This past month we’ve had some crazy volatility in the stock market.

At one point the market dropped 1000 points and retirement account balances dropped with it.

I myself saw my Roth IRA and 401(k) balances dip.

If you weren’t committed to a long term strategy it would be easy to panic and sell, sell, SELL!

Here’s a discussion I had with the rest of the Money Mastermind Show panel on this topic recently.

Quick Navigation

What Do You Do When The Market Dips?

People’s reaction to a downturn in the market are extremely varied.

I asked my twitter followers a few years ago, near the bottom of the 2007-2008 downturn, what they thought of the current market.

Should people get out of the market as fast as they can? Should they keep their regular investments and keep plugging away? Or should they scrape together as many extra dollars as they can and buy while the market is on sale?

Some of the responses:

- Keep plugging, unless you think this is the end for the US and we won’t ever recover.

- Buy at a bargain!

- I am staying put. I haven’t bought anything new, but definitely not selling now. No selling unless you need funds in the immediate future

- Stay! Buy low, sell high, not the opposite! Unless you need the money right now for an emergency, leave it be.

- Buy more, assuming you’ve got time on your side.

- Run, my vote is to get out now.

- Buy now! If my grandparents had been able to buy right after the 1929 crash, they’d have been rich.

- I’m close to retirement, this could ruin me if I don’t get out now while I’ve still got something in my account.

How people react to a drop in the market has a lot to do with their own personal situation. It depends on factors from how long they have until they retire, their level of risk tolerance all the way to what they’re currently invested in.

For those who are young and have a long time to invest before they retire, they’ll have plenty of time to see their losses turn into gains over the long run. A downturn might be the perfect time to buy for them.

For older investors, if they haven’t already looked at their asset allocations and started minimizing the risk in their portfolio, it may be time to do it.

Some Things To Think About When The Market Crashes

There are some important considerations that you should make when the market crashes, before you make any rushed decisions.

Among the things you should think about:

- If you sell your holdings when the market crashes, are you locking in losses (instead of allowing your investments to rebound)?

- Should you make important decisions about your investments when you’re feeling rushed and in a state of fear?

- Should you just let things ride assuming that the market will rebound over time?

- Would now be a good time to buy new investments since prices are low, instead of selling? Maybe now is the time to go bargain hunting?

Over The Long Term The Market Tends To Go Up

If you’re a younger investor, I think one of the most important things you need to consider is the fact that over the long term, markets tend to go up.

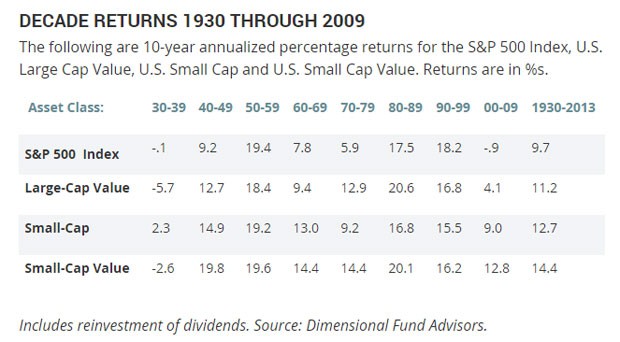

If you look at the last 8 decades for the S&P 500, it has only had one negative decade since the 1930s. Unfortunately, it was the most recent one, from 2000-2009.

Some more things to think about from MarketWatch:

It is obvious that, when measured in 10-year increments, the market was up most of the time. The table (above) shows 32 10-year returns; 28 of them were positive, and only four were negative (and three of those four occurred way back in the 1930s).

The market can have many successful decades in a row. Most investors remember that the 1990s produced very high returns for equities, but this table shows even better returns in the 1980s.

Asset classes that are doing well tend to change, so it’s hard to choose just one. Diversifying yourself across markets and asset classes is a solid bet.It’s impossible to know which asset class will do best next week, next month, next year or even next decade. But there’s magic in combining all four of these in one portfolio. Over 84 years from 1930 through 2013, this Group of Four boosted the annual return from 9.7% to 12%. If you think that’s not a big deal, here’s the math: A $1,000 investment in 1930 (equivalent to $14,084 in today’s dollars) grew to $2.4 million at 9.7% — or to $13.6 million at 12%.

If you have a long time to invest, take heart in the fact that over time it’s very likely that your returns will rebound. Diversify your holdings, buy more in a downturn and buckle up – because it’s along ride – and at times it can feel like a roller coaster.

Stick To Something That Is Proven. Index Funds

As mentioned above, diversifying your holdings across asset classes, and across the entire market is a great way to ensure you against losses in any one stock. That’s why I invest in index funds.

Jack Bogle, the pioneering champion of index fund investing, has 8 basic rules for investing. I’m a big fan of his, and I think his advice should be heeded by everyone – in a downturn – and during other times.

- Select low-cost index funds

- Consider carefully the added costs of advice

- Do not overrate past fund performance

- Use past performance to determine consistency and risk

- Beware of stars (as in, star mutual fund managers)

- Beware of asset size

- Don’t own too many funds

- Buy your fund portfolio – and hold it

For those in a downturn I think they’d do well to heed the last rule listed above – to “Buy your fund portfolio – and hold it”. The idea behind this is that markets can go up or down based on rumors and fear. You’re best served by not paying attention to all that and just buying the entire market and holding.

Have A Battle Plan

When you’re investing in the market it’s a good idea to not just invest without thought, but to have a battle plan for your investments as time goes on.

What will you do as you get older – will your asset allocation change?

What happens if the market drops? Will you buy more? Or just hold?

Plan it out ahead of time, so when the market drops you’ll know just what to do.

Figure Your Asset Allocation – Stocks VS. Bonds

One of the most basic things you should be doing is figuring out your asset allocation. Two of the most popular ways to figure this out are listed below:

- Age in bonds: One rule of thumb used by a lot of folks is to hold their age in bonds, in other words if you are 30 years old you should hold 30% in bonds. So you figure out your percentage of stocks by starting at 100% and subtracting age. (100 – age)

- Twice your maximum tolerable loss: Another method suggested is to figure out what the biggest percentage loss you could bear to see in your portfolio without causing too much worry and abandoning of your plan, and then set your stock allocation at twice your maximum tolerable loss. So if your max loss would be 25%, then you shouldn’t be investing more than 50% in stocks. Not sure what your risk tolerance is? Here’s an article on how to figure out your acceptable level of risk.

What To Invest In?

Once you figure out your asset allocation it’s time to figure out what to invest in.

I’m a big proponent of a three-fund portfolio, something proposed by Jack Bogle. Three-fund portfolios create a simple portfolio that gives you complete coverage in the fundamental asset classes – stocks and bonds. Within the stocks and bonds held in a three-fund portfolio, you would also make sure you have invested in both domestic and international stocks.

On the Bogleheads forum, a group devoted to the ideas of Jack Bogle, they suggest the following funds from index fund giant Vanguard as the best funds for a three-fund portfolio.

- Vanguard Total Stock Market Index Fund (VTSMX)

- Vanguard Total International Stock Index Fund (VGTSX)

- Vanguard Total Bond Market Fund (VBMFX)

With these 3 funds you’ll get complete market coverage in both domestic and international stocks, as well as bonds.

If you prefer to keep it even easier you could use a service that uses indexing like:

Keep Calm And Don’t Panic

When it comes to a downturn in the market, your best bet is to plan ahead and know what you’ll do if the situation is to occur.

Setup a simple yet diversified portfolio that takes into account your age and investing timeline, your level of risk tolerance, and that gives you broad exposure to the asset classes.

Plan ahead for what you’ll do when a downturn occurs (they will happen) and if you’re a bargain buyer – maybe even set aside some cash to buy more assets when the stocks are cheap!

Make a plan, and when the downturn comes, keep calm and don’t panic. Just keep on keepin’ on!

What have you done when the market turns south? Have you stayed the course? Panicked and sold? Have you made plans for a downturn?

Great article Peter!

Every time the market dips I get excited! I love buying investments when they are on sale. If you have an investment plan and many years before you need the cash just keep to your plan. Stay on course and in the end it will work out great for ya. thats what I do in good time and bad.

Take care.

I just started investing in stock market and sometimes it makes me feel happy when the market dips since I can buy more stocks on sale.