After reading on some other blogs how the bloggers had successfully challenged their property tax assessments, saving them hundreds of dollars every year, I decided that it was time that I give it it a shot as well. Our assessed property value last year was almost $20,000 higher than we thought that it should be, and reducing that taxable value would likely save us a few hundred dollars on our property taxes. It was worth a shot – especially since we had just paid for an appraisal for our refinance, and having an appraisal can greatly increase your chances of winning your property tax appeal. If your home value is going to drop, you may as well drop your tax bill as well, right?

Quick Navigation

Our Property Tax Situation

We had never appealed our taxes before, but we knew the process that we would need to go through because I had read up on it before starting the process. In many cases it isn’t as hard as you think it might be. It might only be a 5 minute phone call. In others – it may be a bit more drawn out of a process with appraisals, paperwork filed with a county board or court proceedings. Hopefully you’ll have an easier situation like we did.

Our tax bill for the current year, which we’ve already paid, was $2627. Our home’s assessed value was $252,400. Since our home was recently assessed at a value of closer to $232,000 (we paid $273,000 for the house brand new in 2006. Ouch!), we knew we could save a good amount of money by appealing. Generally you won’t have much time to file an appeal, generally 60 days or less from the time your annual tax assessment was mailed.

Should You Appeal Your Property Taxes?

So what steps should you take to decide if you should appeal?

- Know how much your house is worth: Since the real estate bubble burst a couple of years back home values in many areas have dropped significantly. While property tax values are often assessed on a regular basis, sometimes they may not do an actual assessment every year. Even when they do they may not have the value quite right because there may be other homes in your area skewing the results. Having an appraisal to rely upon for your home value is very helpful as it gives you a concrete value for your home. It helped greatly in our situation and simplified the process. Of course an appraisal can also cost upwards of $300, so be careful before you pay for one just to reduce your property tax bill. We only did one because we had to for our refinance. If you don’t get a favorable one, think about challenging the appraisal.

- Verify that your home’s information is correct on county records: Sometimes the information that the county has on record for your home may not be correct. People will sometimes find that records show their home having more bedrooms that it actually does, or having an addition that was never added. If the county has incorrect information on record for your house, it greatly improves your chances of having a reassessment done. Unfortunately our house’s information was all correct.

- Research homes in your area: Oftentimes it can be hard to tell if your home is fairly appraised without first checking to see what the values of similar homes around you are. To find out this information counties usually have websites that provide property information including purchase taxes, price, number of rooms, square footage, home improvements, total land, etc.

- Save Our Home laws. Some states like Florida have “Save Our Home” laws that limit the amount of increase a homesteaded property owner will have to pay on their home. For example, in Florida the state limits the annual increase in the assessed value of homesteaded properties to 3% or the National Consumer Price Index (CPI), whichever is less. If your increase is more than that, you may have a case for appeal.

- Figure out how your county assesses taxes: Different counties assess taxes differently. Some look at recent sales of comparable homes. Some might estimate the cost to rebuild. Others use a combination of methods. Call your assessor’s office and ask how it pegs values.

Do You Have A Case For A Property Tax Challenge?

If you have done your research and found that there is a difference in your property tax assessment and the fair market value of your home, you now need to decide if you want to proceed with your tax challenge. If the difference is only a couple of thousand dollars, the county may be less likely to hear your appeal, and any savings you might see would be minimal. If the difference is larger, like it was in our case, it is almost always worth the effort of challenging your taxes.

You can usually find out what the difference in your tax bill will be by contacting your local county tax office. Our county website actually has a calculator on their page that shows you what your tax bill will be on a specific assessed value.

NOTE: Remember that sometimes your house may be assessed at a value that is less than market value. (unlikely, I know) Obviously in these cases you don’t want to challenge your assessment! Keep your research handy though as you may see an increase in your taxes in the near future.

Challenge Your Property Taxes

If you decide to move forward with an appeal on your property taxes you’ll need to contact your county tax assessor or auditor’s office for instructions. Some counties will do a reassessment based on a phone or e-mail request. In our case we were able to make an appeal over the phone, give them details about our recent appraisal and comparable homes data, and have our home reassessed. To find your county’s tax website and instructions just do a google search!

Sometimes you may have to do a more formal appeal that requires you to fill out an appeal form, appear before a board of appeal, and if that doesn’t work, file a judicial appeal. Obviously if you do a judicial appeal it may end up costing more than you would like because you may need a lawyer, so it’s better to get it sorted out before then if possible.

To make sure that you have a successful property tax challenge make sure you do the following:

- Do your research and bring together all relevant data: Determine the market value for your house (do an appraisal if it makes sense) and find out the tax assessment value from your county’s website. You should also gather information on comparable houses in your neighborhood and determine if your taxes are in line with like homes.

- Be organized and present your well informed case: Have all your information organized and ready for an appeal when you call. If necessary be ready to cite any errors in the county records, discrepancies between appraised and assessed values, and discrepancies in the assessed value of your house and your neighbors’ houses.

- Be respectful and courteous with county tax officials: When working with county auditors and tax assessors remember to be respectful and courteous. After all, these people can affect how your appeal turns out – and whether you end up paying higher or lower taxes in years to come. Leave a good impression and improve your chances of a favorable outcome!

The Result Of Our Property Tax Challenge

A few weeks back I followed the instructions I laid out above. We found out our home’s value when it was appraised for our home refinance. We then researched available county tax records to see what they said our home’s value was for tax purposes. We also made sure that our home’s information was correct on county records (all information on our home was correct). Finally we researched tax data for other comparable homes in our area through the county website. We found that for the most part they were assessed at a comparable tax rate.

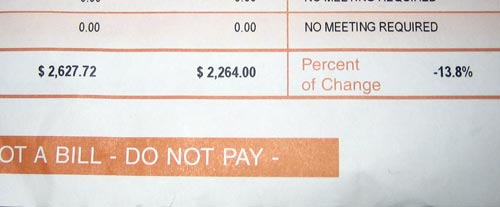

We saved $363.72 on our taxes, or 13.8%, just by doing about an hour of research and making a quick phone call. That’s not a bad hourly rate!

Based on our home appraisal that came in $20,000 lower than the value our home was assessed at by the county we decided to challenge our property taxes. In our county doing this was relatively easy. We called the local county auditor’s office, and stated our case for an appeal. I faxed over a copy of the recent home appraisal that had been done on our property, and then we waited to hear if we had been successful.

We never did hear back, but finally a few weeks later we got a new county tax statement in the mail. It showed that our home’s taxable value had been decreased from $252,400 to $234,200. That value is only $2,200 more than our appraisal came in at. Because they reduced our home’s value our property tax bill for 2010 dropped from $2,627.72 to $2,264. That’s a 13.8% drop in our taxes! That means that we saved $363.72 on our taxes just by doing about an hour of research, and then making a quick phone call.

Have you ever appealed your property taxes? What was the outcome of your appeal? Tell us your property tax appeal story in the comments!

My wife and I saved a lot of money on our property taxes by following a similar process. It’s well worth the effort!

Patrick´s last post ..Mastering the Art of Guilt Free Shopping

Wow… you had an easier time than anyone else I have ever heard of. Usually a municipal government will not be so quick to recede revenue, even if it makes perfect sense – as in your case and many other cases.

I only hope I have this much ease and success if I ever find myself in this situation.

Matt Jabs´s last post ..Cyber Monday – Save Money on Needs

It’s amazing how much money is lost by not simply challening things like this. Thanks for the post and the reminder to not just accept things for what they are.

That’s what I call “found” money! I think we all could stand to get an extra $300 some dollars in our pockets!

Jason @ RedeemingRiches´s last post ..Does Your Money Define You?

Jason–I agree with you completely about the opportunity lost in not challenging things.

The problem is that we’re busy with our lives and don’t always have time and we prefer to avoid conflict. As Matt wrote, challenging a tax bill doesn’t usually go this smoothly. Sometimes there’s a lot of time and emotion tied up in challenging something, and there can be an opportunity cost if the challenge takes you away from more productive activities.

I’m not justifying not challenging, just offering compelling reasons why we don’t do it as much as we should.

Kevin@OutOfYourRut´s last post ..Ten Common Sense Ways to Reduce Our Identity Footprint

Agree with you at this point.

Great if you could handle tax challenging by yourself, but for some the case it might be different. Anyway, tips are always interesting to find out. Congrats for Peter & family and off course their house :)

Ugh, I’m jealous of your property taxes! For a house around $120k in this area, I could expect an annual property tax bill of about $3500 – $4k. No joke. These outrageous taxes are keeping me renting for now.

Here, there are things you can do to lower your tax bill by going to the county assessor’s web site and checking out the abatement options.

Don’t forget that for this tax year, taxpayers should be able to deduct their property taxes, whether or not they itemize. Something to look into!

Kacie´s last post ..Trying out Groupon to potentially save money on local attractions

I know my taxes are over $4000 a year. My house is only assessed at 180,000. But NJ has high taxes. I may try to get them reduced, but I just converted our 1 bedroom into three so I might not want to rock th boat.

Becky Rivera´s last post ..Only two more day to enter my contest!

Unfortunately, where I live, this won’t work. There is an odd formula they use to work out the property tax. Essentially, they figure out what they need and then tax accordingly. The last property bill we got basically said that while our house hadn’t appreciated in value, they were taxing us as though it had. They use both a ‘multiplier’ and an ‘ Equalized Assessed Value’ in the formula. Bottom line, even though my house is worth approximately $60,000 less than we paid for it 4 years ago, my taxes went up. Gotta love Illinois.

Congratulations!!! Nice savings. It really shows that doing a little bit of research pays off in the long run. I’ll take that savings any day of the week :-).

We (Wife, me and Son) live in condo where the association has similar layouts in pretty much all condo units and fm speaking with neighbors, i found we’re all paying the same tax amounts – but i am wondering, since the real estate prices have tumbled in recent times, is it possible to lower your property taxes by challenging the assessed values of our unit even though neighbors may not have done that. I say that becuase county can just come back and say your neighbors have same size condos and they’re all paying the same taxes so you must pay the same amounts. can they argue with me on that front or do they simply go by what my particular unit gets assesed at (regardless of what neighbor is paying on his/her condo taxes)?

thx. please send copy of reply to my email as well so i know you’ve responded to this post. thx again.

And I thought I knew of just about every way to save money out there. This one is completely new to me.

I will definitely investigate and probably give it a try.

David/Yourfinances101´s last post ..Be a Hero This Holiday Season

We used the site zillow.com but there are a lot of these – it shows the homes recently sold, what they sold for, and the price with the taxes paid last year. For homes that haven’t turned over, it just shows their last appraised value. Our area switched to market value (this was common when the market was going up) – I don’t think there is plan to go to rebuild value – so this site was helpful to us. We appealed and got our taxes dropped nearly 4K one year, basically because I was able to show that square footage and tax burden bore NO relationship to one another all across our town and it was very arbitrary. Totally worth doing, even if they don’t reduce this year because who knows, if you appeal again next year they will realize you are on top of it and take more care.

Great job! I appealed last year and got a small check back. The surprising thing I found out was that they won’t take foreclosure and short sales into account. That is a bit ridiculous because most transactions were bank sales. I’ll try again this year.