My wife and I have had a whirlwind past couple of years where we’ve had to deal with health scares, hospital stays, new babies and a couple of minor car accidents.

It’s definitely been a roller coaster ride, but one thing that all of the ups and downs have crystallized for me is the fact that life is fragile. You never know when the good Lord is going to call you home. You can be healthy one day, and in the hospital near death – as my wife was – the next.

Because of that it’s important to make sure you plan ahead for the worst case scenario – just in case. If that time does come God forbid, at the very least you don’t want your loved ones to have to worry about how they can access that online savings account, or who to call to claim your life insurance.

I’ve put together some of our important financial information in the past, but never in a format that my wife could probably make sense of if she needed to.

When we were re-starting our family budget this past week using You Need A Budget, she voiced the fact that she didn’t feel like she had a very good handle on where all of our accounts were, and how she could access them if and when I were to pass away or have a disabling accident. Now that we’ve got a child to take care of in addition to just her, this has become even more important to her – and to me.

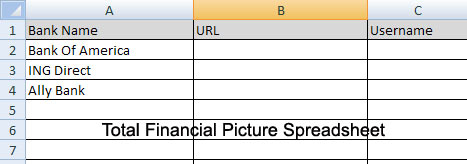

This week I’ve been putting together a spreadsheet that lists our financial life – all in one place. I’m calling it the Total Financial Picture Spreadsheet. Here’s a look at what I’m including, and what I think you should too.

Quick Navigation

What Should Be In Your Total Financial Picture Spreadsheet

The idea behind this spreadsheet is to give your loved ones a snapshot of your total financial picture. It should give them the confidence they need to be able to carry on if you were to pass, without a lot of confusion.

Here are some of the things that I’m including in my Total Financial Picture Spreadsheet.

- Bank account information: I’m including all of my checking and savings accounts, both at physical banks and online accounts. For each bank I’m including a url, phone, username and password, routing number and account number, as well as any other pertinent notes about the account.

- Investment and retirement accounts: It’s important to include all retirement accounts, brokerage accounts, peer to peer lending accounts and any other investments. As with banks I’m including url, user/pass, phone, account number and estimated balance in each account.

- Credit card accounts: I listed the account type, the company the card is with, the url, user/pass, phone and an account number.

- Mortgage information: List your first mortgage as well as second mortgage if you have one. Also include investment properties if you have them. Also include a url, user/pass, phone and account number.

- Other Liabilities: Have other debts or liabilities that are yet to be paid off like a car loan or student loan? List them here as well as including urls, usernames and passwords, phone numbers and account numbers.

- Insurance: A listing of all our insurance information from life and disability insurance (which you may need now) to homeowners, auto and health insurance. Contact information and account numbers included for reference. A writeup in the notes section on who to call and how to claim the benefits may be helpful.

- List of assets: It can be a good idea to leave a listing of assets so that the surviving spouse will know just where they stand. I’ve listed normal things like our house, cars, wedding ring and other miscellaneous items. You may also want to list non-traditional assets. For me that includes listing this site which could be sold for a good sum of cash if needed. I included login information for this site and my hosting provider so that my wife or others helping her could continue the site or sell it.

- Income:While the income may be going away with your death, some may be continuing. I listed all income sources on this tab including sources that will continue earning income passively – like this blog.

- Expenses: I made a listing of regular recurring expenses that can be expected every month. Things like homeowners association bill, electric and gas bills, to homeowners and auto insurance. A listing of everything that is due every month so the surviving spouse can carry on without having to figure out what bills to pay when.

- Other important information: I included another tab for “other” important information. Things you can include here vary – but I’ve included things like a login for my mint.com financial aggregator account, email account logins, photo backup service logins, rewards accounts and more. Figure out what other important information you need to pass on and add it.

Use A Password Software

It’s important to have all of the important information included above, but in some instances you may want to be a bit more careful about security and not include all of your usernames and passwords in your spreadsheet.

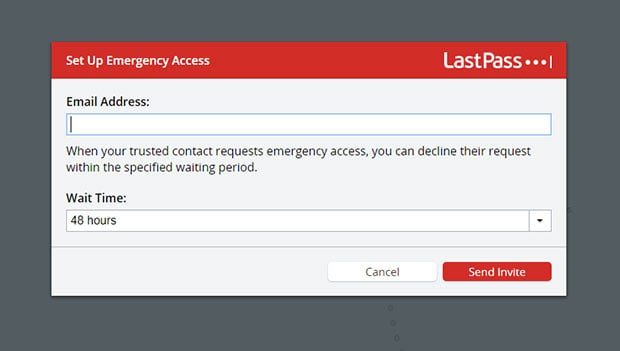

What we have done at our house is to use a software called LastPass that is a vault for all of the important username and password information we want to have handy.

With LastPass you can setup emergency contacts within the software, which will give your trusted contacts access to all of your usernames, passwords and other important information in case of emergency.

Just give them emergency access and then if you are incapacitated they can access your account within 48 hours unless you deny their request.

Just make sure that your emergency contacts know how it works.

Make Sure Your Loved Ones Have Access To Your Spreadsheet

Once you’ve added all of your important information into your spreadsheet the next thing you need to do is figure out where you’re going to save it so that your loved ones can find it easily if you were to pass. You’ll also want to make sure that it’s secure.

For us once I’m done creating the spreadsheet I’m going to print a copy for my wife and leave it in her file folder in the filing cabinet (and show her where it is).

I’m also going to zip a copy and password protect it, and save it in our DropBox online storage (off-site in case of fire/flood). I’ll also place it in my wife’s “my documents” folder on her computer.

I may also put a copy on USB thumb drive and put it in the fire safe.

Want to use the spreadsheet that I set up? You can download it here:

In Case Of Emergency Binder

If you’d like something a little bit more comprehensive than our little spreadsheet above, our friend Chelsea over at SmartMoneyMamas.com has put together what she’s calling an In Case Of Emergency Binder.

The Binder is a complete package that can help you plan for pretty much any eventuality. It’s over 100 pages of simple, printable worksheets (in a fillable .pdf) to organize everything your family may need to know if you’re gone.

It includes sections for things like household information, medical information, key personal documents, financial documents and logins, important contacts, important memories and more.

The binder costs $29, but it’s well worth the cost in my opinion as it will lead to giving you peace of mind that your loved ones are covered in case the worst case scenario were to happen.

So there it is, the Total Financial Picture Spreadsheet. Are there things that I’m forgetting to include, or things that you would add as well? Have you already created your own spreadsheet – and if so, have you also talked with your spouse about what to do if you pass? Tell me what you think about all this in the comments.

Hey Peter, I have an entire website about organizing your finances for the “just in case”. I put all the important information in a binder for easy access in case something happens. Check it out and let me know what you think. Derek

Great spreadsheet Peter. I have been working on this so long. I have to wrap this up soon. I started it when I went to my home country last year for 3 weeks leaving my husband to take care of our financials here. He was clueless and I was not easily reachable. That struck us well to start working on this, I called it “lifeline” :P I have been working on this for 6 months now. You covered all of the financial aspects of it. I am also trying to include other essentials like the copy of the will, medical history, location of important papers, long term health care information, estate instruction…

Great reminder Peter! I put together a ‘financial snapshot’ that’s available for download on F&F. It includes a lot of the areas you mention – sometimes a template financial organizer is just the thing someone needs to get started!

I’m going to steal this idea, Peter. Thanks for sharing!

I really need to update this. It has been a while, and I am not getting any younger. There have been many changes that what I currently have is almost totally irrelevant. Thanks for the reminder.

Thanks for the reminder Peter. We live in the woods and currently are experiencing a drought. A fire could be another reason to have things in order for a quick grab.

Pete

Thanks for sharing this, this looks great. It’s certainly a better system than I’ve currently got – a bunch of pages in a lock box with barely readable numbers for them. I need to firm up these in the future!

Great article Peter. Thanks! I need to do this.

Jim Wang, author of Bargaineering Blog wrote a good article that dovetails into your article perfectly. http://www.bargaineering.com/articles/financial-network-map.html

I have no association with Bargaineering, I just appreciate good ideas.

Jim writes a lot of great stuff – i have not problem with a link to his site. That post you link could be a good complement to mine. First you list all your accounts as I mention, an then do your network map via Jim’s post. I think both would be helpful. Thanks!

I actually did a similar thing; listing all of my accounts in a binder. The only variation is that I did not list my passwords and usernames for access to the accounts; you just never know if something like that could fall into the wrong hands.

One point where I disagree with you is listing physical assets in the same place as your investments and bank accounts. Even things like a house and a car do not belong there because you do not know what the value is when you try to sell. An item is only worth what someone else is willing to pay for it, that is a rule of owning anything. It might be worth more to you, but you should not factor that into something like net worth (if you want an accurate #).

To solve that problem, I actually created a separate 3 ring binder where I keep my insurance policies and a list of everything I own. I stopped short of photography, but I am considering that to make a catalogue that can be referenced in a pinch.

Yeah, i understand the hesitance to put usernames and passwords in the file. I do take precautions to only put the file where we can access it, and in an password protected zip folder that only my wife can open -with a password I’ve given her. Of course, the hard copy is the only weak link, but that is not really accessible, and I can’t imagine a scenario where someone would have access to that.

As far as listing assets, the only reason I’m listing them all in here is for my wife’s use -so that she knows what all the assets are in the event that I die or become disabled. That way, while she won’t know what they’re valued necessarily, she’ll at least know they are there and have value to be sold if need be.

I agree with listing value. It might not stay that value- but it gives a base. I have no idea how much my husband’s tools are worth and he has no idea how much my first edition books are worth. If one of us should pass and the other sells everything at a yard sell—a lot of income could go down the drain.

I did this for my husband years ago. It has come in handy for moves.

We do not put passwords near ids. We have a separate folder just for them- put them in an order that is on the other ids- easily matched up. After watching the “thief on TV” I will never again delude myself that “no one will find” a hard copy!

Don’t forget to list your safety deposit box and where your key is stored. You can list what papers are stored in there (copies of wills & trusts, deeds, jewelry) Also if you have a safe in your house, where it is, combo and/or back-up key location.

You make a good point there.. I may have to add that.

Here’s a post talking about some things to put in that safety deposit box.

Zip passwords are NOT secure. I use an app called TrueCrypt to create an encrypted file that looks like a drive on your Pc. Copy that file to offsite storage. Otherwise this is very similar to what I do. Well worth it in terms of peace of mind.

I have a single “In case of emergency” document that lists not only the financial resources but also other data my sons might need when I go. Things like:

– contact info for my out of town siblings/family

– contact info for my boss and a close coworker or two

– location of important docs: will, car titles, passport, warranty deed, birth certs.

– what needs returned to work: badge, pda, corporate credit card, etc.

– health insurance company info

– contact info for the lawyer who prepared my will, power of attorney, etc.

– automatic withdrawals from my accounts including yearly credit card stuff

– how to keep my vanity website alive if they so choose

– how to transfer AdSense and Amazon affiliate income from said site to them

– how to keep my email alive including setting up a “Sam is dead” autoresponder

– how to unsubscribe from major email lists: Yahoo Groups, meetup.com

– suggestions on what to do with my stuff, what at my house belongs to someone else

– answers to security questions on major websites, hints on how to answer other questions, e.g. answers are one word, lowercase, no punctuation

– passwords for computer and wireless router

– where valuables are hidden at my house

A financial adviser who taught a continuing ed. class I attended recommends the website answersbook.com, where a lady who lost her husband suddenly created a book in which to list all sorts of things she would have liked to have known. I’ve not purchased the book and have no affiliation with the site–it just looks interesting.

“passwords for wireless router”

wow. never would have thought of that!

I have been working on a similar project for a while now. I started with a net worth spreadsheet, then added tabs for more detailed information. Besides the url, I have a column for the location of paper copies (i.e. file cabinet, black binder, blue storage tote). I’ve also included passwords but instead of having an obvious column labeled “password” I’ll put it in say column P and then I hide the column. Not exactly secure but at least not so obvious. Since this is for “just in case”, make sure all accounts have been updated with beneficiary information as well.

We use Mint for a similar purpose. My SO and I have a joint Mint account in addition to our personal ones where we’ve both added all of our accounts. This allows each of us to know the full financial picture (we don’t have any major assets outside of these accounts that aren’t jointly owned) with read-only access. Beyond that our finances are pretty simple and I don’t want to have unencrypted passwords all listed in one place.

I’m not married, but I left a similar document with the executors of my will that lists all bank account numbers, approximate amounts at the time of writing, how to collect the proceeds from my life insurance, and who is the beneficiary on each of my retirement accounts. That way, it’ll be far easier for them to find the funds if something happens to me.

This is awesome! I’ve also stored deeds and copies of such in different places. I have my last few tax returns also in my files (both on paper and electronically) as well.

I know this sounds morbid too, but I also left a list of friends that might want to know that I’ve gone one to the great beyond since I don’t facebook or anything.

After the last few deaths and trying to figure out what was where for relatives, this seems sooooo much easier than the alternative.

Thank you for putting this together and sharing it with your readers. I am in the process of simplifying our financial life and have every intention of creating a document like this for my wife. I’m 33 and she’s 28, but like you said, you never know! Your doc will help me build mine. Why reinvent the wheel, right?