There’s no small number of student loan sources today, so how can you know if one you’re considering is the right choice to refinance student loans?

One way to avoid that dilemma is to use an online student loan marketplace, like LendKey. The platform works with dozens of individual credit unions and community banks to provide student loans.

By filling out a single, non-binding online questionnaire, you can get loan quotes from several of these lenders. Once you do, you’ll be presented with multiple loan offers, so you can choose the one that works best for you. And just as important, you can check out loan offers without affecting your credit.

About LendKey

Founded in 2007 and based in New York City, LendKey is an online lending marketplace. Though they also provide home-improvement loans, their primary loan products are student loan refinancing and private student loans.

As an online lending marketplace, LendKey is not a direct lender. Instead, they enable borrowers to access financing provided by credit unions and community banks. This is significant because credit unions have some of the best student loan programs available. Since the loans are provided by financial institutions – and not by the federal government – they’re all private loans, technically speaking.

You can complete an online application and have access to loan offers from multiple lenders. That will give you an opportunity to select the best rate and term for your personal needs.

The company has a rating of “A”, which is the second-highest rating on a scale of A+ to F by the Better Business Bureau. LendKey has been BBB accredited since 2012.

LendKey Features and Benefits to Refinance Student Loans

Minimum and maximum loan amounts: The minimum is $5,000 in most states, however, it’s $6,000 in Massachusetts, $10,000 in Arizona, and over $15,000 in Connecticut. The maximum loan amount is $125,000 for loans related to an undergraduate degree, $175,000 with a graduate degree, and up to $300,000 for select medical degrees.

Availability: All states except Maine, Nevada, North Dakota, Rhode Island, and West Virginia.

Loans eligible for refinance: Both federal and private student loans. All loans included in your refinance must be in your own name as the primary borrower. Student loans taken on your behalf by parents, including Parent PLUS loans, are not eligible for refinancing. Private student loans are available for current students.

Cosigner permitted: Generally permitted, but specific terms depend on the bank or credit union providing the loan. Cosigners must be US citizens or permanent resident aliens and meet the income and credit criteria required by the individual lender.

Cosigner release: Cosigners can be released after between 12 and 36 consecutive, on-time monthly payments in full. This is not guaranteed to be the case for all lenders, and more specific criteria may be implemented by that lender.

IMPORTANT: The borrower alone must make the required consecutive monthly payments, as well as provide proof of income indicating the capability to make the monthly payments alone. There can be no bankruptcies or foreclosures in the previous 60 days and no loan defaults. The cosigned loan must not be in delinquent status, and any period of forbearance will reset the repayment clock.

Grace period: You’ll have a grace period of six months after you graduate or are no longer enrolled at least half-time in a degree-granting program. You will then be required to make regular principal and interest payments.

Refinance frequency: There’s no limit to the number of times you can refinance your student loans through a LendKey participating lender.

LendKey security: The website uses appropriate physical, technical, and procedural safeguards to protect your personal information from unauthorized access and disclosure. The transmission of personal information over the Internet is encrypted, and available only to authorized employees, business partners, lenders, and third-party service providers.

Mobile app: Not offered.

Customer service: Available by phone or email, Monday through Friday, from 9:00 am to 8:00 pm, Eastern time.

Forbearance due to economic hardship: The availability of forbearance will depend on the policies of the credit union or community bank that funds your loan. These will vary in terms and requirements, and it’s possible some lenders may not offer forbearance at all.

Loan servicing: LendKey will service all loans funded by participating credit unions and community banks.

LendKey Refer and Earn Program: If you refer friends and family members to LendKey, you’ll receive a $200 cash bonus for each person who takes a loan through the platform. But the person you refer will also get $200! What’s more, there are no caps or limits on the number of people you can refer and earn bonuses on.

How LendKey Works to Refinance Student Loans

So how does the student loan refinance process work with LendKey?

LendKey Student Loan Refinancing

To qualify for a student loan refinance, you must be a US citizen or permanent resident alien and have graduated from a Title IV participating school with at least an associate’s degree.

You can also refinance student loans if you are a current student pursuing a bachelor’s degree or higher, but you must have completed an associate’s degree to be eligible. Under this type of refinance, you will usually be required to begin making monthly payments while you are still in school.

Student loan refinances are available in terms ranging from five years to 20 years, and in both fixed and variable rate loans. (See LendKey Rates and Fees below for a full discussion of the terms of both loan types.)

Married couples. LendKey’s lending partners only provide refinances for education loans that are in your name as the primary borrower. As such, you cannot combine loans from both you and your spouse into a single refinance.

Loan payoff schedule: Once you complete your refinance you should expect at least 10 days to as many as 30 days before each of the lenders included in your new loan are paid off. You’ll still be responsible for making the required monthly payment on each loan until it has been completely paid. Any overpayment as a result of the refinance will either be sent directly to you or back to LendKey, where it will reduce the outstanding balance of your new loan.

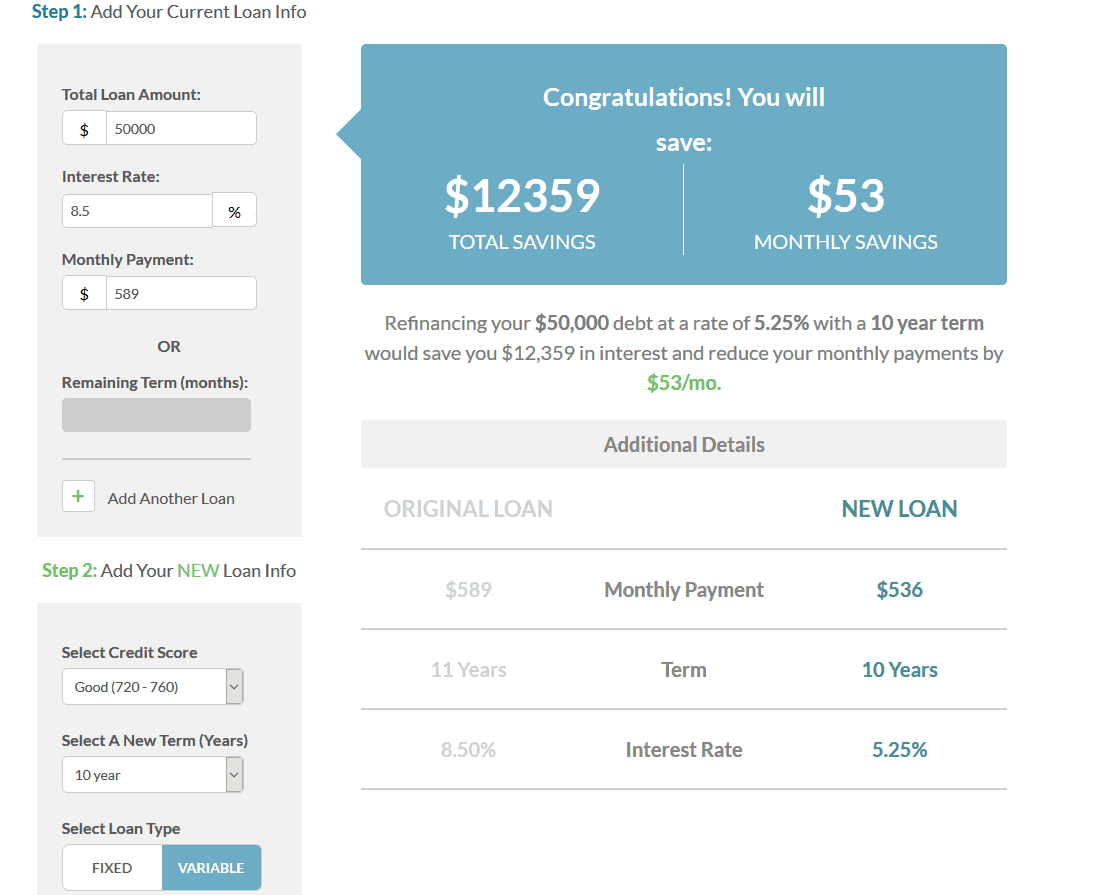

Student Loan Refinancing Calculator

Before you even apply or investigate rates and terms, you can get an idea of what you qualify for using the Student Loan Refinancing Calculator.

It uses two input screens. The first asks for your current loan information, while the second asks you to add your new loan information. Once you do, the results will show the details of the new refinance, as well as the monthly savings it will provide.

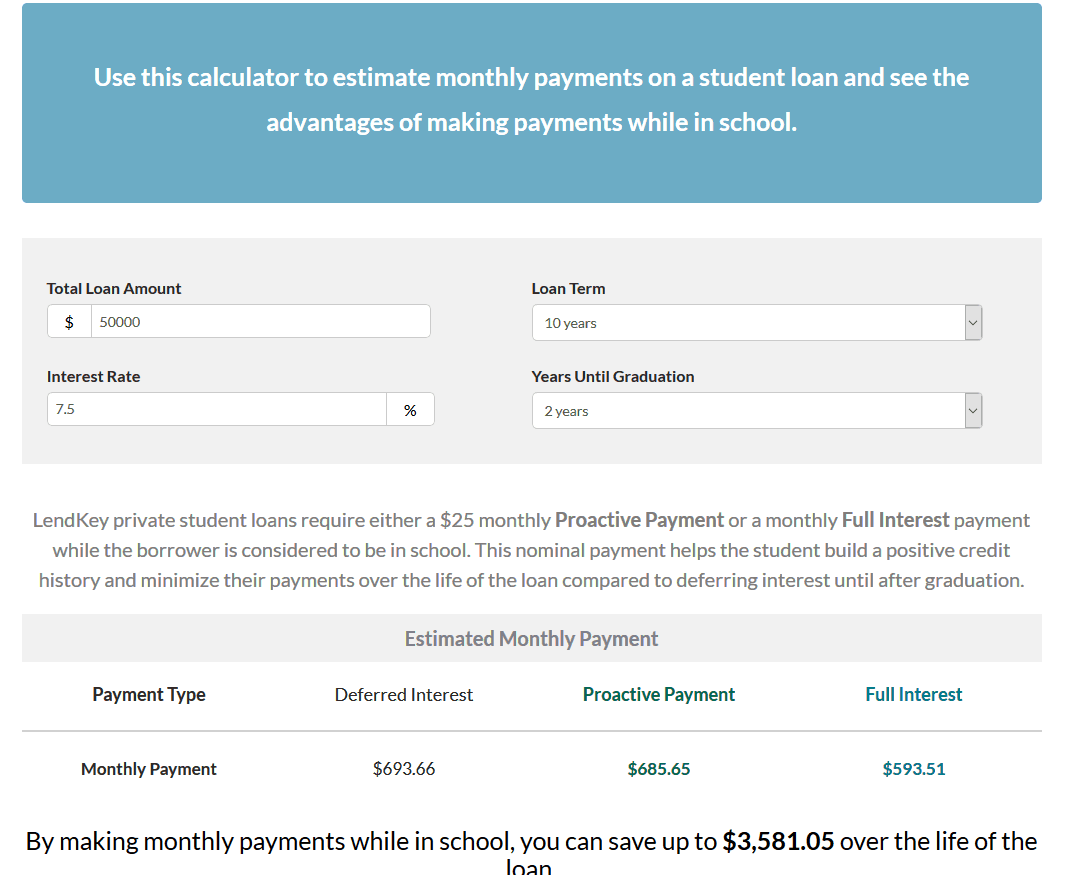

Student Loan Payment Calculator

To show how committed LendKey is to student loan refinancing, they also offer the Student Loan Payment Calculator. It’s designed to show you the benefits of making payments while you are still in school. It even presents different scenarios, showing both partial payments and full payments, and the effect they’ll have on your deferral.

Not all students are in a position to make payments while still in school, but if you are, this tool will help show you the benefits of doing so.

Should I Consolidate My Student Loans?

A student loan refinance is generally done for the purpose of lowering either the interest rate, the monthly payment, or both on your current student loan or loans.

But in some cases, getting a lower interest rate may not be possible. This can happen either because your credit is not sufficient to get a lower interest rate, or because interest rates, in general, have risen since the time you took your original loans.

If that turns out to be true, you can also consider doing a student loan consolidation. It doesn’t lower your interest rate or even your monthly payment. Instead, it combines several loans into a single new one, with a monthly payment and rate that match the average of the consolidated loans.

The primary advantage of a student loan consolidation is combining several loans and monthly payments into one. That may not improve your situation financially, but it will simplify your life.

Please be aware that if you have federal student loans, refinancing those loans could cause you to lose important student loan relief benefits available only on federal loans. These include income-driven repayment plans and public service loan forgiveness (PSLF) that will be lost if you refinance those loans into private loans.

LendKey Private Student Loans

Private Student Loans are available for up to 100% of your school-certified cost of attendance. That includes tuition, room and board, textbooks, and related education expenses. Loan funds are disbursed directly to your institution, and not to you individually.

Loans are available if you’re attending school on either a full-time or part-time basis. However, you must be enrolled at least half-time in a degree-granting program from an eligible school.

If you are applying for a Private Loan, you will not be required to complete the FAFSA form to be eligible for a loan. However, you may want to complete the form to learn what federal aid you might qualify for.

Private Student Loans are available in terms of 5, 10, or 15 years. They are available in both fixed and variable rates. (See LendKey Rates and Fees below for a full discussion of the terms of both loan types.)

LendKey Rates and Fees

Your interest rate will be determined by the information you provide on your initial questionnaire. It will be determined by your income, degree, the school you graduated from, and the credit information from your soft credit pull.

Your rate will be locked when you submit a full application for approval. The rate information provided in the pre-qualification phase is based on the information you supply. Your final rate will be determined by any new information obtained during full application.

Fixed Rate Loans

Fixed-rate loans for Student Loan Refinancing start as low as 5.24% APR, to a high of 9.35% APR. Most participating lenders will provide a 0.25% discount on your rate if you sign up for automatic payments.

Terms range from five years to 15 years for Private Student Loans for current students, and from five years to 20 years for graduates looking to refinance.

Fees: There are no application or origination fees, or prepayment penalties charged by any lenders participating in LendKey.

How to Apply with LendKey

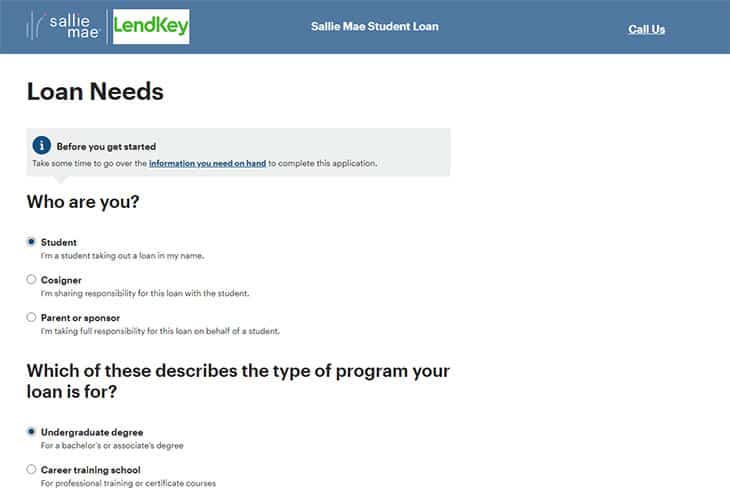

You’ll begin the process by checking interest rates and terms offered based on the information you supply.

The loan information will be offered with a soft credit pull, which will have no impact on your credit score. However, once you select the lender you want to work with, a hard credit inquiry will be performed.

You’ll also need to supply documentation, which will include the following:

- Photo ID, such as a driver’s license, passport, or state-issued ID card

- Your Social Security number

- Income verification, in the form of pay stubs or income tax returns

- A loan statement from your current servicer(s) for each loan you want to refinance

Your documentation can be uploaded with your application. Once again, if you are applying for a Private Loan, you will not be required to complete the FAFSA form to be eligible for a loan. However, you may want to complete the form to learn what federal aid you might qualify for.

Note on loans from credit unions: Many of the participating lenders on LendKey are credit unions. To qualify for a refinance through credit union you will need to become a member of that organization. However, credit unions are free to join and typically require only that you open a checking account or other qualifying accounts.

LendKey Pros and Cons

There are quite a few pros of refinancing with LendKey, and a few cons to be aware of.

Pros

Cons

Who Will LendKey Work Best for to Refinance Student Loans?

There are many direct lenders that specialize in refinancing student loans – and many are quite good at it. But if you want to give yourself the benefit of having a choice of lenders, a platform like LendKey is exactly what you’re looking for.

Since both in-school loans and student loan refinances are provided by private sources, like credit unions and community banks, LendKey is best suited for those who have at least average credit. That means a credit score of 650 or higher, and preferably higher if you want more generous terms and a lower interest rate.

LendKey lenders are also a bit more discerning when it comes to income as well. You can only refinance student loans through a LendKey lender if the loan is in your name as the primary borrower. If it’s in someone else’s name, like your parents, you won’t be eligible.

You’ll need to qualify to have a cosigner released as well, by demonstrating you’ve been consistently making the monthly payments for the 12 to 36 months required to establish payment ability.

Based on that criteria, it would appear that LendKey has a somewhat more limited target market than many of its competitors. However, since those guidelines are set by the participating lenders, you can also fully expect to see similar limits set by many other lenders outside LendKey.

If you’d like to consider other good options in addition to LendKey, please see our guide 10 Best Places to Refinance Student Loans.

To get your LendKey rate quote, click through via the buton below.

Company | Loan Types | Terms | Eligible Degrees | Rates |

|---|---|---|---|---|

Variable & Fixed | 5 to 25 | Undergrad & Graduate | ||

Variable & Fixed | 5, 7, 10, 15, 20 | Undergrad & Graduate | ||

Variable & Fixed | 5, 7, 10, 15, 20 | Undergrad & Graduate | ||

Variable & Fixed | 5, 7, 10, 15, 20 | Undergrad & Graduate | ||

Variable & Fixed | 5, 7, 10, 15, 20 | Undergrad & Graduate | ||

Variable & Fixed | 5 to 20 | Undergrad & Graduate | ||

Variable & Fixed | Varies by lender | Undergrad & Graduate | ||

Variable & Fixed | 5 to 20 | Undergrad & Graduate | ||

Variable & Fixed | Varies by lender | Undergrad & Graduate | ||

Variable & Fixed | 5 to 20 | Undergrad & Graduate |

LendKey

Pros

- Student loan market place with multiple lenders

- No application or orgination fees

- Soft credit pull for prequalification

- FAFSA not required

- Unlimited $200 referral bonuses

Cons

- Not a direct lender

- Maximum loan amounts lower than other lenders

- Cannot refinance loans taken in parents name

- No mobile app

- Forbearance is not gurantees

Share Your Thoughts: