When you talk about saving money for retirement, one of the first discussions that often comes up is – just how much should I be saving?

If you talk to some folks, like some of the popular money gurus or financial planners, you’ll often get the general answer of anywhere from 10-20% of your annual income. If you talk to people who are extreme savers, however, they’re likely to give you a much higher percentage – anywhere from 50-70% or even more!

So today I thought I’d talk about the idea of taking saving to the extreme. What are some reasons that people go down this road, what are the benefits, what are the pitfalls, and in the end, how can you save more?

Here’s a discussion of the topic of extreme saving from the Money Mastermind Show this week.

Quick Navigation

- Taking Savings To The Extreme: Just What Is Extreme?

- What Percentage Would I Need To Save At What Age?

- What Are Some Benefits To Extreme Saving?

- Downside To Extreme Saving

- What Sort Of Lifestyle Change Will You Need To Make?

- Extreme (And Not So Extreme) Ways To Save

- Do You Have To Be Extreme To Retire Early?

Taking Savings To The Extreme: Just What Is Extreme?

Our country’s savings rate has dropped dramatically over the past 70 years. According to the Bureau of Economic Analysis if you go back as far as 1944 the average American would save 26% of their income. Granted, it was during World War II and people were skimping and saving during hard times. Fast forward 70 years to 2014, however, and we have a personal savings rate that is hovering just below 5%. Not only that, but only 41% of Americans are actually saving regularly.

With so few Americans actually saving regularly, and when those who are saving are on average saving less than 5%, it doesn’t take much to be above average. But there are those who are far above average – saving up to half or more of their income every year.

So just what would be considered extreme saving? I’ve read in more than one place that you could be considered an extreme saver if you’re saving more than 20% of your income. Others say closer to 50-60%. Some of the truly successful extreme savers, however, are banking in excess of 70-80% of their income every year.

What Percentage Would I Need To Save At What Age?

When you talk about having enough to live on in retirement, when you are ready to retire can depend heavily on a couple of major factors. First, how much you’re making each year, and second, how much you can live on – what your lifestyle is.

If you’re consistently spending 100% or more of your income (as many Americans do), you will likely never be ready for retirement – unless you win the lottery or get a large inheritance.

If you were able to live on nothing every year, save 100% of your income and could maintain that indefinitely, you could essentially retire whenever you want.

Once you start saving the goal is to create a nest egg that essentially reproduces itself and doesn’t reduce in size every year after accounting for your expenses and inflation. So once you start saving and investing, your initial savings starts compounding and creating more income. Then the earnings on that income creates more income and so on.

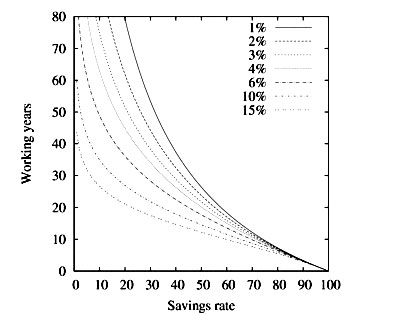

Once your earnings from your savings and investments reach a level where they pay for your living expenses, while leaving enough in gains to keep up with inflation, you’re ready to retire. The book Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence by Jacob Lund Fisker gives a graph that illustrates the idea of what percentage of income you’ll need to save in order to retire – based on number of years you want to continue working. Here it is:

On his site, Mr. Money Mustache breaks it into table form for us, and uses the assumptions that you’ll get a 5% investment return (after inflation), you’ll live off a 4% safe withdrawal rate after retirement and that you’ll want your nest egg to last indefinitely.

| Savings Rate (Percent) | Working Years Until Retirement |

|---|---|

| 5 | 66 |

| 10 | 51 |

| 15 | 43 |

| 20 | 37 |

| 25 | 32 |

| 30 | 28 |

| 35 | 25 |

| 40 | 22 |

| 45 | 19 |

| 50 | 17 |

| 55 | 14.5 |

| 60 | 12.5 |

| 65 | 10.5 |

| 70 | 8.5 |

| 75 | 7 |

| 80 | 5.5 |

| 85 | 4 |

| 90 | Under 3 |

| 95 | Under 2 |

| 100 | Zero |

So if you look at the table above, for someone who is 30 who wants to retire in 37 years at 67, you’d have to start saving about 20% of your income every year. Bumping it up 5% would mean dropping 5 years off that projected retirement date. If you start saving like an extreme saver, the likelihood of being able to retire at a much younger age becomes a reality!

What Are Some Benefits To Extreme Saving?

While most people immediately think of all the perceived downsides to being an extreme saver – like not being able to have any fun – they often don’t think of the benefits.

- You can retire much sooner: If you go extreme with your savings,, you’ll be able to retire much sooner than the average person. Go very extreme by saving 70-80% of your income, you might be able to retire in 7-10 years!

- Peace of mind: When you’re saving so much of your income you’ll see your cash reserves and retirement accounts growing so much faster – which will give ou a whole lot more peace of mind.

- Sense of freedom: When you no longer work, or at least when you find yourself in a place where you’re able to work less if you want to, it will give you a big sense of freedom – of being able to do the things you want.

- Simplified life with less stuff: When you’re buying less stuff, you’ll have less stuff to worry about, and a much more simplified life!

- You get to be more creative!: When you have set limits on how much you can spend you’ll be more creative about how you go out and have fun. Instead of an expensive dinner and movie out, why not a bike ride and a picnic at the park!

- It’s fun – make it a game: For some people the extreme saving can become almost a game – where they find ways to save more and spend less – and win the game by reaching their goals.

Downside To Extreme Saving

Most extreme savers will admit that saving so much of your income does have it’s downsides:

- You’re not able to do as many things, feel deprived: If you’re saving is to the extreme end of the spectrum, you likely won’t be able to do as many things with your money as far as taking vacations, buying nicer cars or a bigger house. The extreme savings will preclude that from happening and you could end up feeling deprived.

- You can’t be as spontaneous: If your budget is strict to allow higher savings,, it might mean that you can’t be as spontaneous with friends or a loved one, and you can’t go out for an expensive meal or drinks. You may have to try and encourage cheaper alternatives.

- Less of a comfortable lifestyle: If you read on some of the extreme savings sites they’ll talk about how they may keep their home’s temps outside of the normal “comfortable range”, or that they may eat less expensive food that may not taste as good – but is more affordable.

- If you have a family it can be hard to get them on board: If you’re attempting to be an extreme saver with a family in tow, it can be quite the struggle – especially when the kids want to be involved in extra curricular activities, sports camps, etc. Also, if a spouse isn’t completely on board with the extreme saving plan, it likely won’t go well.

- It can be hard to maintain: A lot of people go into extreme saving intent on doing it long term. The problem is, like a crash diet – it can be hard to maintain. You go in with the greatest of intentions, but you can’t do it for more than a few months or a couple of years.

What Sort Of Lifestyle Change Will You Need To Make?

If you want to become an extreme saver, you’ll definitely need to make some lifestyle changes, especially if you’re like the typical American that over-consumes and under-saves.

What does that mean? It means simplifying. Cutting out some things that just aren’t necessary, things that could be considered a luxury. Cut the cable TV, get rid of the landline phone and drop the daily visit to your local coffeehouse. Quit the gym and start lifting weights at home. It may also mean having a lower standard of living where you’re not eating out as much, not spending as much on entertainment, living in a smaller house and cutting back wherever money is spent. There are a million and one ways you can find to cut, and in reality, once you make the change after a short while you won’t even miss most of the things you’ve cut.

Jacob from EarlyRetirementExtreme.com talks about simplifying his life, but still living relatively comfortably. While he didn’t completely cut out everything, he minimized his possessions, and typically only bought quality items that would last when he really needed something.

everything I truly needed to live well fit into a couple of large suitcases and reduce my expenditures to what is considered somewhat below the poverty level while maintaining a comfortable lifestyle. In terms of quality I live somewhat above the ordinary consumer class standard of living since I own more luxury items but in terms of quantity my life style is quite a bit below.

Your lifestyle change may need to change more or less, depending on how extreme you want to get in your saving, and depending on how willing your family is to join you in your extreme saving. While you may not get your spending down to the poverty level like Jacob, you can certainly do better than you are now.

Extreme (And Not So Extreme) Ways To Save

So what are some ways that you can save?

- Extreme couponing: Some people will take couponing to a whole other level, finding ways to double up coupons, take advantage of sales, and only buy items when they’re on sale. In some cases they use multiple coupons to get items for free! The downside is that often this can be almost a full time job. The good news is that even a lazy couponer can still save a good amount of money.

- Extreme frugality: Do things other people aren’t willing to do – things like not using toilet paper, not flushing, showering and doing laundry at the same time, dumpster diving. Here’s a look at some folks who do that sort of thing. I tend to avoid most of these things.

- Cancel all services except ones necessary to live: Some people won’t pay for anything except for the services they need to live – like heat, water, electricity. Even those they will do their best to skimp on.

- Cut out the vices: If you’re a smoker, drinker or if you gamble on a regular basis, cutting out these vices can save you hundreds of dollars a year.

- Live without AC or with minimal heating: I was reading on one site how one extreme saver would allow his home to get extremely warm in hot weather without using the AC, and allow the house to get down to as low as 65 in the winter. He said he adapted quickly to the new temps.

- Downgrade to a tiny house or rent: Downgrade your living situation on one of your biggest expenses, and save big money.

- Downgrade your car, or go without one: Some folks will go completely without a car, riding only on mass transit or biking to work. Others will downgrade from a nicer car to an older and cheaper model that gets decent mileage.

- Buy everything used or freecycling: There are so many things that you can just buy used and save a ton of money. For example, we recently bought my son a new bike. Instead of spending $100-150 buying it new, we found a nice used one for only $40 at a local store. You can often find things free through your local freecycle site or facebook groups.

- Never eat out: If you trying to be extreme in your saving, you may need to cut the eating out, and eat mainly at home. Not as extreme? Cut back on the number of times you eat out and you can still save a decent amount.

Do You Have To Be Extreme To Retire Early?

Saving 60-70% of your income isn’t something that everyone can or want to do The question is, do you have to be an extreme saver in order to succeed? Or can you save less but still have a comfortable and enjoyable lifestyle? I can’t imagine I’ll be heading down the road of being an extreme saver, but I definitely would like to cut back on our expenses, and start saving more. I’d love for us to save at least 30% of our income, and be able to give away another 10-15%.

So what can we do to head down that road?

- Start a budget, find problem areas: Start tracking your monthly expenses, and find where you’re overspending. Setup a zero based budget that will help you to make sure your money gets to where it needs to be.

- Find areas that you can cut: Identify areas of the budget that are either extraneous, un-needed or just wasteful. Cut them.

- Save an emergency fund buffer: Make sure to save up an emergency fund to cover you in case of an unplanned negative event. Once you’ve got that saved, you’ll be able to work harder at saving and investing for other purposes.

- Put your savings and investments on auto-pilot: Put your savings goals on auto-pilot so that all of your savings goals and investments happen every month without your intervention. If you don’t have to think about it, it’s more likely to happen.

- Revisit and revise your plan on a regular basis: Make sure you stay on top of your family’s financial situation, and revisit your goals and financial plan on a regular weekly, monthly or quarterly basis.

For me I want to find a balance between saving more for our future, and still being able to give and live a decent lifestyle today. I don’t think I ever really plan on fully retiring, but I’m still planning on working hard until retirement age so that I can do more of the things I want to do – and not the things I need to.

What are your thoughts? Could you ever be an extreme saver – or are you already? Tell us what you consider to be the ups and downs of this lifestyle.

I ditched the car back in 2011 and haven’t looked back since. Not to say I may not get one in the future but the past 2.5 years has been pretty great.

I’m glad you got to that short little statement at the last paragraph about balance — it’s hard to find much biblical justification for doing anything to extremes (except giving) or for retirement as a concept or goal in life.

So, first, I have zero interest in retiring early. Zero. I love my career, and get enjoyment from it every day. Why I would give that up blows my mind.

I do love the idea, however, of creating a retirement package (investments and income streams) that would last indefinitely. I got the same perspective from Todd Tresidder’s book as well.

That being said, i don’t see the point of going all “extreme.” I don’t see why I would want to “live like nobody now, so I can live like nobody later.” What if I never get to “later?” Each year of my life is meant to be enjoyed (not just the retirement years), so there has to be a nice balance there somewhere.

We save over 50% each month, and don’t feel deprived at all. Of course, a lot of that has to do with the fact that we are always looking to increase our income.

Jacob Fisker and Mr. Money Mustache are impressive, but they both had very well paying jobs. How can someone earning the median US salary or less pull off a high savings rate? Especially if you must have a car for work?

The main problem with extreme saving is that you might not live to actually enjoy that retirement. I’m no advocate for splurging, since it’s really not a good idea, but you should try and save money and also find enjoyment in life. I’ve seen so many people die young, that I kinda changed my outtake :D

Great post Peter, its hard to believe we have shifted from a society of savers, to that of consumers. We must be falling prey to all the constant advertisements and ‘keep up with the Jones’ mentality’, but all that does is keep us poor and force us into servitude!

Hey Peter, can you share your thoughts on budgeting apps to help save? I’m seeing more and more the regular ones like Mint and YNAB, and then some new ones like Status Money etc Personal Capital seems to get good reviews too but rather than sign up and test them all I was wondering if you have a favorite that you use?

It depends on just what you’re trying to do with your budgeting app. Personally I use YNAB for an everyday budget to keep us on track, and then I use Personal Capital to give a 10,000 foot view of our finances, investments and everything else. We also use the spreadsheet software Tiller Money, if you prefer to budget with spreadsheets via Excel or Google Sheets.

Thanks so much Peter, that’s really helpful!

My family currently saves 55% of our income, but I hadn’t thought of us as “extreme” savers until reading this. I suppose some of our friends might call us that when we turn them down for yet another lunch out and invite them over to our place for a meal instead. I think the values of Christianity match many of the values of “extreme saving,” like freeing ourselves from the world and practicing self-control. And it protects against many of the downsides you listed, too, like discomfort and feelings of deprivation. As Christians, we know to expect discomfort and even suffering and not to put our hope in the pleasures of this life (e.g., a big house and nice car) but in the eternal life that has been given to us in Christ. Thanks for sharing this post!

This economy is a debt based economy. every one has a debt card (credit) it really a debt card. The money or dollar bill is a debt note, a promise to pay. it is extremely a debt based economy. This is what did with all my maxed out credit cards: told the debt card company satanic banks to validate the debt. Well they could not validate the debt card.. now my debt card is no more….

I think a major downside to this way of thinking and living is that it cultivates a long life as a parasite. It is an attitude of extreme parsimony, a grave sin, and one that goes beyond your attitudes toward money to all your relationships. As you don’t support the restaurants and other small businesses in your area (because, too expensive) and you seek to pay less and less for everything, you withdraw from any idea of the common good, thinking only about yourselves and your lifestyle and needs and desires. These savers generally give nothing to charity and don’t invest in anything of shared value. I have experienced this personally in a shared living situation with some extreme savers. The very idea that your money should make money, and there is not a value in being productive in society, is very problematic, or should be, to Christians.