I‘ve been investing with Lending Club for a couple of years now, and I’ve gone from a skeptic when I first started investing with the service, to someone who is convinced that Lending Club can be an integral piece in any person’s investing strategy. I’ve seen good returns since I started, and despite warnings from a variety of sources about how the site was a flash in the pan and not something you’d probably want to put your money in, I’ve stuck with it. Over the years I’ve used the site I’ve only had one loan get charged off. Since I was diversified, however, I’m still getting 11.44% returns. Not too bad.

This past week Lending Club announced that they had reached $500 million in loans originated since inception (2007), further showing just how strong the platform is.

Lending Club, the leading platform for investing in and obtaining personal loans, today announced that $500 million in loans have been originated via the platform since inception.

Lending Club serves the needs of prime consumers who choose the lower interest rate loans available through Lending Club over more expensive credit cards.The San Francisco-based company commenced operations in 2007 and has exceeded 100 percent growth in loan volume each year since. More than a quarter-billion dollars in loans were originated on the platform in 2011, more than doubling the previous four years combined. Lending Club now averages more than $1 million in loan originations per day, with an average loan size of $10,945. The majority of borrowers (66.7 percent) say they use Lending Club’s fixed-rate personal loan platform to pay off their high-interest credit cards.

So Lending Club according to their site is originating more than $1 million in loans per day. I would say that they’re here for the long haul, and if you haven’t checked them out yet, you should give it a shot!

Interested in my original Lending Club Review? check it out below.

Check out my original Lending Club review

Returns Increase To 11.44% And Another Late Loan

This past week I started looking at my taxes and figuring out how much interest I earned last year with Lending Club – as it is taxable income. If most of your loans are smaller ones with Lending Club like me, you won’t be getting any tax forms, and it can be quite a confusing process figuring out your interest earned. If you’re as confused as i was when I started looking at it, check out my post on Lending Club and taxes.

This past month my Lending Club account had it’s first charged off loan in over 2 years of using the site. While it was disappointing, thankfully I didn’t lose much on the deal because the loan was over 1/2 paid off already. Despite the charged off loan, my returns increased this month again to 11.44% as I added more “high risk” loans. Unfortunately I had another loan go into the “16-30 days late” category. We’ll see if they get back on track, it shows that they have scheduled a payment.

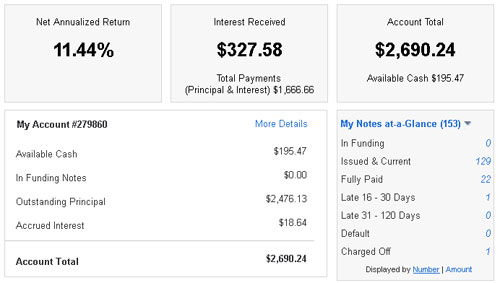

- Net Annualized Return of 11.44%: Up from 11.23% in December, 10.93% in September, 10.76% in August and 10.53% before that. At last check my returns were higher than 62% and lower than 38% of all investors on Lending Club’s compare feature. Unfortunately the compare feature in Lending Club account is now gone completely, so I can’t keep up on those numbers anymore. I understand the numbers weren’t completely accurate, but it was still a fun to compare.

- Number of defaults.. one and counting: Last month I had my first charged off loan, a Grade B loan. Go figure. Just goes to show that it isn’t always the high grade loans that peform as well. I’ve seen quite a few Grade A and B loans either pay off early, or as in this case – get charged off.

- Twenty two loans have been paid off early: Nine were A grade loans, six were grade B loans, five were C grade, and one grade E and F. Looks like grade A and B loans are more likely to get paid back early, reducing returns. Another reason why I’ve started investing in more higher grade loans.

- My account balance still going up: I currently have $2,690.24 in my account, with $195.47of that ready to invest. I’ll be finding some loans later today.

- I’m still diversified by investing across a large number of loans: I’ve had 153 loans, with no more than $25 in each loan. In other words, I’m diversified across a large number of loans, lessening my risk from any one loan going into default or getting charged off.

NOTE: Did you know that 100% of investors who have invested in 800 notes or more had positive returns. Not too shabby, not everyone in the stock market can say that!

What’s Your Actual ROI?

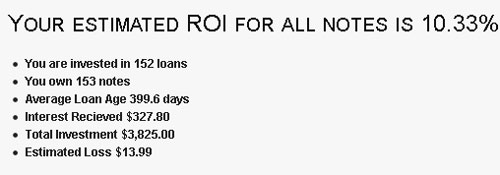

A site that I discovered a while ago that gives what I think is a better picture of the actual ROI you can expect is Nickel Steamroller’s Lending Club portfolio analyzer. Basically the analysis tool with give you an estimated ROI after you download all your notes from your Lending Club account and upload the .csv file. It will go through you notes and give sell recommendations, show duplicate notes and highlight notes that are below Lending Club’s average return (so you can sell them on the secondary platform). It will even give you a fun little map showing where your loans are (see mine above).

In looking at my returns on the analyzer, my actual return according to the site will be closer to 10.33%.

Those are still better than the returns I’ve seen in the stock market this year, or in my savings account.

Lending Club Strategy

Here’s the basic strategy I’ve been using with Lending Club over the past couple of years. I’ve fudged on this a bit in the past few months due to the fact I’m buying more low grade loans, but it still holds mostly true.

- Less than $10,000: I believe I’ll still be sticking with mostly loans below $10,000. Lower amounts mean higher likelihood of payback of the loan.

- Zero delinquencies: Again, I may fudge slightly on this one, but I still want it to be very few or zero delinquencies.

- Debt to income ratio below 20-25%: I like to invest in loans where the borrowers have a lower DTI ratio, and preferably have higher incomes. I’ll try to keep this as is.

- Good employment history: I like loans with a decent employment history of at least 2 years, and a decent income.

So that’s what I’m doing with my Lending Club portfolio right now, and how I’m investing.

Not ready to invest, but looking to consolidate debt or pay off a high interest credit card? You might want to consider borrowing from Lending Club. Check out my post on borrowing from Lending Club.

Are you currently investing in Lending Club? How are your returns looking? Tell us in the comments!

Peter-I’ve read a lot about Lending Club including several of your posts. I love the idea of it but unfortunately it looks like its not supported in my state. Anyone know if there are certain regulations that prevent it in some states? Has there been any talk of expanding into more states?

Scott………….Without knowing what state you are from Peter Renton’s answer is going to be the best you’re going to get. However, despite the fact that no one seems to ever spell it out, there are specific reasons & specific thresholds that need to be met before p2p is allowed to be issued in the more restrictive states. It’s not just a matter of filing paperwork, jumping through hoops & paying fees. Not at all.

And I’ll be glad to spell them out……………even though I’m not an “expert” & have no blog of my own :)

I’m in Arkansas. I don’t need too much detail (b/c I might not understand it) but I would be curious about the reasons and “thresholds” you are talking about.

Ok, then I’ll give you the Readers Digest version. The SEC characterizes all p2p loans as debt obligations of the companies involved…………….not the borrowers themselves. In other words, regardless of the individual choices we make in choosing this or that note, ultimately all of them are legally a “bond” that is issued by the companies themselves. Therefore our returns/interest are also viewed as being issued directly by the companies & not the borrowers.

Now,…………. regulatory agencies from certain states have specific regulations that prohibit the issuance of “bonds” in the primary market by companies that have not achieved profitability. These states stipulate that interest that is paid to us must come from profits. No profits=no authorization to offer notes. Neither company is profitable yet, so no p2p for those that live in those states. These regs do not however apply to the secondary market. The End.

PS……..I’m not a lawyer so there’s always the chance that I have no idea what I’m talking about. :)

Scott, Lending Club needs to comply with state securities regulators and unfortunately some states are worse than others. I wrote about this very issue on my blog a few months back (Peter – I hope you don’t mind me providing a link):

http://www.sociallending.net/regulation/why-some-states-dont-allow-p2p-lending-investments/

Peter, Congratulations on your continued success. Anything over 10% I think is a great effort in this environment. With just one loan that is only 16-30 days late I expect you will be close to 12% by the time the next update rolls around.

Peter,

Great Job on your returns! Would you ever consider having an IRA or 401K with Lending Club?

Thanks Brad

I have considered it, but haven’t gone down that road yet. I know some others are doing that though, like Peter at http://www.sociallending.net

Peter/Brad, Yes I am a big fan of the IRA product. Because all interest earned at Lending Club is taxed as ordinary income an IRA makes the most sense. I have a large percentage of my investment there in an IRA – having rolled over both 401(k)’s and IRA’s into it.

Roths are the best tax vehicle right now!

Please read this company’s financial statements, before you go investing in a hole in the ground….

We have incurred operating losses since our inception. For the three months ended September 30, 2011 and 2010, we incurred

net losses of $3,346,357 and $2,938,890, respectively. For the six months ended September 30, 2011 and 2010, we incurred net losses

of $6,453,035 and $5,464,124, respectively. For the six months ended September 30, 2011 and 2010, we had negative cash flows from

operations of $5,173,712 and $4,373,273, respectively. Additionally, we have an accumulated deficit of $47,907,686 since inception

and a stockholders’ deficit of $43,443,394 as of September 30, 2011.

Since our inception, we have financed our operations through debt and equity financing from various sources. We are dependent

upon raising additional capital and/or seeking additional debt financing to fund our operating plans. Failure to obtain sufficient debt

and/or equity financing in the future and, ultimately, to achieve profitable operations and positive cash flows from operations could

adversely affect our ability to achieve our business objectives and continue as a going concern. Further, there can be no assurance as to

the availability or terms upon which any required financing and/or capital might be available in the future, if at all.

Gabe, Most of us are fully aware of the finances of Lending Club – I have written about this myself recently. It is true they have made considerable losses to date and continue to make losses but they are very well funded and have a steep growth curve that should see them to breakeven around the end of the year. Within 18 month to 2 years they will be solidly profitable.

I am interested as to where your growth curve is being calculated. The company has ~$48mil in accumulated deficit. There is no way in 18 months to 2 years that they will be profitable. I find it very interesting that a company that is built to help people pay off their own debt is itself in debt. This company is very similar to the common Ponzi scheme of continuing to get more people to pour more and more cash in until one day the plug gets pulled because payments will not be able to be made when promised.

“Do not charge your brother interest, whether on money or food or anything else that may earn interest.” Deuteronomy 23:19

I think there is definitely a discussion to be had behind Christians lending money. There needs to be an examination of the historical context of money lending and how and why it used to happen, and how it works and is different today.

There’s a great discussion on the topic over at MoneyHelpForChristians.com that’s work checking out: Should Christians Lend Money?. But to boil it down I think there can be a context when a loan can be a blessing and not a burden as it usually was in Biblical times.

Do not charge your brother interest, whether on money or food or anything else that may earn interest. You may charge a foreigner interest, but not a brother Israelite, so that the Lord your God may bless you in everything you put your hand to in the land you are entering to possess. (Deuteronomy 23:19-20 NIV)