When people talk about their investment plans, one of the first topics that invariably comes up is how much they should be investing.

Should they be investing 5%?

15%?

50% of their income?

Today I thought I’d look at the number that comes up most often as being conventional wisdom for most people when it comes to how much to invest – 15% of yearly income.

Investing 15% Of Your Income Into Post-Tax And Pre-Tax Retirement

For many folks the discussion of how much to invest is a moot point as they’re still struggling to get rid of debt, and get to the point where they’re able to start saving for their future.

If you’re beyond that point, congratulations, you should be applauded.

For me getting to the point where you really start to save and build wealth for your future is so exciting! A variety of financial gurus suggest saving 15% of your household income in good solid long term investments in order to have enough for your future.

So why is that number brought up?

Why Should I Save 15%?

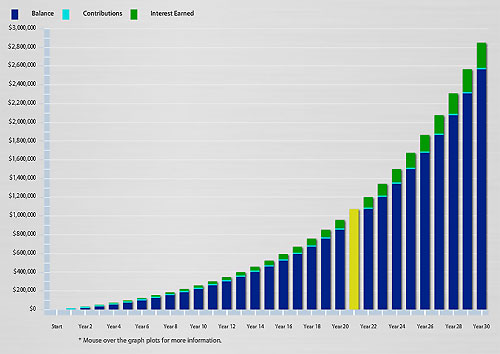

To give a visual demonstration of why some folks suggest that you save 15% for your retirement, I went to Dave Ramsey’s website and used his investment calculator. I put some numbers into the calculator based on these factors:

- Making $100,000 a year

- Saving 15%

- Starting at age 30

- Saving for 30 years

- 10% return on the investments

When you put in those numbers above, it comes up with a return of well over 2.8 million dollars by the age of 60.

If you were to keep it going even for 5 more years until the age of 65, the account would grow to over 4.8 million dollars. That’s not half bad!

So how much money would you really need in order to have a comfortable retirement? Assuming that you would want 80% of your pre-retirement income to live on as many suggest, and a withdrawal rate of 4% per year and a 30 year retirement, you would need to have about 2 million dollars.

If you invest 15% of your 100k income, that would allow you to withdraw $112,000 a year for 30 years. (which assumes the money would still continue growing at a rate of at least 8% while you are withdrawing) That is 12% more than your pre-retirement income! 4.8 million would allow for $192,000 per year!

Now if you were to invest 10% using the same assumptions you’d end up with substantially less money, 1.5 million over 30 years, and 2.4 million over 35 years. Still not bad, but maybe not as much as you might want to have that comfortable retirement. At the 30 year point you’d have enough to withdraw 60% of your income, and at 35 years you’d have 96% of your pre-retirement income.

All of these numbers are of course assuming that you don’t have money coming from social security. I have my doubts it will last until my own retirement. That is obviously up for debate, and hopefully the system will be fixed. But why depend on it if it might not be there?

The point of all this to me is that 15% is usually going to be more than adequate to get you to where you need to be. 10% may not be, depending upon how much of your previous income you want to live on, and how much time you have until retirement.

The longer you have until retirement, the bigger the gains you’ll see through compounding interest!

Play it safe and start saving 15%. You won’t be sorry!

Another caveat; if you’re older and have less time until retirement, or if you want to retire early, you may need to be investing a higher percentage than 15%. You started late or want to finish early, so you have some ground to make up!

Starting earlier? You might not need to invest all of the 10%. But why not do it anyway!

What Should I Invest In?

Once you’ve decided on how much you want to invest, the next step is to decide on what types of investments you should be holding. What to invest in will vary greatly on your situation, but here’s what we would do:

- Company 401k or other plan up to the match

- Roth IRA for you and your spouse (Where to open a Roth IRA)

- Back to the 401k or other plan

When choosing what types of funds to invest in I would highly recommend doing your research first, however, for us we prefer investing in low cost index and retirement target funds through companies like Vanguard where the costs remain low (Try a 3 fund portfolio!).

If you want an option that costs a tiny bit more than DIY, but is less work, Betterment or Wealthfront may be good options (after maxing tax preferred investing).

What do you think? Will 15% be enough for your retirement? Do you think you should save more or less?

| Account Minimum | Mutual Fund Commission | Stock Commission | Annual IRA Fee | Review | |

|---|---|---|---|---|---|

| Betterment | none | Included in 0.15-0.35% annual fee. | Included in 0.15-0.35% annual fee. | none | Betterment Review |

| Wealthfront | $500 | Included in fees. FREE up to $10,000. 0.25% annual fee for balances over $10,000. | Included in fees. FREE up to $10,000. 0.25% annual fee for balances over $10,000. | none | Wealthfront Review |

| TD Ameritrade | none | $0 | $9.99 | none | TD Ameritrade Review |

| Kapitall Generation | none | $7.95 | none | Kapitall Review | |

| Etrade | none | Up to $19.99 | $9.99 | none | |

| Motif Investing | none | $9.95 (per motif/bundle of stocks) | Motif Investing Review | ||

| Schwab | $1,000 | ? | $8.95 | none | |

| Fidelity | none | $0 | $7.95 | none | |

| Vanguard | none | $0 | $7.00 | $20 | |

| Ally Invest | none | $9.95 | $4.95 | none |

Thanks for this post! So many people are worried about investing right now, and forget that careful investing is part of solid financial planning. Indeed, by choosing companies with good fundamentals now, while they are on sale, it is possible to reap even greater benefits down the road. We have been putting a little extra in our retirement accounts for just that purpose.

Mirandas last blog post..Top 5 Tips for Your Retirement Account — For Those Just Starting Out

Is this 15% of your gross income? Or take-home?

We’re not quite to this step yet, but when we get there, we will crunch the numbers to make sure 15% is indeed enough.

Yes, 15% of your gross income. So if you make 100,000 it would be 15,000 dollars.

Great post! The only thing that I would follow up with from your comments is that remember that while your are doing your 15% into retirement you are also paying for kids college and paying off your home early. So when you retire you would actually need less to live on then when you were going through the baby steps. If you invest your retirement money properly and you need less to meet your basic needs in retirement (due to being debt free) then you will have all the more money to give, save and spend!

This will be the first year I do both the Roth and the 401k. Wish I’d started sooner.

one question I’ve always had on this step is if you consider your company match as part of the 15%. Is it 15% of YOUR gross, or 11% plus the 4% match? (or whatever the breakout is).

At any rate, this is where I am LOL

personally i wouldn’t include the company match. I don’t have one, however. If I did, I wouldn’t include it though.

I have to agree with Pete on this one. I wouldn’t include it, especially if you can afford the 15%. Part of my reasoning is this:

1. It’s very well possible that the company match could be reduced or disappear. I’ve had several clients that their employer has reduced the matching portion recently.

2. If you get used to the 15% and can swing it, then the extra 4% match will be icing on the cake. You’ll hopefully be able to realize your financial goals much sooner than you ever imagined. Stick with it and good luck!

Jeff Roses last blog post..2008 Tax Guide

thanks for the follow up, guys. My gut agrees with you – more is better *G*

So spending a bit more time on this step ….. OTOH, the house is already paid for! (We never moved out of our ‘starter’ home. LOL)

Assuming 10% return on investments is a very optimistic assumption, especially in these times. 4-5% is more realistic.

I think for the short term, 10% may not be realistic. If you’re retiring soon, you may want to be looking into your options.

However, I’m in it for the long haul and I don’t think over the next 30 years 10% is unreasonable. I’m not one of those who think that the economy and the markets aren’t going to recover (unless our government keeps up its spending and bailout craziness.

I think you should define short term and long term. By most financial gurus definitions, 1-3 years is short term. 7 years+ is long term.

Do you have any idea what the average annual return is of the stock market over the last 10years? Find out, and then think again about your long term expectations, especially if you are planning on managing your investments yourself.

for me short term is 5 years – long term 10+ years. I know this past 10 year period hasn’t been a good one, but I don’t think that precludes future growth. An interesting article on this topic of long term/short term investing in the Chicago Tribune. Quotes:

“The returns from any particular period are an unreliable anchor for long-term return expectations”

“In its best 10-year period, the S&P 500 chalked up average annual compounded gains of about 20 percent. Over 20 years, returns have ranged from average gains of 18 percent to 3.1 percent.

Yet, some investors mistakenly believe that “average” stock market returns are the returns they can expect consistently. When they don’t, many abandon stocks and miss out on strong gains that often follow down periods.

The average historical long-term return for the S&P 500 index is about 10 percent a year. But the index rarely comes close to returning 10 percent any particular year.”

My only problem is not putting the money away, but deciding in what to invest in with Roth IRA!!

I think maybe you are right about the 10% return being a long shot. Please let us in on your plan to save for retirement……We’re waiting.