If you’re interested in getting started with trading and investing, choosing a feature-filled and reliable platform is a must.

M1 Finance has been around since 2015 and the platform continues to develop new features and improved functionality on a regular basis. It has quickly become one of the go-to platforms for new and experienced investors.

In this M1 Finance review, we’ll explore this company in detail and help you determine if it could be a good fit for you.

M1 Finance Basics

M1 Finance, "The Finance Super App", offers a great mix of automated investing and portfolio customization tools along with spending and borrowing features.

This platform offers 80+ “pies” or pre-built portfolios, but you can also build your own portfolio and investing strategy. This makes M1 a great option for newbies who like the idea of pre-built automated investments or the more experienced investor who wants to customize their portfolio according to their specific risk, personal preferences, and other investment goals. Either type of investor will enjoy the low-cost of the service, with no fees for trading or investment management. So, if you like to watch the pennies or don’t have a massive investment fund, you won’t need to compensate for hefty transaction fees.

M1 Finance has various account services to ensure greater flexibility and seamless money movement. You can schedule auto deposits to your portfolio on a weekly, bi weekly or monthly basis. The platform also allows you to place individual trade orders and consolidate your holdings with transfers from an external brokerage or retirement account. Investors can also use margin accounts and borrow up to 35% of their account value, if the balance exceeds $2,000.

M1 Finance Fees

All M1 basic accounts have no monthly fee with all supported investment trades being commission-free.

M1 Plus costs $0 for the first 3 months, then $10/month or $95/ year. M1 Plus adds features and functions to the platform that we’ll cover in more detail below.

While most activities on M1 Finance are fee-free, there are some possible charges that you’ll need to consider. For example, if you don’t log into your account for over 90 days, there is a $20 inactivity fee. There is also a $25 wire transfer fee. M1 is quite transparent, however, and has a full fee schedule available on its website.

Setting Up An Account

Another attractive thing about M1 Finance is that setting up an account is remarkably straightforward.

Once you’ve created your user name and password, you’ll be prompted to enter the onboarding process, which guides you through how M1 works. It will ask that you answer a few general questions about your investment experience, so you can start to construct your portfolio, whether it is a pre built pie or a customized option. You'll then need to select the type of account you want to open.

M1 Finance supports Traditional IRAs, Roth IRAs, SEP IRAs, brokerage, and trust accounts. If you opt for M1 Plus, you can also open a custodial account.

Each type of account does have a minimum to open the account. The minimum is $500 for IRAs and $100 for other types of accounts.

Once you have selected your account type and finalized your portfolio, you’ll just add your banking information for your external funding account, and you’re ready to start your investing.

M1 Finance Features

The M1 Finance features that your account has will depend on whether you choose to open an M1 Basic account or upgrade to M1 Plus.

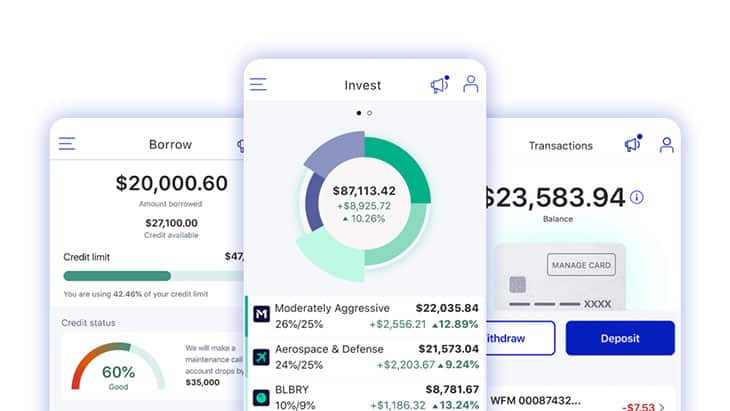

M1 Basic has no annual fees, but all your trades are made just once per day each morning. M1 Plus has a second trading window in the afternoon, with lower margin borrowing rates, along with other benefits.

The standout features of M1 Finance include:

Owners Rewards Card by M1

The Owners Rewards Card by M1 is a unique cash back credit card that is available to anyone who wants to sign up. With the card you can earn up to 10% cash back when you spend with certain companies tied to investments that you hold through the platform. You also get a base 1.5% cash back on all other spending.

For example, let's say you hold Spotify stock in your portfolio, and you put your monthly charge for the service on your Owners Rewards Card. You'll get 10% cash back on that charge. Then, you can automatically reinvest that cash back into your Pie to keep building wealth!

An M1 Plus subscription is no longer a requirement to apply for the Owner's Rewards Card by M1, so anyone can apply. The annual fee for the credit card will be waived for active M1 Plus members. The annual fee for the credit card, without an M1 Plus subscription, is $95 per year. If you're signing up for M1 Plus anyway (which is also $95/yr), the credit card is a no brainer.

New credit card holders can earn a $300 bonus when you spend $4,000 on your new credit card in the first 90 days after activating. Terms and Conditions apply. Open Account

Smart Transfers

This is another exclusive feature for Plus customers. You can set a rules based strategy to transfer money into your specific investment goals. Allocate your excess cash towards maxing out your annual IRA contributions, investing with one of your brokerage accounts, or spending.

You can layer the rules, so the cash management tools automatically transfer funds to match your specific needs.

M1 Borrow

M1 Finance also offers M1 Borrow. This allows M1 users to enjoy a portfolio line of credit at a low interest rate. This feature makes it easier to access funds on more flexible terms with lower costs compared to personal loans, home loans, or mortgages. This type of feature has previously only been available for the ultra wealthy, but M1 Finance has opened it up to a far larger audience.

To qualify for M1 Borrow, you must have a taxable brokerage account with a balance of at least $2,000. You cannot use an IRA account to access this feature. However, your credit score is unimportant, as M1 Finance uses your portfolio as collateral, so it will not perform a credit check.

You can borrow as much as 35% of your account balance as a loan, with an interest rate of 3.5%. M1 Plus members can access an even lower rate of 2%!

What’s really interesting is that there is no set payment schedule. You can simply pay the loan back as and when you like, you’ll just need to appreciate that you will incur interest on the outstanding balance each month.

M1 Invest: How To Invest With M1 Finance

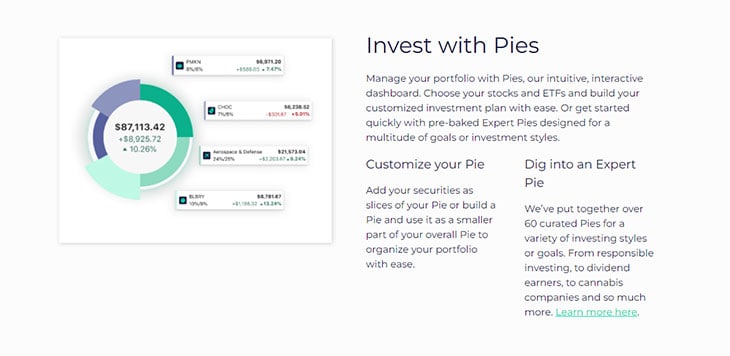

You can choose your preferred investment strategies with M1 Finance. There are pre made portfolios you can choose, or you can create your own.

Custom Investment Portfolios

If you prefer a self-directed investment strategy, you can build your own portfolios from over 6,000 ETFs and stocks that are listed on Nasdaq, the New York Stock Exchange and BATs exchanges. You can simply select the specific funds or stocks and indicate the number of shares. M1 allows you to buy full or fractional shares.

Searching for individual stocks is quite straightforward. You can use the ticker symbol or use the research tab and screen your stocks according to P/E ratio, market sector, dividend yield or market capitalization. For ETFs, you can screen by dividend yield, expense ratio or total assets.

PIES

M1 Finance also offers pies. These are pre made portfolios generated by industry experts. There are almost 100 pies organized into categories including:

- General Investing: These are tailored to specific risk tolerances with seven options that range from ultra conservative to ultra aggressive. Each portfolio contains up to 10 diversified stock, real estate ETFs, and bonds.

- Income: These are an alternative to CDs to generate income. There is a choice of US and international dividend paying equity funds. There are also short to long term bonds, mortgage backed and bond ETF combinations and US dividend stocks.

- Retirement: These portfolios target specific retirement years up to 2060 in five year increments. Each of the target year funds offer a conservative, moderate or aggressive allocation.

- Responsible Investing: These are designed for those who want to create a socially responsible investment strategy with five to seven ETFs from US or international socially responsible investing portfolios.

- Hedge Fund Followers: These Pies copy strategies from big hedge funds without incurring the big fees. There are eight options that follow names such as Berkshire Hathaway, Tiger Global, and Coatue Management. The number of stocks varies according to the portfolio, from seven to 25.

- Stocks and Bonds: These are simple portfolios with diversified global stocks and global bonds.

The Pros And Cons Of M1 Finance

As with any financial product or platform, M1 Finance is not perfect and there are both positives and potential downsides. It is important to be aware of these, so you can make an informed decision.

The Pros:

- Almost 100 tailored portfolios tailored to a variety of investing strategies.

- Choose from 6,000+ ETFs and stocks to create your own personalized portfolios.

- Competitive margin account rates.

- Little to no fees.

- Great features including credit card and cash back for M1 Plus members.

The Cons:

- Smaller feature set: Compared to some full service online brokers, M1 Finance does have a more limited set features. You cannot actively trade assets other than stocks and ETFs, and you only have 2 trading windows per day.

- Limited customer service options: There is only a phone number and email address to contact the support team.

- No live financial advisor access: Unlike many platforms, you will not have access to live financial advisors.

The M1 Finance User Experience

You can access the M1 Finance platform on your computer or mobile device. The website is straightforward with a clean design that is simple to navigate.

You’ll find tabs to access your portfolio activity and your holdings, while the buttons to rebalance, buy or sell are easy to find. You can also access graphs that illustrate your allocations in detail.

M1 Finance also has an app that is highly rated. The workflow of the app is almost identical to the website, allowing you to do almost anything on the app that you could on the website. These elements combine to create an excellent user experience.

While M1 Finance may lack some of the more advanced features offered by some other platforms, the low fee structure that allows Basic members to perform trades with little to no fees is hard to beat. Even if you upgrade to an M1 Plus account, the feature set more than offsets the annual fee.

Who Should Use M1 Finance?

M1 Finance is a great option for investors who already have intermediate skills and experience that means that they don’t need a lot of hand holding. They can enjoy auto investment management with the flexibility to customize portfolios to suit their unique needs.

This is also a good platform for those who are looking for automated investment management with a very low fee structure. While it is becoming more commonplace for online investment platforms to have low fees, M1 Finance is tough to beat.

Whether you choose a Pie portfolio or like to choose your own investments M1 Finance manages your investment portfolio with rebalancing to ensure your asset allocation is aligned with your goals.

This platform is also a great option for those who prefer to use margin loans. The M1 Borrow feature has very low rates even for basic members that provides additional buying power or cash to meet any unexpected needs that set this platform apart from the competition.

M1 Finance - A Great Low Cost Financial Platform

To sum up, M1 Finance offers a great option for investors with experience or those who are looking for a low cost way to get into investing.

The customization is a clear strength that allows M1 to stand apart from the typical brokerage. You can choose pre built portfolios or create your own, which is far different from what you could expect from a more basic automated investing service. This makes M1 closer to a self directed investment platform with automated features.

Once you feel comfortable with the interface, you can automate your personal finances and concentrate on building your investment expertise.

M1 Finance is one of our favorite financial platforms available, and since the basic account is free there isn't much to lose in giving it a try.

Brokerage | Promotion | Open Account | Review |

|---|---|---|---|

2 free stocks (Up to $1,600) | |||

Free stock slice | |||

Free $10 bonus | |||

1 free stock (Up to $200) | |||

Get $100 when you deposit $2,500 | |||

Free stock (Up to $1,000) | |||

Get up to $1,000 cash to invest. | |||

2 free stocks (Up to $400) | |||

3 free stocks (Up to $1,200) | |||

Free $5 bonus | |||

Free $5 bonus | |||

Free $10 crypto bonus | |||

Free $250 bonus |

Love the in-depth review!

As an experienced investor I’m definitely a huge fan of M1 Finance. If the goal is to just set up a selection of index funds and ETFs (aka your pie), automate some investments, and lay back and see growth over the long-term – I’d say nobody can beat them. They’re to easy to use and have enough great funds so that you should be able to set your pie up however you like. They do miss out on some specific Vanguard and Fidelity funds, but I’d say overall their selection is still great!

I used M1 Finance for 18 months. It’s a nice platform and has an attractive borrowing feature, but I ultimately left due to security concerns and lack of confidence in the engineering team at the company. Too many small mishaps. I use Schwab now.