At the beginning of the year I announced that I was going to be participating in this year’s Grow Your Dough Throwdown 2.0, an investing challenge for personal finance bloggers sponsored by one of my favorite investing companies, Motif Investing.

The challenge is relatively simple. Each person or site in the challenge is given $500 in a Motif Investing account, and then over the entire year they invest that $500 and see who can come up with the largest gains for the year.

Last year’s contest had a runaway winner, PTMoney. He found the largest gains by speculating on individual stocks. He saw gains of around 33% for the year, which are obviously pretty great.

So how is this year’s contest going so far?

Quick Navigation

The Grow Your Dough Throwdown 2.0 Update

The Grow Your Dough Throwdown 2.0 (GYD 2.0) has been going on now since January 1st, 2015. The last time I posted an update my returns had bottomed out at -2.0%. That was good enough to put me in dead last place in the contest. Not good.

The motif/portfolio that I started the challenge with was focused on a long term growth dividend strategy, probably not ideal for a short term investing contest. I was pacing myself for a marathon when we were in fact doing the 100 meter dash.

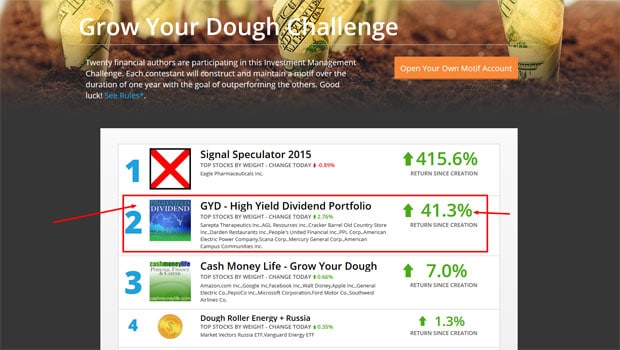

Phil with PTMoney is in the lead again this year, and at the time of my last update he had enjoyed a 286% increase on his initial investment. That comes out to about $1358.50 value on his initial $475 investment. Since the last update his returns have ballooned again, to the tune of 415.6%. That means a value of $1974.10 on his initial investment. Crazy! No wonder some people get hooked on speculative investments!

Phil posted about the strategy he was using in the contest. He picked stocks that were listed as “100% Buy” on the BarChart.com Top 100 Signals Stocks, and then he would sell if the stock in a month if it either increased by 35%, decreased by 10% or flatlined.

He picked a stock this year, Eagle Pharmaceuticals Inc. (EGRX), that has seen some amazing growth. The stock continues to increase from month to month and you can’t blame him for sticking with it so long. At this point I doubt anyone is going to catch him unless they find another hot stock.

A New Strategy For Grow Your Dough

In May, after seeing that I was in dead last place I decided that I should change my strategies mid stream. I decided to try and switch to using a strategy similar to what PT was using. Time to get worried about short term returns – time to speculate.

My New Strategy

So last month I implemented a new strategy based on PT’s.

- I checked the “Top Signals Stocks” at BarChart.com for a stock that was showing good positive momentum, and that was listed as a 100% buy (as per PT’s strategy).

- After identifying 3 or 4 good possibilities at the top of the list, I did some brief research on the stocks. I narrowed my pick down to Sarepta Therapeutics Inc (SRPT), a biopharmaceutical company. The company is listed as a big buy in many spots because of a positive meeting they just had with the FDA this week that could lead to the approval of their new drug to help treat Muscular Dystrophy.

- I sold most of my dividend stock holdings in May and switched 95% of my motif portfolio to be the new hot stock, SRPT.

- I bought 17.5 shares of SRPT stock at $24.60 in May. Since then the stock has mostly gone up to the point where it now lies at $37.89 this morning. A gain of 53.70%!

I’m pretty happy with a gain of 53.7% for my stock, but the question is, how am I doing in relation to the other contestants?

The Grow Your Dough 2.0 Leaderboard Update

During the contest Motif will host a leaderboard that is continually updated with the current standings in the contest. I’ll check in from time to time to see how I’m doing. View the entire leaderboard and what people are investing in here.

As of today, 9 months into the contest, I am in 2nd place! Before switching my strategy in May I was in 20th (last) place. So the switch in strategies has been effective. It has helped to bump me up 19 spots!

I’m not super optimistic that I’ll be able to improve my standings from 2nd place to 1st. The reason? PT now has a healthy 415.6% gain in his account. It doesn’t seem to be stopping either! I can take some solace in knowing that at least I’m ahead of PT’s pace for last year.

Here’s a widget showing my GYD – High Yield Dividend Portfolio motif as it stands now. You can definitely see the point at which I made an investment strategy change. Click on the banner in case you want to look at it more in depth, or even invest in it yourself.

Motif Investing: The Brokerage We’re Using For The Contest

This year’s GYD 2.0 challenge is being sponsored by one of my favorite brokerage companies, Motif Investing. I was already familiar with Motif Investing from reviews I wrote about them over the past couple of years. I had an existing account with them, so I was all set to go.

Motif Investing – Investing In Themes

Investors can invest in already pre-built motifs that experts have put together (High Yield Dividend Stocks, Obamacare Stocks, Real Estate Stocks, etc), or they can create their own custom motifs and then invest in those. You can have anywhere from one stock up to thirty stocks in your motif. It’s essentially a way to create your own ETF-like bundles of stocks, without the added expense ratios.

You are allowed to do real time market trades via Motif Investing, and part of the great thing about investing in a motif is that you can buy fractional shares in up to 30 stocks, but still only pay the one fee per transaction, instead of one fee for each stock you buy.

Here’s what the fees look like to invest at Motif Investing.

- $9.95 per motif trade, no minimum trade requirement.

- $250 minimum per motif (bundle of up to 30 stocks)

- $4.95 per stock trade to customize stocks in a motif.

- No maintenance fees.

- No inactivity fees.

The main numbers to take note of are you have to spend a minimum of $250 to buy a motif, and anytime you buy a motif (no matter how many stocks are in it) it will be a commission fee of $9.95. That’s a great deal!

Open An Account With Motif Investing And Play Along!

If you open an account now and play along with us on the GYD 2.0 challenge for the last few months, you can get up to a $150 bonus through the link below. Here’s what you need to do to get the bonus:

- Open an account with Motif Investing

- Fund the account with at least $2000.

- Do a motif trade within 45 days. If you do at least 1 trade you get $50. At least 3, $75. At least 5 and you’ll get $150.

If you decide to jump in with us and try your hand at our investing challenge, let us know in the comments!

Open An Account With Motif Investing

I can’t sign up, since I am not an US citizen. Uff. Loved the idea and I wished I could invest as well. Do you know of any company that lets people from outside US invest (I do have a paypal account and a Chase account in the US, since we stayed there for a while)

Sorry, I’m not familiar with any products for non-us citizens since I focus mainly on US products. Good luck!