When you’re trying to get ahead financially it can be easy to look at only the large expenses in your budget, and focus your attentions on finding ways to cut those.

Some have said, however, that keeping your focus only on the big things is a big mistake.

In order to get ahead you should focus on the whole financial picture – the big and the small expenditures in your budget.

Quick Navigation

The Latte Factor®

In his book The Automatic Millionaire author David Bach coins the term “The Latte Factor®” to focus on how if you want to “finish rich” in retirement you can simply redirect spending on small discretionary budget items (things like your daily latte, bottled water or cigarettes) towards spending on yourself.

Cut back on discretionary items, and spend that money instead on savings for retirement.

Here’s how he explains it on his site:

The Latte Factor® is based on the simple idea that all you need to do to finish rich is to look at the small things you spend your money on every day and see whether you could redirect that spending to yourself. Putting aside as little as a few dollars a day for your future rather than spending it on little purchases such as lattes, bottled water, fast food, cigarettes, magazines and so on, can really make a difference between accumulating wealth and living paycheck to paycheck. We don’t even realize how much we’re actually spending on these little purchases. If we did think about it and change our habits just a little, we could actually change our destiny.

So if you want to finish rich Bach suggests that you should:

- Identify small things you spend money on every day, or regularly.

- Figure out if you could redirect that spending to a savings goal, and then do it.

- Over time those small savings amounts add up.

Changing your habits even just a little bit over time can mean big changes in your financial future. Here’s a discussion we had surrounding The Latte Factor® on a recent Money Mastermind Show.

Small Savings Amounts Add Up Quick

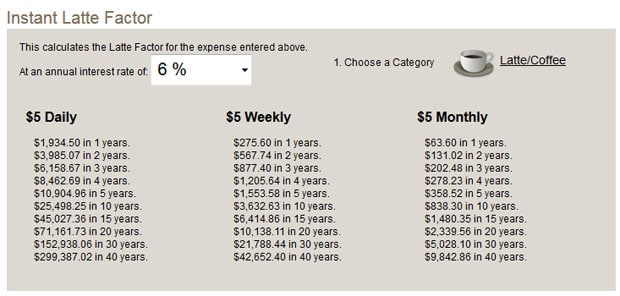

On his site David Bach has a “The Latte Factor® Calculator” that helps to illustrate just how much those small savings amounts can add up to over time.

For example, if I were to redirect a regular daily $5 coffee habit to savings (more like $5.50 in my area for specialty drinks), over time those small dollar amounts would add up. Here’s the breakdown of how $5 daily, weekly and monthly coffees redirected to savings will grow over time at a conservative 6% rate of interest.

If you only nix one $5 weekly coffee for a contribution, even that will lead to $42,652.40 over 40 years. Still a significant amount of money.

Your Latte Factor May Be An “Eating Out Factor” (Or Something Else)

While the name “The Latte Factor®” is catchy, I think for many their “factor” that causes them to overspend may not necessarily be a morning coffee. Their money leaks may be in another area.

I know for years our family has had an “eating out factor”. We would each spend $5-10 to eat out just about every day of the week. If instead we had been making our lunches and bringing them to work, I shudder to think how much money we could have saved. The key is to sit down and figure out where your weak areas are. Some of the more common areas for money leaks to arise:

- Eating out: Eating out every day can add up quickly, $5-10/day can add up to $300/month or more! Over 30 years that could mean in excess of $300,000 at 6% interest! This has been one of our problem areas.

- Coffee and/or snacks: Having a daily coffee, energy drink or donut can easily cost you $5-7/day. That can add up over time!

- Books, magazines, music downloads: While most people probably don’t buy books or magazines daily, even buying a few in a month can add up to the equivalent of a few dollars a day.

- Unused services: Often we’re paying for a higher level of service than we need, or we’re paying for features that we’re not using. Find those extra features, products or services that you don’t need, and cancel them! That can add up to quite a bit of extra cash to invest!

- Online spending: For many, with the advent of the internet, shopping and making impulse purchases has become easier than ever. Take the time to look at just how much you’re spending on Amazon or other online retailers, and you might be surprised.

Cons To The Latte Factor®

The Latte Factor® has it’s detractors and critics. There are a few main reasons why:

- Too much focus on the small expenditures: Some people say that the amount spent on a coffee here and there really doesn’t add up to as much as some might say. They say it encourages people to focus on small expenses, when they should be focusing on the big wins. I do think this criticism is one of the most valid – that if you focus too much on smaller things it can be a problem. You do need to focus on the big and small things I think to have a successful outcome.

- The numbers: Other critics say that Bach gives unrealistic expectations of how much interest you can earn on your savings. I think he may have given numbers in the 10-11% annual returns range at one point, which some people point to, but as Bach says about The Latte Factor®, “It’s a teaching method to get people to “re-think” how they spend money, and realize they have more than enough to start saving. It’s not about guaranteed returns, and my books don’t promise 10 percent returns. And my books show in many cases compounded interest rate examples from 1 percent to 10 percent.” To be honest, much of the criticism in this area feels like nit-picking to me. The idea is that we all have extra money that we could be saving. It’s about changing habits and making honest choices in how we spend or save.

- You need to splurge every once in a while: Another criticism of The Latte Factor® is that it encourages burnout – due to the fact that it never allows people to splurge or enjoy life’s little luxuries. Why not have a coffee if you want one? I don’t think anyone, David Bach included, would ever say that people should give up their coffee (or other spending) completely. It’s about making a conscious decision to say that maybe it isn’t necessary every day, and that I could plan ahead for my future by cutting back in some ways.

Saving Your Money In Small Amounts

To me the power of The Latte Factor® is to point out that even small amounts can add up to large amounts if you give it enough time.

Make a sacrifice here and there, and save and invest for the long haul, and in the end you’ll come out much further ahead in the end.

My Experiment In Regularly Saving & Investing Small Amounts

Digit.co has an interesting business model where they save money for you on a regular basis without your intervention. It analyzes your checking account balance and regular spending, and when it thinks it won’t overdraw your account, it will save money to your Digit savings account in small amounts – anywhere from a few dollars to $30-40 or more.

Over time those small savings amounts add up to larger amounts – and in the end you probably won’t even notice the money has been taken out.

Once the balance in my Digit savings account reaches $75 or so, I take the money and move it to my Roth IRA at the free investing service Axos Invest.

So far in the two months that I’ve been doing the experiment I’ve saved and invested almost $630 via Digit and Axos Invest.

Over an entire year that works out to $3780, which is over half way towards fully funding the Roth IRA for the year. I never even missed the money since it kind of trickled out of my account – instead of going in one big chunk!

The Power Of Making Small Cuts & Saving For The Future

The power behind the idea of The Latte Factor® is the idea of being intentional about your spending and saving decisions, and realizing that even the small choices you make every day have an effect.

What is the opportunity cost of having that cup of coffee?

If you choose to forgo your coffee a few days a week and instead save that money, how much more will you have saved when it comes time to retire?

Don’t forget that focusing on small things like a cup of coffee is only just the start, and that focusing on the big things in your financial life is just as important.

Having one bad home loan or unpaid credit card can effectively wipe out any gains you might have made through your savings on the small things.

Stay on top of your whole financial picture!

As for me, I’ll likely still be having that coffee at Starbucks every now and again, I’m not one to completely forgo any of life’s pleasures. Having something less often means you’ll look forward to it more anyway, right?

Have you ever tried implementing the ideas behind The Latte Factor®? Did you find you were able to successfully cut back in some areas in order to save more?

I think you captured the pros and cons of the Latte Factor pretty well. Whether or not it actually helps you save, I think it helps us look at our time and money a little differently and helps us get into more of a savings mindset. I still enjoy sitting at Starbucks and writing, but I’m much more aware of my spending there and try to only do it if I have a gift card or a special deal. Cheers!

I really do think it’s all about making you more conscious of your spending, and helping you realize how little expenses can add up to big amounts over time. So why not use that to your advantage and save that money instead of spending it! Or at least cut back, and save a little more.

Well done Peter! I am a firm believer in concentrating on the Big Three first; Housing, Transportation and Food but doing the deep dive on all your expenses is wonderful for the awareness factor. I recommend people doing it periodically so they can see the future impact one small item has on future value. It is an eye opener. Thank you for sharing.

I always feel a personal kickback against this phrase, because I really enjoy a good cup of coffee! You’ve done a great job covering all sides of this spending question. When I look around at folks that are deeply indebted, it’s usually car payments and too big a house that have gotten them there. When I talk with people that aren’t in debt, but don’t have a large savings or invest, it seems like it’s usually the latte factor that has kept them stagnant. I know that the latte factor keeps us from investing even more than we do now. But we’re at a comfortable spot, and keeping an eye on our trajectory. We know when we drink a latte what we’re giving up, and so we make sure we really enjoy that cup!

My wife shared a conversation with me. A friend told her that she was concerned that they hadn’t saved nearly enough for college for her 3 kids, 2 of whom are high school sophomores.

My daughter quickly commented how the family had takeout food 4-5 times a week, and frequented Starbucks.

The problem with the Latte Factor has nothing to do with the math, but with human nature. That $5, or $25 for takeout, appears too small in the spender’s mind. Yet, three decades of these daily wasteful spendings take their toll.

In my current job as a part time real estate agent, I handle rental apartments, and the typical applicant will barely have the required 3X the rent (ranging from $650-$1000) as a monthly income. But a good number of them smoke ($10 a pack?) or walk into the office carrying their latte. I keep quite but just want to ask “You barely make $2500 a month, do you really think spending $100/mo on coffee makes sense?”

Last thought. I see people on line at the supermarket, with 2 or 3 magazines on the belt. In most cases, you can subscribe for a year for the cost of one issue.

For all of us, that $5 drink actually does add up. If saving more is not a good idea, what do the critics propose? If that saving doesn’t come from this poor spending, where will it come from?

We are currently using the latte aka “eating out” factor to pay down a car loan and it’s working really well. That being said, we’ve been looking at all areas of our finances over the past 6 years and have learned a lot about priorities. At this stage in our journey, we have gotten really good at being intentional and understanding tradeoffs when we do spend. The latte factor didn’t actually work for us until there was something I wanted more (no car loan) than to avoid cooking.