiding panic selling and high fees will help your simple strategy outperform over the long-run and you’ll get to your financial goals more quickly.

Joseph Hogue, CFA runs PeerFinance101, a blog where you share your stories of personal finance challenges and success. There’s no one-size-fits-all solution to meeting your financial goals but you’ll find a lot of similarities in others’ stories and a lot of ideas that will help you get through your own challenges.

Share Your Thoughts: