Last week I talked about a new Lending Club video training course that was just launched by Peter Renton of Social Lending Network. The course goes in depth about how to make wise investing decisions when using Lending Club, and how you can optimize your holdings to get the best possible returns.

If you follow his advice to the T, I’m pretty sure that you’ll be seeing some good positive returns in your account. If you do in fact make interest and fees in your account, one thing you’ll need to think about is how you’ll be paying taxes on that interest income when it comes to tax time. Remember, you DO have to pay taxes on those earnings!

I’ve been thinking about this lately as I have made more with my account this year than in previous years. Figuring out how much you’ll need to pay in taxes on those earnings can be confusing. So today I thought I’d look at Lending Club and taxes.

Quick Navigation

Lending Club: Is It Taxable Income?

If you’re using Lending Club, the first question we need to ask is whether or not the interest income is taxable at all. The easy answer is that yes, the income is in fact taxable. Depending on when your loans in your account originated, you may be getting a 1099-INT or a 1099-OID to report it. You may not be getting either of those forms – which is where this gets confusing. We’ll go into which loan types and origination dates have which reporting forms in a moment.

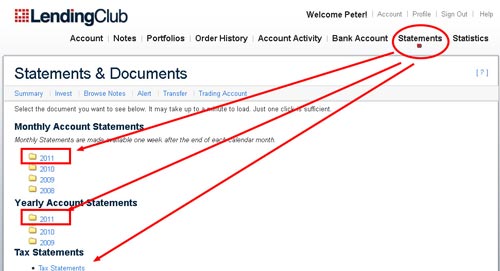

To get started, however, you’re going to need a few things from your Lending Club account’s statements page.

- Your monthly account statements

- Your yearly account statements

- Your tax statements

How Will Interest Income Be Reported For Lending Club?

Depending on when your loans originated you could be receiving either a 1099-INT or a 1099-OID.

- If you’ve been investing for a while and your loan(s) originated prior to October 14, 2008, you will receive a 1099-INT if the total interest you earned in 2010 for all these loans was greater than $10.

- If your loans originated after October 14, 2008 you will receive a 1099-OID (Original Issue Discount) to report interest income received on notes where the total interest on that note is in excess of $10.

Here’s where things can get confusing. If you have diversified your holdings across a variety of $25 loans like I have within your Lending Club account, you may not receive either a 1099-INT or 1099-OID at all as you may not have reached the $10 threshold on interest earned on that particular loan. That, however, doesn’t mean that you shouldn’t be reporting that interest income. Just that you won’t be getting a 1099 to give you a quick and easy number to report doesn’t mean the IRS won’t come after you if the unreported income comes to light.

How To Report Interest Income From 1099-OID

If you do in fact receive a 1099-OID, you’ll need to report that income on your taxes.

You can report it on Schedule B, Line 1. Want more details about reporting that income, you can find specific details in publication 1212. Page 6 has a section called “how to report”.

Once you get the 1099-OID you’ll want to reconcile the numbers on that form with your year end statement mentioned above to make sure they match. If they don’t (and they probably won’t if you invest in individual $25 loans like I do) you’ll need to add on any additional earnings to Schedule B that weren’t reported when you do your taxes.

How To Tabulate Net Earnings

So how do you tabulate your net earnings from your Lending Club account? You need to take the total of your interest income (reported and non-reported) plus income from fees, minus losses from charged off loans and minus the servicing fees.

- Taxable earnings = Interest income + late fees – defaults or charge offs – servicing fees.

To figure out your taxable earnings you’ll just need your year end statement to get the interest income, late fees and defaults.

The servicing fees, however, aren’t included on the year end statement. For that you’ll need to go to each of your monthly account statements (page 2) and get the servicing fees from there. It would be nice if they reported that on the year end statement as well, but they currently don’t.

If you had charge-offs (which I don’t), I’ve read elsewhere that you can claim the capital loss on Schedule D by reporting it as a bad personal debt. As with anything – verify this information for yourself before completing your taxes.

Haven’t Opened A Lending Club Account Yet? Do It Here.

Have you reported interest income on a Lending Club loan before? Tell us your experience in the comments.

Peter, Great detail about taxes. We will all need to be thinking about that soon. The one thing I would emphasize is that it is quite likely your 1099-OID statement will not reflect your total interest earnings from Lending Club. It is tempting for many investors to just received that statement and put those numbers on your return. But that will likely lead to under reporting of your Lending Club earnings.

Also, for the Prosper investors their 1099-OID includes interest earned from all loans (even those below $10) – not sure why both companies do it differently.

> Also, for the Prosper investors their 1099-OID includes interest earned

> from all loans (even those below $10) – not sure why both companies do it

> differently.

One of the main IRS office for California is down the street from Prosper? ;)

Funny. But Lending Club is now just four blocks away from Prosper in downtown San Francisco…

This is one of the reasons I have a Roth IRA with lending club. I don’t know if I would want to deal with all the paperwork. With the roth, there really is none.

If you haven’t received any tax forms (1099 INT or OID) where do you report the interest income? Do you just fill a 1099 INT?

Haris, It goes under Part I – Interest on your Schedule B (at least that is where my accountant puts it).

So my accountant last year placed the amount from 1099-oid box 1 from Lending Club on Schedule B. Then he did a subtotal and backed out that complete oid amount on a line labeled “OID Adjustment” to ultimately have a zero effect on my income tax. I have read up and down and in and out and can’t figure out why he zeroed out the effect of the oid amount. Publication is thoroughly confusing and that accountant won’t respond to my inquiries probably because we are not using him this year. Please help if you can.