A short while ago I wrote reviews of two services that recently launched, both of which intrigued me. One is a free online savings account called Digit, and the other is a free automated investing adviser called Axos Invest.

Both companies are different from anything else out there.

Digit’s claim to fame is that they will automatically save money for you after analyzing your spending and account balance trends. Once Digit figures out how much it can save without you noticing, or overdrawing your account, it just does it. It saves small amounts to your Digit savings account throughout the month. At the end of the month, you’ve got a nice lump sum saved in your account. (Digit review here)

Axos Invest is gaining traction because of its unique business model as well. They’re a robo-adviser, an automated investment advisory along the lines of Betterment or Wealthfront, but they’re different in that they don’t charge any management fees as most other companies do. They invest your money in ETF index funds with no trading fees and no management fees whatsoever. They plan to make their money off of premium add-on products like tax-loss harvesting in the future. (Axos Invest review here)

I liked the ideas behind these services and signed up for both of them to give them a trial run. While I was at it I decided to turn this into a bit of an experiment. I plan to see just how much money I can automatically save and then invest with them through the end of the year. I thought it would be interesting to show just how much you can automatically save and invest (at no cost), without even thinking about it. Saving and investing doesn’t have to be hard, or expensive!

Quick Navigation

Digit Savings Account

According to Ethan Bloch, the founder of Digit, the company was started to help people, “maximize their money, while at the same time driving the amount of time and effort it takes to do so as close to 0 minutes per year as possible”

So how does Digit work? You sign up for an account, and link your checking account. Digit will then analyze your income and expenses, find patterns and then find small amounts that it can set aside for you – without any pain for you.

So once you sign up and turn on auto-savings, every 2 or 3 days Digit will transfer some money from your checking to your savings, usually somewhere between $5-$50. Digit won’t overdraft your account, and they have a “no overdraft guarantee that states they’ll pay any overdraft fees if they accidentally overdraft your account.

Open Your Digit Savings Account

Axos Invest Investing Account

Axos Invest launched with the goal of being the world’s first completely free financial advisor. Their founders had a mission “to ensure everyone can achieve their financial goals, which starts with investing as early as possible. This is why there is no minimum to start and we do not charge fees.”

Axos Invest’s founders understood that one of the drags on the typical person’s portfolios is the fees that they’re paying to invest, as well as the friction point of having to invest thousands of dollars to start. They changed that with no minimums to invest, and no fees charged for investing. Axos Invest will be releasing some premium add-on products for their users, which they will charge for, but a basic investing account will not cost anything beyond the mutual fund expense ratios associated with your investments.

What do you invest in with Axos Invest? Axos Invest will invest your funds based on Modern Portfolio Theory (MPT). Your investments will be diversified, low cost, and recognize the value of long term passive investing by investing in ETF index funds.

Open Your Axos Invest Investing Account

The Digit + Axos Invest Experiment (D+AI Experiment)

For the experiment I plan on using the two accounts I have just opened with Digit and Axos Invest in order to show just how easy it is to invest.

From now until the end of the year I plan on allowing Digit to automatically save money from my checking account and put it into my Digit savings.

When the amount in the account gets to around $75 or more, I’ll transfer it back to the checking and transfer the same amount over to my Axos Invest Roth IRA to invest in their automated investing service. I figure by doing it this way, I’ll engage in a bit of dollar-cost averaging, instead of waiting until the balance is higher and investing once or twice. Since Axos Invest has no minimums and you can buy fractional shares, why not?

When the end of the year rolls around I’ll do a review and look at how much money I’ve been able to save and invest using these two sites.

The Experiment In Progress

Once I had setup my Digit and Axos Invest accounts I started putting the experiment into action in early February. I turned on the automated saving feature of the Digit savings account, and waited for the small savings amounts to start showing up. After about 3-4 days, my first few deposits into Digit appeared. There were deposits for $5, $6.50, $8.45, $2.35 all within the first 7 days. I have also referred friends to Digit, and $5 referral bonuses started showing up as well.

Day after day the referrals and savings deposits started piling up and before I knew it, I had $186 in the account. At this point I decided to withdraw and make my first investment over at Axos Invest.

Amounts Withdrawn And Invested So Far

I’m only about a month into my little experiment, and so far I’ve withdrawn my Digit savings balance and invested it in my Axos Invest Roth IRA twice. The amounts were:

- $186.00

- $74.72

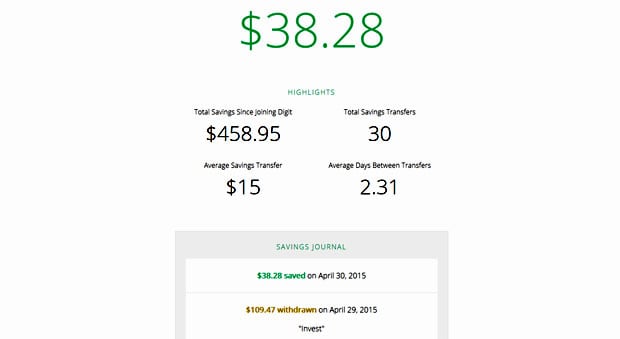

Here’s a screenshot from my Digit account showing my latest withdrawal for the purpose of investing.

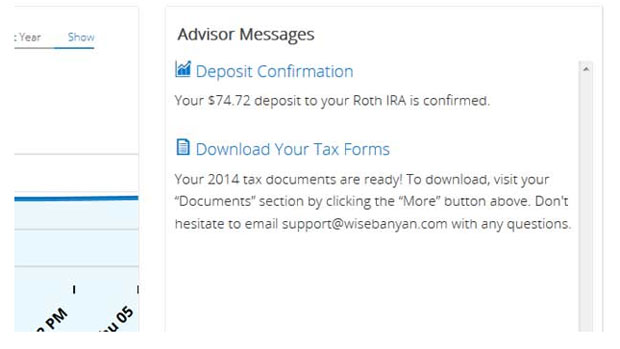

After withdrawing the money I then transfer it from my checking account over to Axos Invest. Here’s a screenshot of my latest deposit with Axos Invest.

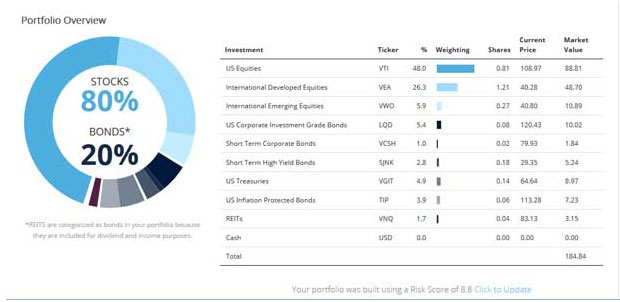

Once this deposit goes through I’ll have a little less than $260.72 invested at Axos Invest since the market has gone down slightly since I started. You can see the $184.84 total invested for my first $186 deposit below.

Here’s the portfolio’s asset allocation in my Axos Invest account currently. Probably a tad more aggressive than in my other retirement accounts, but that’s OK.

The funds that Axos Invest uses and their expenses are shown below (and are subject to change)

- Vanguard Total Stock Market ETF (VTI): 0.05%

- Vanguard FTSE Developed Markets ETF (VEA): 0.09%

- Vanguard FTSE Emerging Markets ETF (VWO): 0.15%

- Vanguard Intmdte Tm Govt Bd ETF (VGIT): 0.12%

- Vanguard Short-Term Government Bond Index ETF (VGSH): 0.12%

- iShares Investment Grade Corporate Bond ETF (LQD): 0.15%

- State Street Global Advisors Barclays Short Term High Yield Bond Index ETF (SJNK): 0.40%

- iShares Barclays TIPS Bond Fund (ETF) (TIP): 0.20%

- Vanguard REIT Index Fund (VNQ): 0.10%

Depending on how the market does, we’ll see what kind of returns my account sees. No matter how it goes, I’m already ahead of the game as I don’t have to pay any account management or trading fees. Can’t beat that.

Join In The Digit & Axos Invest Experiment

If you’re intrigued by Digit and Axos Invest like I was, and want to join in the “D+WB Experiment”, I invite you to join in.

Open an account with both services (both accounts are free), set Digit to start automatically saving and get started. Let’s see how much we can save and invest this year – without lifting a finger!

This sounds like a great and very tempting idea. I wonder if I’d be able to convince my husband? I’ve heard about digit before, but never WiseBanyan. They certainly do have low fees. The only concern I see with the process would be the extra pain in the neck of adding the withdrawals and transfers into my money management software as they occur, but I suppose it would be worth it if I ended up saving a bit.

For me I just download the Digit transactions automatically from my checking account into YNAB, and then I transfer money directly over to WiseBanyan account. Works well for me, but that may truly be one of the hiccups in this that make it “not as easy”. :)

Haha love it man.

I’m about to do my own Digit update as well here soon – I’m nearing $400 in 2+ months with them and loving it (haven’t poked around WiseBanyan yet)

J, you should check WiseBanyan out. It’s like Betterment or Wealthfront in many respects, except there are no management fees.

Hi Peter,

I save, but not as much as I’d like to. I’ve signed up to test it out. Thanks for the tip!

:) Heather

Thanks Heather, good luck with Digit, hope you find it as useful as I have in my short experiment using it so far.

Wisebanyan claims no bank guaranteed which I believe means that if they go belly up you lose all your money. I don’t know much about investment but I think this is what it means. Could anyone confirm?

Your money with WiseBanyan is safe. It is SIPC insured, like any other brokerage. So if WiseBanyan were to become insolvent, the SIPC insurance protects you, the investor, against losses that stem from the financial failure of the brokerage company. The account is also covered by WiseBanyan’s broker dealer FOLIOfn Investments. Here are the full details from the WiseBanyan FAQ:

I’m thinking of doing the same. Can you provide an update?

A year later … how have things turned out?

Joel, I think things have turned out pretty well with over $4500 saved to my Digit account. I recently wrote an update to the series talking about what my total amount saved was, the amount invested, etc. You can find the write up here:

My Digit And WiseBanyan Automated Investing Experiment After 1 Year