If you’re looking for something more than a typical robo-advisor, Titan Invest gives you a good alternative option.

Titan offers many of the portfolio management tools you get from typical robo-advisors, but your portfolio is highly concentrated, focusing on a small number of what Titan believes are high-quality, high-performing stocks. The objective of Titan Invest is not just to match the S&P 500, but to outperform it over the long-term.

What’s more, Titan Invest provides an investing app that is built like a hedge fund. But they do it without the high fees and the six-figure minimum investment usually required on hedge fund accounts.

About Titan Invest

Titan Invest is an SEC registered investment advisor, launched on February 20, 2018, by Clayton Gardner, Joe Percoco and Max Bernardy. All three have been investors or engineers at well-known hedge funds, Goldman Sachs, and McKinsey.

Titan Invest is set up as a mobile application, but they are currently also working on building out a fully operational web version. And though the company uses hedges that aim to protect each investor’s portfolio, Titan Invest is not a hedge fund. Your money is held in your own individual account, and a personalized hedge is added based on your risk tolerance.

The company’s mission statement:

“The first is simple – compound your capital at a high rate of return over the long-term. We aim to achieve this goal by investing in a concentrated group of world-class companies with the mindset of a long-term business owner and providing a personalized hedge. The second – we want you to grow as an investor along the way. We spend a lot of effort and transparent with all investors on the “why”.”

How Titan Invest Works

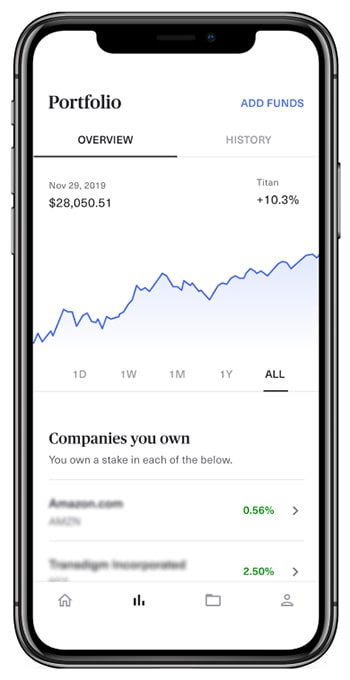

Titan Invest is currently available mainly as a mobile app, though there is a lite web version, and a fully functional version is on the way.

The mobile app is available on Google Play for Android devices 7.1 and up. It’s also available at The App Store for iOS devices, 11.0 and later. It’s compatible with iPhone, iPad.

Titan Invest creates and manages a portfolio for you, including periodic rebalancing. But what makes it different from robo-advisors is that they don’t rely on building the Titan portfolio through a selection of exchange traded funds (ETFs) tied to market indexes. Instead, the Titan portfolio is invested in individual stocks from a select group of what it believes to be 20 high quality, top-performing companies.

A Personalized Hedge (described later) is attached to each individual portfolio, aiming to lower the impact of losses due to market downturns.

When you sign up for the service, you’ll complete a questionnaire that will determine your investor risk profile. The three investor risk profile categories are Aggressive, Moderate and Conservative. Though the long portfolios of 20 stocks are the same for all investors, the amount of your portfolio dedicated to the Personalized Hedge will be higher or lower, based on your individual profile.

Use of “fractional shares”. Though Titan Invest enables you to begin investing with just a few hundred dollars, your portfolio will be spread across equal weights of all 20 companies through the use of fractional shares. For example, if you invest $1,000, $50 will be invested in each of the 20 companies. If the current price of one stock is $200, you’ll get 0.25 shares of that company’s stock, equal to $50. This enables Titan Invest to provide you with a fully diversified portfolio, even with a relatively small amount of money.

Titan Investment Methodology

Titan Invest uses a long-term, quality-oriented approach to investing, in which they seek to invest in companies that have strong fundamental characteristics.

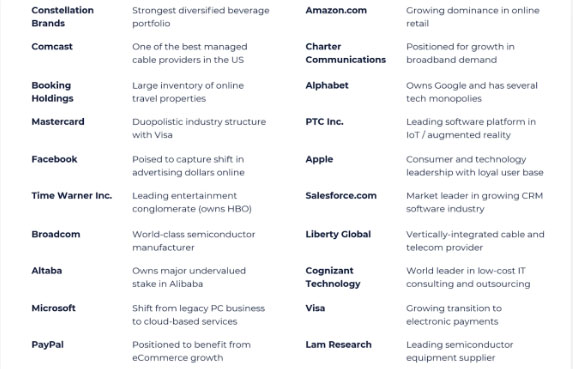

Investments are culled from the public filings of ~5% of hedge funds (out of more than 3,500 funds), from which they create a basket of their top 20 stocks. The goal is to create a “best-of-the-best” portfolio. The portfolio is updated quarterly- as the public filings are updated.

The 20 stocks held in the portfolio are equally weighted. One of the factors that makes Titan Invest different from other investment platforms, and especially robo-advisors, is that you own direct shares in the stocks held in your portfolio. Unlike a mutual fund or ETF, you’re not holding shares in Titan Invest itself.

Titan Invest likens their investment strategy to that used by Warren Buffett. Their strategy seeks to minimize stock turnover to maximize portfolio tax efficiency. Also, no leverage of any kind is used in their investment strategy.

Titan Invest believes its algorithm tends to identify stocks of companies that meet the following criteria:

- Durable competitive advantages

- Excellent growth prospects

- High returns on capital

- Strong leadership teams

- Attractive valuations

Titan Invest uses proprietary software to algorithmically identify these companies. Along with the 20 stocks your portfolio is invested in, based on your risk tolerance, you are given an automated, personalized hedge. The portfolio will short between 0% and 20% of the S&P 500, using an inverse ETF vehicle.

Titan Invest uses the same 20 stocks for all investors in each portfolio . The Flagship portfolio held the following stocks (as of the end of the first quarter of 2019):

All investment information is provided to investors in a detailed fashion.

They provide real-time updates, including deep dives on portfolio holdings, videos and audio notes, and quarterly letters on the portfolio. As an investor with Titan Invest, you’re always aware of what you’re investing in and why.

Personalized Hedge

This is one of the primary features distinguishing Titan Invest from other managed investment platforms. All Titan Invest investor accounts include the use of the Personalized Hedge. The degree of hedges varies by client based on the client’s personal risk tolerance, which once again, can be Aggressive, Moderate, or Conservative.

It is believed the hedge can help mitigate losses on the portfolio during times of market volatility. But they emphasize the hedge does not guarantee that any or all losses will be mitigated by the hedge. The hedge is an inverse S&P 500 ETF as described above.

The hedge is applied to your account based on the direction of the Titan portfolio’s return compared to the overall market. When the portfolio enters a downturn the degree of hedge increases, then decreases when the downturn ends. The hedge is personalized based on questions you answer when you sign up for the app. The more conservative you are, the greater the hedge.

A portfolio downturn is defined as when the trailing 12-month return of the Titan portfolio falls below the average cumulative return of the S&P 500 over the trailing 12-month period. This is referred to as a momentum hedge.

The levels of hedging are as follows:

When the portfolio is NOT in a downturn:

- Aggressive: 0% of the portfolio value is hedged.

- Moderate: 5% of the portfolio value is hedged.

- Conservative: 10% of the portfolio value is hedged.

When the portfolio IS in a downturn:

- Aggressive: 5% of the portfolio value is hedged.

- Moderate: 10% of the portfolio value is hedged.

- Conservative: 20% of the portfolio value is hedged.

When a downturn occurs, the designated portion of your portfolio value will be sold in in equal amounts across all 20 stocks. The proceeds of those sales will be reallocated to the hedge position.

Titan Invest Portfolio Performance

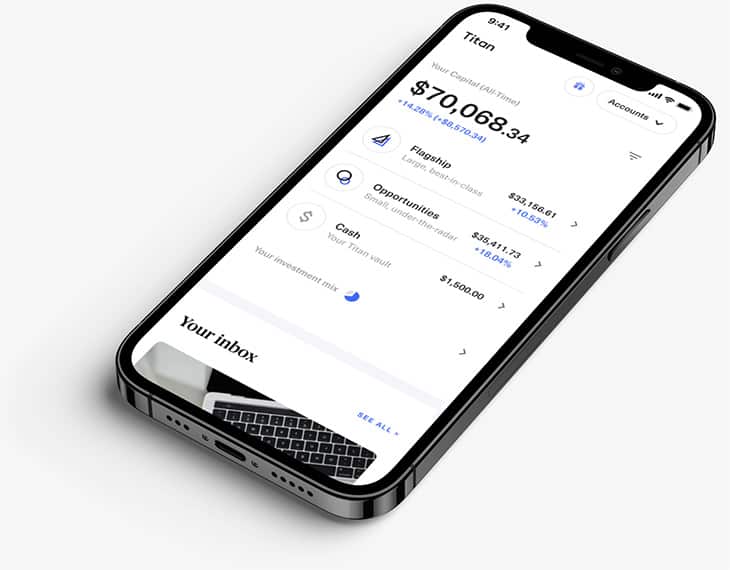

Though Titan Invest has only been around since spring of 2018, their portfolio performance since then has been very good. They have three main portfolios you can choose from, the Titan Flagship portfolio, Titan Opportunities portfolio and Titan Offshore portfolio.

Titan Flagship Portfolio

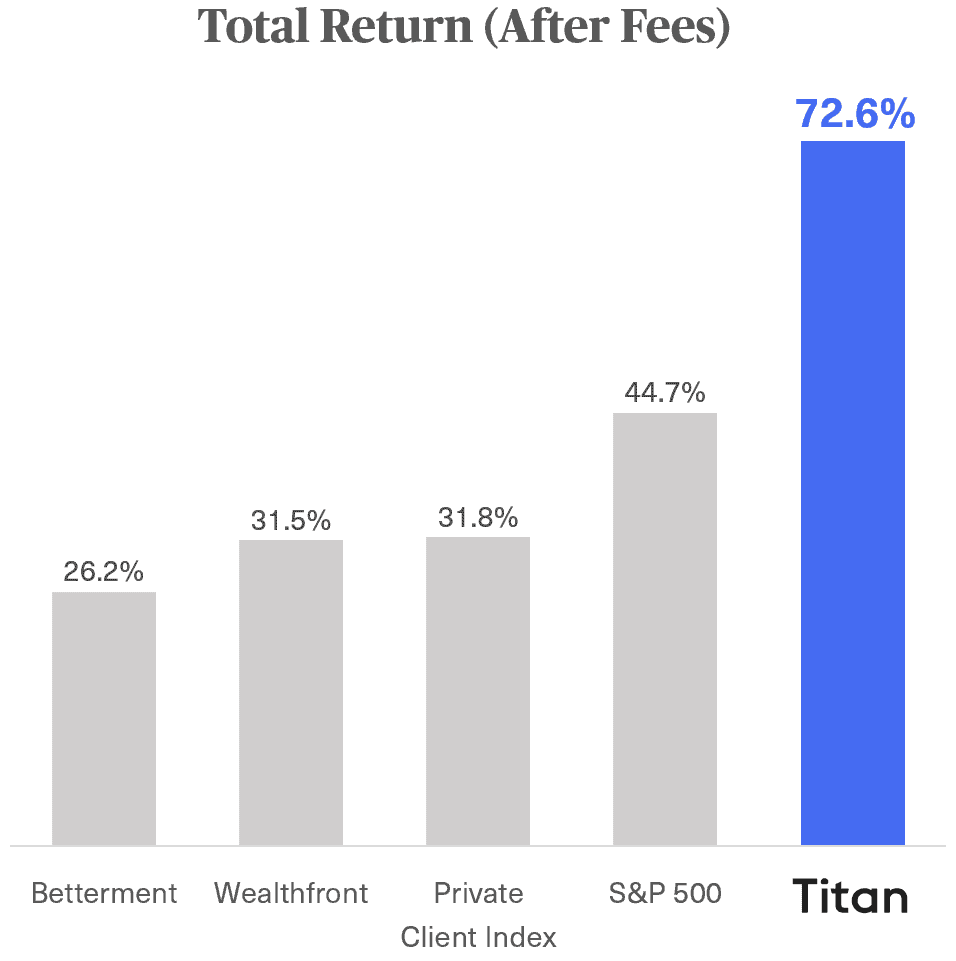

Their Titan Flagship portfolio’s (aggressive risk profile) return looks very good as of this writing (the figures below are as of 1/31/21). It invests mainly in large cap U.S. growth companies that can compound capital in excess of the S&P 500 index:

Titan Opportunities Portfolio

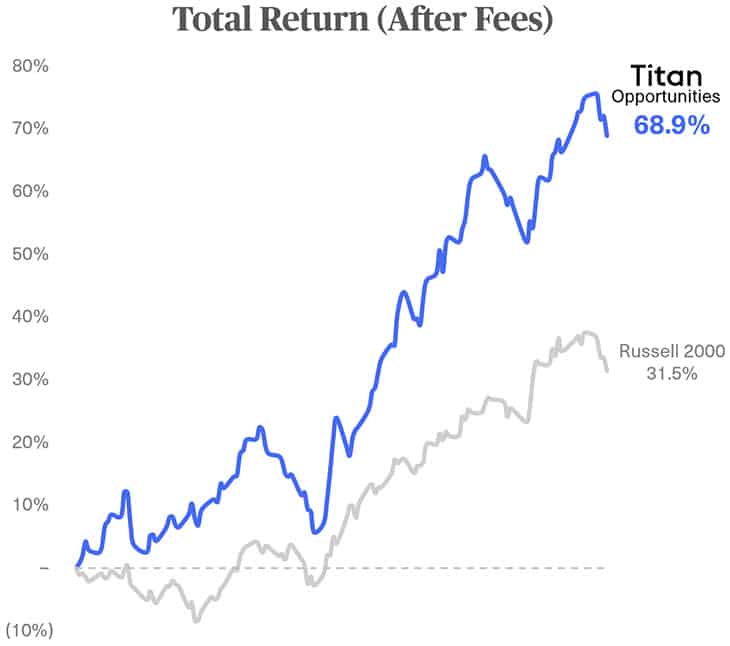

The Titan Opportunities portfolio focuses on smaller U.S. companies that Titan believes can grow at exceptional rates. The portfolio performance for their Opportunities strategy (aggressive risk profile), which has been around since August 2020, look like this as of this writing (the figures are as of 1/31/21):

Titan Offshore Portfolio

The Titan Offshore portfolio was just launched in April of 2021. It is focused exclusively on an international growth strategy, aimed at identifying the best businesses in developed and emerging markets around the world. Since it just launched it doesn’t have any performance data as of yet.

Titan Crypto

Titan Crypto is one of the very first available actively managed cryptocurrency investment strategies, having just launched in August 2021.

This investment strategy invests in 5-10 crypto assets that show the most promise for outstanding long-term returns based on their team's in-depth analysis. They state that their goal is to outperform the Bitwise 10 Large Cap Crypto Index over a 3-5 year horizon. Since it is so new there are no performance data yet available.

*See full performance disclosures at the end of this post and on Titan’s website.

Titan Invest Features

Minimum initial investment: $100 (used to be $500)

Available account types: Individual taxable investment accounts, Roth and Traditional IRA. Joint, custodial, trust, LLC, and other account types are hopefully coming soon

Third-party integrations: You can link your Titan Invest account with popular online services, including Personal Capital and Mint. Titan Invest is also reaching out to other integration tools, and expects to add the capability to export transaction data to Quicken eventually.

Titan's Fees and Pricing: There’s an annual advisory fee of 1% for accounts over $10,000. Accounts under that amount pay $5/month. Unlike hedge funds, there are no performance fees. There are also no trading fees or early withdrawal fees.

Free tier: There is now a free tier where new users can install Titan and get access without having to make an initial investment. This gives users a chance to explore the app.

Withdrawals: You can withdraw funds at any time, though Titan Invest recommends you invest with a long-term mindset given the long-term nature of the investment strategy. The minimum withdrawal is $100.

Instant deposits: All users now get instant deposits for free. Most robo-advisors will charge for this feature, or deposits will take 2-3 days.

Portfolio rebalancing: Quarterly

Clearing agent/account custodian: Apex Clearing Corporation, one of the largest clearing houses in the country, which also acts as a custodial agent for some of the most popular investment platforms in the industry.

Customer service: The company can be contacted by email or via live chat in the app, as well as on Twitter, Facebook, and Instagram. There is currently no phone support.

Platform security: All accounts are protected by SIPC insurance through Apex Clearing Corporation, for up to $500,000 in cash and securities, including up to $250,000 in cash. The platform also encrypts all customer data using 256-bit encryption and Secure Socket Layer (SSL) security.

How to Sign Up with Titan Invest

To open a Titan Invest account you must be at least 18 years old, be a US citizen, have a legal US residential address and a valid Social Security number (tax identification numbers are not acceptable). The app is also available for green card holders and holders of certain visa types (H-1B, E-2, E-3, F-1, K-1 and L-1).

You’ll be required to supply the following information:

- First and last name

- Email address

- Date of birth

- Social Security number

- Home address

- Phone number

- Employment status

You can get started through the button below.

You can fund your account with minimum deposits of $100 through the mobile app. You can connect your bank account and have funds transferred by ACH. Funds will settle in your account in one or two business days.

Titan provides a list of major banks you can link. But if you don’t see your bank or credit union listed, you can add it manually. If you do, you’ll need to enter the institution’s name, type of account, routing number and account number. Two small deposits will be transferred into your bank account for verification purposes. Once the account has been verified, you’ll be already to make transfers.

You can also use wire transfers to make deposits, but you’ll need to contact the company directly to receive wire instructions.

If you want to make regular contributions to your account, you can set up automatic deposits through the mobile app. Titan Invest enables you to make automatic deposits on a weekly, biweekly and monthly basis. Automatic deposits must be a minimum of $100.

Titan IRA

When they launched Titan didn’t have IRAs available as an account type, only individual taxable investment accounts.

In October 2019 they added both Traditional and Roth IRA accounts as well.

Titan Invest Referral Program

Titan Invest offers a unique referral program. For each person you refer to the service who opens a qualifying new account, Titan Invest will lower your annual advisory fee by 0.25%. They also extend the same fee reduction to the person you’ve referred.

It’s even possible to reduce your annual advisory fee all the way to zero. Four referrals opening accounts is all it will take to get you there. This makes it possible to get a fully managed stock portfolio – with the Personalized Hedge protection – completely free of advisory fees.

The referral program works by you sending invites to friends, family and people you know. However, you must invite them only through the interface on the Titan Invest app.

Titan Invest Pros & Cons

Titan Invest, like any other investing website, has it's pros and cons.

Pros

- Your portfolio is invested in 20 of what Titan Invest believes are the best-of-the-best stocks on the market, rather than an index or a very broad portfolio.

- Each portfolio is hedged, using an inverse S&P 500 ETF which aims to minimize losses in a market downturn.

- Titan Invest’s human research team keeps you in the loop on what’s driving your investments, and why, using videos, deep dive reports, and other digestible insights.

- You will be the direct owner of the stocks held in your portfolio, rather than a shareholder in the Titan Invest portfolio.

- Real-time reporting enables you to check the value of your portfolio on your mobile app at any time.

- The annual advisory fee is 1% and there is no performance fee. That’s well below the typical hedge fund fee structure, which includes a 2% advisory fee and a 20% performance fee. ($5/month for accounts under $10k)

- The Referral Program enables you to lower your annual advisory fee by 0.25% for each person you refer to the service who opens an account. It’s even possible to lower your annual advisory fee all the way to zero.

- Titan Invest offers customer service via email, app, social media, and phone (848-222-3664).

- Titan now offers investing in cryptocurrencies as well.

Cons

- No IRAs, but they expect to have them available by the summer of 2019. UPDATE: Traditional and Roth IRAs are now available!

- Not available for non-US investors, but they do have a waitlist available for the day when they’re available internationally.

- Titan Invest was launched in February 2018, so it’s a relative newcomer.

- The web version of the platform is currently limited, so you’ll need a mobile device to participate fully. However, the company says they’re working on launching a more advanced web version soon.

Titan Aims To Outperform

Not only does the company invest in what they believe to be some of the top performing stocks and cryptocurrencies on the market, but they also hedge your portfolio which aims to mitigate sustained market declines. It gives you an opportunity to participate on the way up, but to also hopefully mitigate losses on the way down.

Unlike traditional robo-advisors, Titan Invest provides you with a personalized hedge alongside your portfolio stocks. The company goes to great lengths to help you understand exactly what you’re invested in and why, using engaging tools like in-app videos, audio notes, deep dive reports, email updates, push notifications, and more. No other robo-advisor offers a service like this (to my knowledge).

On the other hand, similar to a robo-advisor, your assets will be automatically invested (into the Titan portfolio stocks) and subject to quarterly rebalancing. All you’ll need to do is fund your account, and Titan Invest will handle all the management details for you. And don’t forget the Referral Program. It’s possible to lower your annual advisory fee all the way down to zero by referring family and friends to the service.

If you’d like more information, or you’d like to sign up for the service, visit the Titan Invest website.

Brokerage | Promotion | Open Account | Review |

|---|---|---|---|

2 free stocks (Up to $1,600) | |||

Free stock slice | |||

Free $10 bonus | |||

1 free stock (Up to $220) | |||

Get $30 when you deposit $1,000 | |||

Free stock (Up to $1,000) | |||

Get up to $1,000 cash to invest. | |||

2 free stocks (Up to $400) | Cell | ||

2 free stocks (Up to $1,200) | |||

1 free stock (Up to $200) | |||

Free $5 bonus | |||

Free $5 bonus |

This article is a paid partnership with Titan Invest (“Titan”). All opinions are our own. This is for informational purposes only and does not constitute a comprehensive description of Titan’s investment advisory services. Titan uses a proprietary algorithmic strategy in selecting recommendations to advisory clients. Please see Titan’s website (https://www.titanvest.com/) and the Program Brochure (available on the website) for more information. Certain investments are not suitable for all investors. Before investing, consider your investment objectives and Titan’s fees. The rate of return on investments can vary widely over time, especially for long term investments. Investment losses are possible, including the potential loss of all amounts invested. Titan’s registration as an SEC registered investment adviser does not imply a certain level of skill or training and no inference to the contrary should be made. Nothing here should be considered as an offer, solicitation of an offer, or advice to buy or sell securities. The above content is for illustrative purposes only to demonstrate products, services and information available from Titan. Performance results are net of fees and include dividends and other adjustments. 2019 YTD results are from 1/1/19 through 5/31/19. 2018 results are from Titan’s launch date of 2/20/18 through 12/31/18. All-Time IRR, alpha, beta, and Sharpe ratios are from Titan’s launch date of 2/20/18 through 5/31/19. All-Time IRR is the actual internal rate of return. Alpha is calculated using the Capital Asset Pricing Model (CAPM) and uses a risk-free rate of 2.09%, which was the average 3-month Treasury Bill rate during the period. All performance figures represent performance of a hypothetical account created on Titan’s inception date of 2/20/18 using Titan’s investment process for an aggressive portfolio, not an actual account. All Titan performance results include the use of a personalized hedge for a hypothetical client with an “Aggressive” risk profile; clients with “Moderate” or “Conservative” risk profiles would have experienced lower returns. Please visit https://support.titanvest.com/investment-process/hedging for full disclosures on our hedging process. See Titan’s website for full performance disclosures.

By signing up for Titan from this page, you acknowledge your receipt of the Wrap Fee Brochure and Solicitor Partner Compensation Disclosure. In addition, you understand the new account opening requirements. Solicitors may receive compensation for funded account openings on the Titan app that occur through this referral landing page.

I have used titan with great returns over the last year. Of note titan has outperformed all others robo advisor in rate of returns in the most recent robo ranking report since inception ~38.8% return rate. Downside is they charge an 1% advisory fee which is much higher than betterment or wealthfront.

You can find the report and see the methodology here:

Titan Invest November Review 2020 – Backend Benchmarking https://www.backendbenchmarking.com/blog/2020/11/titan-invest-review

Btw if you are interested to sing up for Titan (minimum to invest is 100 $) you can use my referral link below to get 0.25% discount on advisory fees for both of us.

Titan | First Class For Your Capital

https://www.titanvest.com/?r=c59a5ee1-7572-46b2-b17b-fc25b7a513a5