There are times where you may want to setup an account for one of your minor children or a family member to help them start saving for the future, to teach them about how to manage money or to jump-start a college savings fund. Depending on what your goals are, there are different ways to go about doing this, but setting up a custodial account under the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA) can be done at most banks, brokerages and mutual fund companies.

Setting up one of these accounts shouldn’t be too difficult, but there are quite a few things to know about these account types before jumping in. So first, let’s start with the basics.

Quick Navigation

What Is A Custodial Account?

So what exactly is a custodial account? It’s an account setup at a brokerage, mutual fund company, bank or brokerage that is managed by an adult for a minor. The definition of a minor will vary from state to state, but usually it’s going to be someone who is under the age of 18 or 21. Once minor gets to the “age of majority” for their state, then the account legally becomes theirs, and they can do whatever they want with it.

Usually under the terms and conditions of a custodial account the approval of the account custodian is required if the minor wants to make some sort of transaction.

The custodian of an account is usually the parent or guardian of the minor, however, it can usually be any legal adult.

Setting Up A Custodial Account

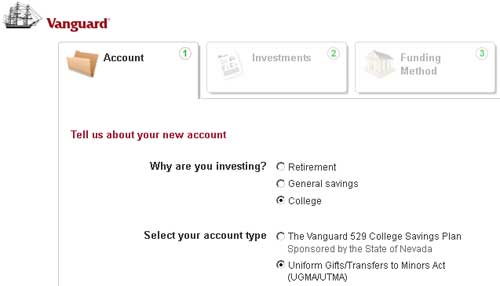

Most financial institutions will have an option to open a custodial account for whatever account type you’re starting. Whether it’s an account at a mutual fund company like Vanguard, a Brokerage like TD Ameritrade or a savings account at a company like Ally Bank or CIT Bank – all you have to do is choose the account type of a “custodial account” or “UGMA/UTMA” account when signing up. Just make sure to have your information handy as the account custodian, as well as the minor’s information as well, including Social Security number.

Benefits Of Custodial Accounts

There are several good reasons why you may want to consider contributing to one of these accounts for your child:

- Unlimited contributions: Unlike some other account types, like a 529 college savings plan, you can contribute as much as you want to a custodial account.

- No income restrictions: There are no income restrictions on giving money to a minor through one of these accounts.

- A way to avoid the estate tax: Giving money away to a minor while you’re still living can be a way to get around the estate tax. Just give up to the exclusion every year ($14,000) and you’ll be able to avoid the estate tax, as well as gift tax.

- Good way to give a modest financial gift: If you want to make a gift to a child and perhaps give them a taste of ownership in stocks, bonds or mutual funds – and see the benefits of compound interest and investing from an early age, it may be a good account type choice. If you’re purely looking for a tax benefit, the kiddie tax may negate that.

Cons of Custodial Accounts

There are quite a few cons to setting up a custodial account. Some things to be aware of:

- The money is no longer yours, it’s the minor child’s: Once you setup an custodial account, the money in that account becomes the child’s, and can legally only be used for purposes that benefit them. You can’t get the money back.

- The child gains complete control at age of majority: Even if the child isn’t mature enough or versed enough in financial topics when they become an adult, they still get complete control over the money. If that gives you pause, you may want to reconsider.

- The child may need to file taxes: Any income generated from the account belongs to the child and counts as taxable income. If that income exceeds $950, a separate federal income tax return usually has to be filed for the child.

- The kiddie tax: Under the kiddie tax rules a child who has investment income below $950 has no tax. Above $950 it’s taxed at the child’s tax rate for income or long term gains. Above $1,900 and the money can be taxed at the parent’s higher rate. That means instead of paying a lower tax rate on income (of 0-15%), they could end up paying at the parent’s higher rate of up to 35%. Seek the advice of a professional on these complicated tax matters.

- Gift tax consequences: If you give the child more than $14,000, or $28,000 for a couple in any given year, you may be liable for gift taxes of the money. Read the IRS notice on gift taxes.

- Financial aid consequences: A child having a custodial account can cause them to receive reductions in available financial aid.

So as you can see there are quite a few things you should consider before you setup one of these accounts for your child. From tax consequences to control of the money, there are plenty of things you’ll need to make sure you think about long and hard.

Alternatives To Custodial Accounts Under UGMA/UTMA

While a custodial account can be a good fit for some situations, for other situations it may not be as good of a fit. For example, if you’re mainly saving for the child’s college expenses, an ESA or 529 savings account may be a better fit because of the tax free growth of the money. The downside? The money has to be used for education expenses only. Other options include using a Roth IRA for college savings.

We currently haven’t opened a custodial account for our son as we think we’ll be more likely to save money in a 529 and a Roth IRA at some point because of the tax benefits. I think the best use of one of these accounts for many people may be as a teaching tool to give a child or young niece or nephew a lesson in investing, the power of compound interest and the importance of saving for the future. Others may want to use it as a way to gift money to avoid the estate tax, although there are ups and downs to that as well.

What are your thoughts about custodial accounts? Would you use one? Would you prefer to save for a minor in another account type like a 529, Coverdell ESA or Roth IRA?

I was only aware of a Roth IRA or 529 for saving money for children. This caught my attention as a great way to let children see how finances work when they still have an adult to explain what is happening. I agree about using this as a teaching tool. To see investing returning money in the account would be an exciting way to teach a child, yet I still think I would lean towards only using the money for education in order to not spoil the child. I would also want to keep the account very low for the same reason. I don’t have children yet, but this will certainly stick in my mind as a teaching tool. Thanks for bringing it to the light!

Very informative article! I especially appreciate how well you break down the pros and cons of opening a custodial account – and it includes a lot of things I’d never have thought of! This is a great resource for any parent or guardian thinking of doing setting up a custodial account.

I don’t have any because I am afraid of losing complete control at the kid’s 21st bday….I think the other alternative you are missing is a simple trust

This was the big thing back in the 80’s, so I did it for all 3 kids with their college money. There wasn’t the options you have today. It was a huge and painful mistake. I would only recommend it for very small amounts of money.

I thought you can’t have a ROTH IRA until your child is making their own money (at age 15 or 16). Is that incorrect?

We have a 529 for our kids (of course we wish it was bigger!), but I was looking for ideas for a “custodial account” because my 13 year old daughter would like to invest the money she saved from babysitting for neighbors (currently around $500). But thank you, some of this information was helpful.