I‘ve been investing with Lending Club for the better part of 5 or 6 years now. In that time I’ve been happy with the returns that I’ve seen. Despite having some defaults and loans being charged off in my account, I’m still enjoying in excess of 10% returns on Lending Club loans.

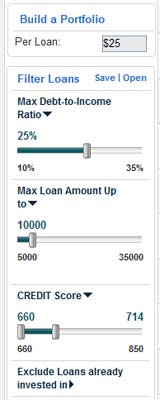

In reading other sites that understand peer to peer lending much better than I do, I understand that the way to get the best returns, and to see fewer defaults, is to do more rigorous analysis of the loans you’re investing in. Typically they do this by filtering the loans that they could invest in by certain criteria, and then only choosing the ones that fit the model of the historically highest loan returns.

While the idea of downloading loan data, filtering it and doing analysis has it’s appeal, I was looking for an easier and less time consuming way to choose my loans. Something that wouldn’t take a ton of time. Then I discovered that there are now quite a few websites out there that will help you to choose your Lending Club loans based on the data, which will tell you which loans are likeliest to give the highest return. One of those websites that i came upon was PeerToPeerQuant.

Quick Navigation

Choosing Loans With The Highest Returns Via Filters

- Income

- Inquiries

- Delinquencies

- Debt-to-income ratio

- Loan amount

- Credit score

- Interest rate

- Home ownership

Some folks that I respect very much in the P2P space have mentioned that their favorite filtering criteria are income and number of inquiries, and they have built filtering models based off of those.

I’ll be the first to admit that at times I’ve done some form of filtering when choosing loans, and that other times I’ve just been too lazy when re-investing my earnings – and just chosen a mix of loans I found available at the time. I’m not investing in large amounts on P2P yet, and as such, why bother?

PeerToPeerQuant Loan Choosing Tool

I actually discovered the tool because one of the co-founders, J.J. Hendricks, emailed me to introduce himself. I promised to check out the tool and possibly do a review, but quickly got swamped with other things when my wife ended up in hospital off and on for a month or more around the holidays. J.J actually kept in touch with me and kindly kept asking after and praying for my wife in his church small group as she was recovering – which was greatly appreciated.

Finally at the end of November I opened a PeerToPeerQuant account to give it a test ride.

PeerToPeerQuant – What Is It?

Choosing loans based on setting up a series of filters can be effective, but time consuming. PeerToPeerQuant has a slightly different method for helping you to choose loans. I’ll let them describe it for me:

Our model uses Lending Club’s past data, quantitative analysis and genetic algorithms to determine which peer to peer (P2P) loans to invest. The model aims to determine which borrowers will pay the most to investors. It factors in interest rates, expected default rates, expected recovery rates on defaults, and late payment fees. We feed a computer program all historic loan data and create a population of initial investment strategies like:

- Invest in loans where borrowers have more than $100,000 in income and own their home

- Invest in loans smaller than $10,000

- Invest in loans where borrower’s FICO score is below 700

The program evaluates each strategy against all historic loans to determine which strategies have the highest total return. The best strategies become the “breeding population” for the next iteration. When two strategies “breed”, attributes from each strategy are combined. If the second and third strategies (above) were to breed, we might get a strategy like “Invest in loans smaller than $10,000 where the borrower’s FICO score is below 700”. A random mutation might change that 700 FICO threshold to 750. This process is repeated thousands of times until an optimal solution is found.

So they’re essentially taking the historical loan data, running it against a multitude of investment strategies and they have then determined which ones have the potential to have the best returns.

Loans chosen with their model currently have a 11.1% return since inception, although the site is still relatively new and only has historical investment returns since last summer. (Return calculated using XIRR method).

Finding P2P Loans That Are Worth Buying

How does the PeerToPeerQuant website work in practice?

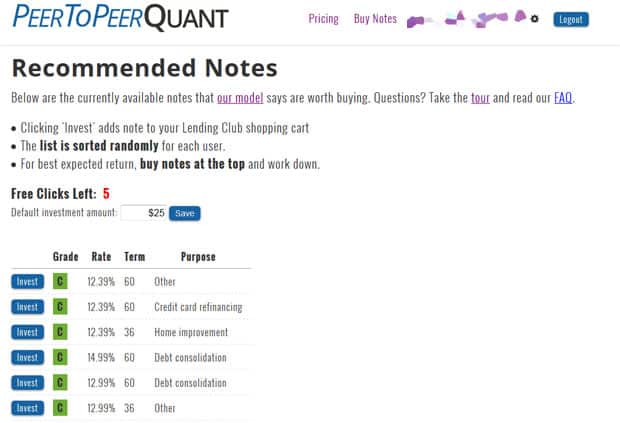

The site will give you a list of available notes that they recommend purchasing based, off of their algorithm.

To invest all you have to do is choose your “default investment amount” (which I always set to $25) and click save. Then they suggest you buy notes at the top of the list and work your way down until you have as many notes as you need. Clicking on the invest button will automatically add the chosen loan to your cart at the Lending Club site, and you can then view your order and invest at your leisure.

The loans aren’t listed in any order or with any ranking, they’re just randomized. Any loans that meet the criteria are ranked the same by the site. The folks at PeerToPeerQuant have determined that any additional filtering on their criteria has already been tried with their algorithm, and won’t likely yield better results.

PeerToPeerQuant Pricing

How much does the PeerToPeerQuant site cost? If you’re a casual investor like me, it may not cost you anything. Here’s their pricing from their site.

- Free – Seeing note recommendations is always free

- Free – 5 free clicks every month

- $0.15 – Each click after free ones are a flat $0.15

So let’s say you invest in 20 notes via the website in one month. Your cost for investing in those loans would be 5 for free, and then 15 notes at $0.15 = $2.25.

What if you invest only in 5 loans per month like me? Then your cost to use the service will be nothing.

My PeerToPeerQuant Portfolio

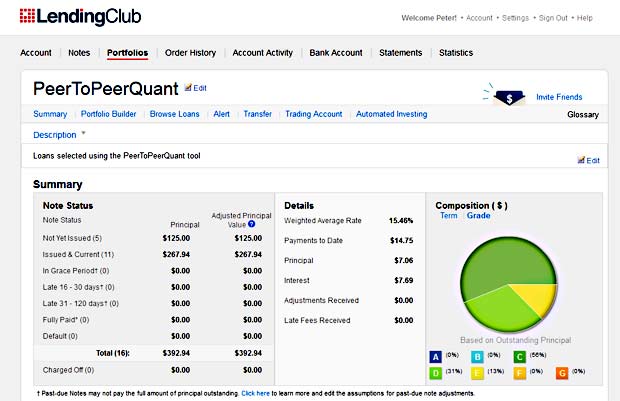

My results are very preliminary at this point with PeerToPeerQuant since I’ve only been using the site to choose my loans for the past few months. I chose to setup a portfolio on Lending Club only for my PeerToPeerQuant chosen loans. Here’s a look at my results thus far:

So far the loans chosen have a weighted average rate of 15.46% and the loans are all issued and current or in funding. The loans are all C (9), D (5) and E (2) rated loans, with amounts varying from $3,000 all the way up to $35,000.

I plan to keep an eye on this portfolio over the coming months and seeing how it performs. We’ll see how it compares to my other portfolios, and whether it performs better, worse, or about the same as my previously filter chosen loans.

Other PeerToPeerQuant Tools

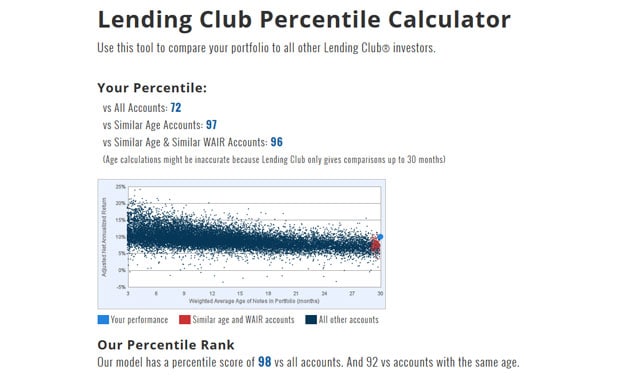

PeerToPeerQuant also has another interesting tool that you can try out as well called the “Lending Club Percentile Calculator”. It will basically compare your portfolio against the portfolios of all other Lending Club investors to see how you’re doing.

Essentially you find out a couple of pieces of information from your account including adjusted net annual return, weighted average interest rate and age in months of your loans and it will give you a percentile rank for your account telling you how well your returns stack up against other users.

Here are my results:

My ranking puts my returns as being better than 72% of other accounts, better than 97% of similar age accounts and better than 96% of similar age and interest accounts. Not too bad, but I’m sure I could always do better.

Happy investing!

Have you tried PeerToPeerQuant or a similar service? Tell us what your thoughts on the service are in the comments.

Sign Up For A Lending Club Account Here Before Trying PeerToPeerQuant

Hi, This seems interesting, Thank you for writing about it. I will have to check out your analysis on Lending club. A question. Could you use Lending club as a sort of savings account for one year or more money? Thank you, Brad

When you invest in Lending Club loans they are 3 or 5 year loans that you’re investing in, so it’s more like a 36 or 60 month CD that you’re investing in where your money is locked up for a period of time. You could always sell your notes on the secondary notes platform if you wanted to get out before they mature, but there isn’t a guarantee you’ll be able to sell them for what you’d want.