If you’re anything like most of Americans the new year is a time for examining your life, setting goals and finding ways you can make the coming year a better one than the last.

The improvements we make in our lives can be anything from changing our diet, to finding a better job or just spending more time with family. Another popular area for making goals is in our financial lives.

At our household we’ve made the goal this year to be saving as much as we can towards a house down payment as we’re hoping to have my home builder in-laws build us a house sometime this spring or early summer. That’s a huge savings goal that we’re working towards, but there are other goals that we have in mind once we complete that goal.

Once we’ve bought and paid for our house we’ll get back on our savings and investment plan to save as much of our income as we can towards retirement.

To start we’d like this year to be the first where we put in the maximum contribution towards our retirement accounts.

Quick Navigation

Start Early In The Year And Plan To Max Out Your Investments

I think for most people there are places in their budget where they can save some money in order to create some surplus that they can put towards retirement – beyond what they may already be giving.

Last year at our house we actually probably would have maxed out our contributions if we hadn’t decided in the fall that we were going to be building a new house this year.

At that point we stopped our retirement contributions temporarily to start saving as fast as we could for our house down payment.

If you do want to max out your contributions to your Roth or Traditional IRA – or your 401k type accounts, it’s best to plan ahead and plan on making regular deposits throughout the year to fund your account. When you make the contributions in small amounts with each paycheck it really doesn’t hurt as much.

So how much can you contribute to your retirement accounts?

401k And Roth 401k Maximum Contribution

When it comes to your 401k and Roth 401k accounts, you will have one contribution limit combined.

For those who don’t know the 401k accepts pre-tax contributions and is taxable upon withdrawal in retirement. The Roth 401k contributions are made after tax, meaning they are tax free at retirement. We have a combination of the two account types in order to diversify our taxes – since we don’t know what tax rates will look like when we retire.

So what is the contribution limit for the 401k and Roth 401k? The 2019 401k contribution limit is:

- $19,000 if you’re under age 50

- $25,000 if you’re 50 or older

So you can contribute a maximum of $19,000 combined to your 401k and Roth 401k for 2019. If you’re 50 or older, that limit rises to $25,000.

How much is that if you get 2 paychecks per month? $791.66 each paycheck, or about $1583.33 per month.

Traditional And Roth IRA Maximum Contribution

The traditional and Roth IRA also have a single combined contribution limit. The Traditional IRA contribution can be tax deductible in certain circumstances and made pre-tax, but are taxable at withdrawal. The Roth IRA contributions are made after tax, but are not taxable at withdrawal. So take that into account.

So what is the contribution limit for the traditional and Roth IRA? The 2019 IRA contribution limit is:

- $6,000 if you’re under age 50

- $7,000 if you’re age 50 or older

So you can contribute a maximum of $6,000 combined to your traditional and Roth IRA in 2019. If you’re 50 or older that goes up by $1,000.

How much is that if you have 2 paychecks per month? $250 per paycheck, or about $500 per month.

Start a Roth IRA with Betterment today (where we have our Roth IRA)

How Much Can You Save If You Max Out Your Contributions?

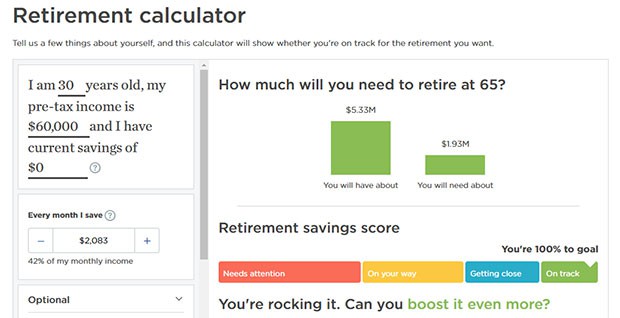

If you were to start saving at age 30, and save the current max for someone under 50 every year ($25,000, or $2083.33 per month), how much would you end up with by a retirement age of age 65?

Assuming an 8% return, after 35 years you’d have over 5 million dollars (calculator):

That’s a lot of money! Admittedly, most people aren’t going to be able to max out their retirement accounts each and every year, but imagine if you did? How about even trying to contribute half of that? Contributing $12,500 every year would lead to over $2 million!

Start Early And Invest What You Can

At our house I want to make it a plan to make retirement savings a priority.

While we aren’t able to re-start that goal until we’re done saving our house down payment, once we do we’ll be jumping in with both feet. I know we can max it out if we try.

How about you? Have you thought about trying to max out your contributions? Have you been successful?

I maxed out my contributions for one 7 month period when I was 23. The investment is paying off for sure. Another consideration is inflation. $4 million today isn’t $4 million in 30 or 35 years. The dollar losses half its value roughly every 20 years.

Good information yet I personally don’t have the confidence giving the government so much control of my retirement. Yes the $4 or $2 million sounds good but that’s before taxes and inflation, what one ends up with is after those current facts. Earlier you mentioned who knows what taxes and inflation will be then this is true but just as the growth is predicted so can these. I’m more concerned with what I actually end up with as opposed to gross growth estimates. I find it interesting that most retirement calculations predict amounts that show gross but not net, after taxes and inflation. Yet there are many calculators that predict inflation (based on history) and taxes predicted, based on current rates. Wouldn’t complete estimates that include these truths be more realistic? When I calculate the taxes paid on these predicted retirement investments even at today’s low rates I question if deferred is the way to go.

Great point Mark, I fully agree with you. That’s why diversifying is the key. One mistake I see a lot of younger folks (like myself) make is to have the idea of just throwing everything into your 401k.

You can really get burned that way.

We started late, my wife and I, but when we started, we went all out to maximize both our 401k and IRA contributions. We cut our spending to the bone to do this, but today’s we’re really glad we did that. At the time Tried my best to pick funds within the 401k plan to maximize my returns, but eventually I just put it all into an S&P 500 index fund, which turned out the be the smartest choice.

In hindsight, the important thing, though, was just to “get it in there.” Once I retired, I transferred all our 401k investments into IRAs, where we could invest in individual companies. That has (so far, touch wood) worked out well.

In the late 90’s, my wife and I both began maxing out our 401(k) and IRA accounts every year. It wasn’t always easy, but now looking back we can see the clear advantages of getting the money saved early in life.

Do you know which apps are best for tax loss harvesting? I know Betterment and some of the other personal finance apps have it as a feature, but wondering if there are any apps that just specialize in this – or if not – which one is the best for this function?