Throughout the Bible, physical possessions and money are used to teach many spiritual lessons.

Christians are instructed to be wise stewards of their physical possessions without allowing them to become idols.

But sadly, many Christians and non-Christians alike have a strained relationship with money because of these very parables. But it’s not the teachings themselves that are problematic but rather the presentation!

Deserved or not, wealth tends to be presented as either being evil or, best-case scenario, less holy than being poor. Of course, it’s also convenient for us to downplay wealth when we aren’t stewarding our money as we should…

Whether it’s the mainstream media taking a single verse out of context and drawing political conclusions, a televangelist telling you that if you send their ministry money that God will repay you abundantly, a well-meaning person saying that money is the root of all evil, or your hardworking parents talking down “rich people”, we’ve all experienced these confusing, often conflicting but almost always negative conversations regarding money.

So when it comes to the topics of investing and building wealth everyone has many preconceived views of whether it’s good, bad, or straight-up evil!

As Christians, we should investigate this in light of God’s Word and seek to understand the principles that ought to guide us. Christians tend to grasp budgeting relatively easily. Budgeting is an obvious example of being a good steward of your money. But investing and building wealth doesn’t enjoy the same level of comfort or competence that budgeting does.

Quick Navigation

- Barrier #1 – We Simply Never Learned Good Money Management

- Barrier #2 – We Struggle With The Idea Of Being Wealthy

- Barrier #3 – Some Struggle With What To Invest In

- Two considerations before you jump in the Timothy or ESG funds:

- First, the companies behind the shares that you hold do not directly benefit financially from your investment, but you do benefit from how they perform.

- Second, both of these approaches have had subpar returns in comparison to basic index funds.

- How Then Should Christians Invest?

- Applications

Barrier #1 – We Simply Never Learned Good Money Management

As it’s been said about parenting, more is caught than taught. If your parents weren’t good with money then it’s likely that you may not be either.

On the other hand, some parents who are good with money tend to throw money at their kids without any of the lessons of how to manage money.

But the sad truth is that many people must become self-taught when it comes to being a good steward of our finances. That’s why I love blogging about it and reading great blogs like this one!

Fortunately, budgeting is a rather simple concept to grasp and do. Larry Burkett, Dave Ramsey, and many others have popularized and presented budgeting in a way that many people grasp.

Investing, however, hasn’t shared the same enthusiasm and acceptance.

Even Dave Ramsey pushes people to his ELPs (Endorsed Local Providers) rather than have them invest on their own.

Barrier #2 – We Struggle With The Idea Of Being Wealthy

Many Christians struggle with the thought of building wealth. For some reason, we take blessed are the poor in spirit and apply it to our finances.

Perhaps for you this is due to the prevalent viewpoints that I mentioned above.

Or perhaps it’s from reading that it’s harder for a rich man to enter heaven than for a camel to go through the eye of a needle and draw the conclusion that rich people can’t go to heaven (Matthew 19:24).

But we read right past Jesus’ response “With man this is impossible, but with God all things are possible” (Matthew 19:26).

We focus only on the fact that the young man was rich. But when the disciples inquired to Jesus about this, they didn’t ask how rich people can get to heaven. Not at all! In fact, they asked, “who then can be saved?“. The disciples realized how great the cost of salvation was, and that it’s not monetary, though Jesus’ answer recognized that for that rich young ruler it had to do with him simply wanting to check a few boxes and he wasn’t willing to make the sacrifice of leaving it all to follow Him.

The disciples understood that Jesus was talking about full surrender, not merely making a small penance or trying to “buy” your salvation with money. And full surrender is nearly impossible for EVERYONE, not just the rich, though I do believe it can be harder for those with great wealth if they’ve begun trusting their riches. We should be encouraged by and remind ourselves often of the poor widow who gave everything she had (Luke 21:1-4), though that’s never been commanded or taught.

Finally, I believe that the disciples also realized that perhaps it’s not the amount of money that someone has but rather the love of money that traps people (1 Timothy 6:10).

Poor people who love their money are at greater risk than rich people serving God with open hands.

Barrier #3 – Some Struggle With What To Invest In

Investing is complicated enough but it’s especially hard for Christians who want to invest in line with their conscience. Many Christians don’t want to invest in companies that they view as immoral or disagree with. This is why the Timothy Funds exist.

There has also been a recent surge in what’s known as ESG investing, or socially conscious investing. ESG funds aren’t constructed from a Christian perspective but rather an approach that aims to avoid companies deemed to have negative impacts on either environmental or social issues. The challenge of ESG investing is the lack of standardization as to what counts as ESG. There have also been some harsh, and I think rightly deserved, criticism of why some companies are investable while others are not despite well-known issues within the companies.

But many people simply invest in plain old index and mutual funds without regarding either of the considerations mentioned above. I am personally in this camp. Why? I’ll tell you in a couple of minutes.

Two considerations before you jump in the Timothy or ESG funds:

There are a couple of things you should consider before you start investing in the Timothy Funds or ESG Funds.

First, the companies behind the shares that you hold do not directly benefit financially from your investment, but you do benefit from how they perform.

Prior to going public and getting listed on a stock exchange, companies are funded by private equity investors. At a certain point, some companies decide to raise more money by going public. An IPO (initial public offering) is when a company sells shares to the public for the first time. The money raised in an IPO is used to fund the company and hopefully help it grow.

After a share of a stock is sold in the IPO it now belongs to the investor who bought it. When that investor sells the share to someone else, they keep the profit (or take the loss), not the company. Therefore, when we invest, we are buying and selling shares between one another without any direct financial benefit to the company.

I share this with you to say that if you avoid index funds out of fear of supporting “sin” stocks, like casinos, alcohol, etc., that it doesn’t quite accomplish what you might assume.

A casino doesn’t directly benefit from you buying their stock. But you will benefit if that casino generates a large profit and pays out a dividend that you receive. And if their share price goes up and you sell to another investor then you will have profited off the casino’s performance.

The big takeaway is that your investment does not directly support companies that you disagree with, but you do still own that tiny slice of that company. Indirectly, companies look good if there’s a demand for their stocks and they look bad if there’s not.

You must determine if you’re OK holding a tiny slice of ownership in that company that you disagree with and profiting from their profits.

For me, this issue is amoral. The company will make the profit (or take the loss) regardless of my holding the share or not. I believe that I can do good with the profit that I’ll make if that company is profitable than if I leave it to another investor. I liken this to the religious leaders taking the 30 silver coins that Judas received for betraying Jesus and buying the potter’s field to bury strangers (Matthew 27:6-7). Something good came through that “blood money”. But this is an area we must each wrestle through.

Second, both of these approaches have had subpar returns in comparison to basic index funds.

The greatest challenge to these investing approaches is that you must exclude some stocks from your portfolio. The most recent SPIVA Scorecard for the end of 2020 revealed that over the last 20 years, 94% of large-cap funds FAILED to beat the S&P 500 Index benchmark. That’s an astounding bit of perspective for us long-term investors.

It goes to show how difficult it can be to actively select some funds to overweight in a portfolio while excluding others. Over shorter time frames actively managed funds look better but maintaining that active edge is very difficult.

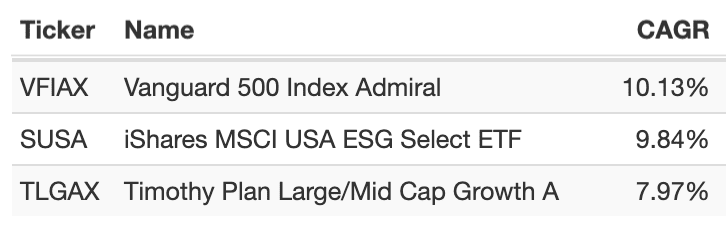

These are the annualized returns (the CAGR) for each of the three types of funds in comparison to a simple S&P 500 Index fund from January 2006 through March 2021:

As you can see, a simple S&P 500 Index fund beat the ESG fund and handily outperformed the Timothy Plan growth fund.

But the crazy thing is the costs of these funds!

- The S&P 500 Index fund costs 0.0% at Fidelity (FNILX) to 0.03% at Vanguard (VOO).

- The iShares ESG ETF costs 0.25% – that’s not too bad, but expensive for an ETF.

- The Timothy Plan fund costs a whopping 1.56% to 2.31% per year depending on which share class you hold! That’s an expense ratio that’s nearly gone the way of the dinosaur, or at least it needs to! But that’s what’s required for a fund like this.

The huge cost of the Timothy Plan fund explains the significant gap in total return from it and the S&P 500 Index fund.

How Then Should Christians Invest?

My answer to this question is that Christians should invest confidently in line with their conscience.

But where should our conscience lie?

Like many of you, I’ve wrestled with my conscience in many areas of my life not just investing. I’ve come to identify the most with the struggle of the early Christians in Corinth trying to reconcile what to do with meat that had been offered to idols (1 Corinthians 8:1-13 and 10:23-33).

I encourage you to read those passages in 1 Corinthians. Meditate on them. Pray on them seeking God to move your conscience. I encourage you not to merely do what I or anyone else is doing if it goes against your conscience. You will stand before God one day and give an account – don’t try pulling me into that! ;)

Where My Conscience Lies

Like many things in life, there are numerous perspectives that have shaped my conscience when it comes to personal finance and investing. From growing up with humble means and not even knowing what investing is to being older now and better off than I ever expected to be, there have been many phases of growth and some of regression. But it’s all part of the process. I don’t pretend to have it all figured out or that what I’ve shared here today is the Gospel truth. It’s merely where I am today in my journey based on where I’ve been and what I’ve been learning.

After working through this, I invest aggressively in a diversified portfolio of mostly index funds.

Investing in this manner doesn’t leave me with much leeway to become selective of what individual stocks I invest in or not. My philosophy is that the more your money grows the greater the contributions you can give to the world.

My intent is to be able to free up my time and life to serve God. We all have gifts with which to serve one another. Saving and investing aggressively will help me provide for my family and wisely plan for their future without becoming a burden to someone else.

I am pursuing entrepreneurship so that I can be a job creator and provide the answer to someone’s prayer for God’s financial provision. I also want to be able to give generously on-demand to help people out in dire circumstances.

All of these require that I be a good steward of my finances and work hard to build a level of wealth that will support those endeavors.

Striking A Balance Is Challenging

These convictions require me to balance being wise with what God has blessed me with while not becoming a hoarder of money lest I become the guy in the Parable of the Rich Fool in Luke 12:13-21 (another excellent passage to read and re-read and measure your motives against as you save and invest).

For where your treasure is, there your heart will be also.

Matthew 6:21

Applications

Wherever you currently stand regarding your finances and your financial future I encourage you to spend some time reading these passages and praying about (submitting to) God’s will in your life.

One of the greatest lessons I’ve been learning lately is how to pray purposefully, not to get God to bend His will to align with mine but rather that I would submit to His will in my life. It’s challenging. I can’t say that I’ve gotten it right yet. Hopefully, if you touch base with me in three years, I’ll have a better perspective of what it means to do that than I do today. I hope the same is true of you too!

Work through this with prayer and time in the Word. Ensure your heart is in the right place to build wealth. I believe that as in the Parable of the Talents, God will give us only what we can manage, nothing more. It’s a huge responsibility that sadly, I’m pretty sure many – if not most – Christians are NOT prepared for. Be the Christian who is prepared and faithfully stewarding what God has blessed you with; you never know when God might be having you save up for something big. Be the one who knows how to use their wealth for good and for the sharing of God’s love.

In the next post, I’ll share more on the approach to investing that I take.

By day, I’m a Physical Therapist who applies evidence-based medicine to my patients. But at night, I’m just some guy that loves to read research and has developed a bit of a niche in evidence-based investing, which has led me down the path of factor investing. I hope you’re as excited to read it as I am to share it!

Until next time, cheers! Dan

Dan is a physical therapist in the Army by day and aspiring personal finance and investing blogger by night. He is married and has a 2-year-old son that keeps him and his wife on their toes. They are currently stationed in Germany. If you’d like to read more about Dan’s take on investing you can check out his blog Keep Investing $imple, $tupid!.

Your article excuses Christians for owning stock in companies who are bad stewards by suggesting that their individual ownership does not matter to the company. However, you ignore the collective impact Christians can have on the demand for such stock — and the demand affects price and management.