Real estate is a popular investment for several reasons, including the ability to generate online cash flow through rental income and the possibility for appreciation to increase the value of the investment over the long run.

When you think about investing in real estate, you probably think about owning rental properties and becoming a landlord.

Unfortunately, managing rental properties can require a lot of work and headaches, so many people choose not to go down this path.

Thankfully there are other ways to invest in real estate and get the perks without requiring you to become a landlord.

These hands-off real estate investments can be perfect for adding some diversification to your portfolio, or for serving as an introduction to the world of real estate investing.

If you’re interested in real estate as an investment but you don’t have the time or desire to manage properties and deal with tenants, here are 4 options that you can consider.

Quick Navigation

1. REITs

Through a real estate investment trust (REIT), investors can buy shares in real estate portfolios. REITs may own office buildings, retail properties, apartment complexes, hotels, and any other type of property. Most REITs specialize in a particular type of property, so there is a great deal of variety that is available to investors.

The REIT collects rent from tenants and then distributes the income to shareholders in the form of dividends.

REITs can be:

- Publicly traded – listed on a national securities exchange where shares can be bought or sold, and regulated by the SEC.

- Public but non-traded – not traded on a national securities exchange, but registered with the SEC.

- Private – not traded on a national securities exchange and not registered with the SEC.

There are some significant differences between these types of REITs. One of the most important issues to consider is liquidity. Publicly traded REITs can be bought or sold easily, so liquidity is not an issue. However, non-traded REITs lack liquidity and you may need to hold the investment for at least few years. The specifics will vary from one REIT to another, but liquidity is something that should be considered when you are researching your options.

Although non-traded REITs may lack liquidity, they can make up for the lack of flexibility with higher returns. Of course, the performance will vary from one REIT to another, but the main reason to consider a non-traded REIT over a publicly traded REIT would be for the possibility of higher returns.

If you decide that a REIT may be the right type of investment for you, you’ll have plenty of options. See this list of the best REITs for 2019.

2. Real Estate Crowdfunding

Real estate crowdfunding was made possible by the passing of the JOBS Act in 2012. Like investing in a REIT, investing through a crowdfunding platform allows you to get many of the perks of real estate investing without the responsibilities of owning or managing property.

There are many different types and varieties of crowdfunding platforms, but they all allow investors to have an ownership interest with much smaller investments as compared to buying properties on your own.

Many crowdfunding platforms are open only to accredited investors, but there are several that are open to all investors.

To qualify as an accredited investor, you will need an annual income of at least $200,000 ($300,000 for joint filers) or a net worth of at least $1 million, excluding your primary residence.

It’s important to know if you qualify as an accredited investor because it will determine which crowdfunding platforms are available to you. But don’t worry if you’re not an accredited investor, there are still several good options, and we’ll look at them in just a minute.

Like REITs, crowdfunding platforms also tend to specialize, and there are platforms for all different types of real estate.

Some crowdfunding platforms allow you to invest in individual properties, where you can choose the specific investments, and others involve investing in a portfolio of properties.

Here are some of the leading real estate crowdfunding platforms.

Fundrise

Fundrise is one of the most popular crowdfunding platforms and it is open to all investors, regardless of whether you are accredited or non-accredited.

There is a minimum investment of $500, and it’s very quick and easy to get started. With the $500 investment, you can invest in their Starter Portfolio, which includes investment in apartment complexes, single-family rental homes, and commercial properties. Some of their projects are renovations and others are new construction.

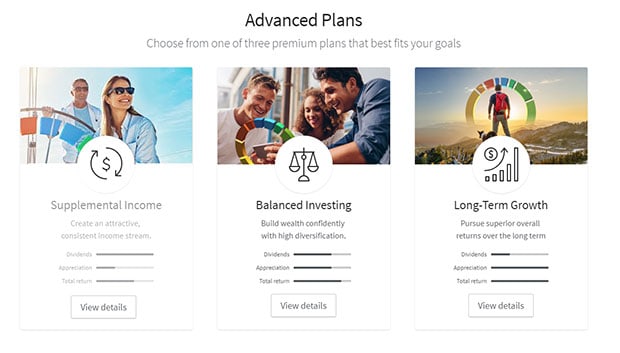

Aside from the Starter Portfolio, Fundrise also offers 3 different Core Plans: Supplemental Income, Balanced Investing, and Long-Term Growth.

Fundrise lists historical annual returns of 8.7% – 12.4%.

Learn more in our Fundrise review.

Groundfloor

Groundfloor is a very unique platform. It is one of the only options for non-accredited investors to invest in individual projects, as opposed to the portfolio approach used by others, like Fundrise.

Groundfloor allows house flippers to get loans in a peer-to-peer lending style. As an investor, you can choose the exact projects that you want to invest in.

The investments through Groundfloor are short-term, typically 6-18 months, and they claim to produce 10% returns on average.

The minimum investment is just $100, which makes it accessible to anyone. All you need to do is pick the projects that you want to invest in, and get started.

You can view the details of each project, like the grade, interest rate, projected term, and loan to value.

To learn more, see our Groundfloor review.

DiversyFund

DiversyFund provides investors with the opportunity to diversify their holdings into a sector that has traditionally done very well, commercial real estate.

The minimum investment is only $500, and the fact that non-accredited investors can invest with them is a definite bonus.

DiversyFund is different from most other real estate crowdfunding platforms in that their REIT actually owns the multi-family apartment properties held in the trust. They buy, manage – and when necessary – sell properties in the trust.

You can expect a 7% preferred return before DiversyFund receives any profit split. Then investors earn 65% of the cash flow profits above the 7%. Once investors have made 12% per year, any remaining profits are split 50/50 between investors and DiversyFund.

To learn more, read our full DiversyFund review here.

RealtyMogul

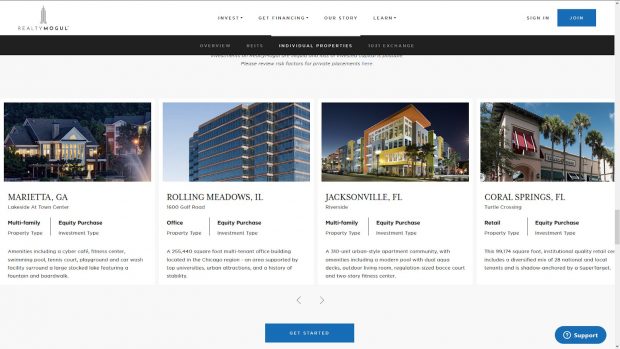

RealtyMogul offers a few different types of investments, including individual properties and public non-traded REITs.

You’ll need to be an accredited investor in order to invest in the individual properties. These investments typically range from 3-7 years and require minimum investments from $15,000 – $50,000.

However, the REITs are open to all investors, but they do require a minimum investment of $5,000.

To learn more, see our RealtyMogul review.

Rich Uncles

Rich Uncles may be a great option for getting started with real estate because it is open to all investors, and because they have an incredibly-low minimum investment of just $5.

Like Fundrise, Rich Uncles takes a portfolio approach. You can invest in Rich Uncles through one of their REITs. They currently have two different REITs available, the BRIX REIT (student and multi-family housing, restaurants, convenience stores, and fitness centers) and the NNN REIT (single-tenant office, industrial and retail properties).

The BRIX REIT has an estimated annualized dividend of 6% and the NNN REIT has an estimated annualized dividend of 7%.

PeerStreet

Unlike the other platforms we’ve covered so far, PeerStreet is available only to accredited investors.

PeerStreet allows you to invest in private real estate loans with historical returns at 6-9%, with 6-36 month terms.

You’ll be able to pick the specific loans that you want to invest in, and you can invest a minimum of $1,000 per note.

To learn more, see our PeerStreet Review.

EquityMultiple

Like PeerStreet, EquityMultiple is an option only for accredited investors. Through EquityMultiple, you will be able to invest in commercial properties, and you’ll choose the specific projects that you want to invest in.

The investments will be in commercial real estate, with a minimum investment of $5,000. You can invest in syndicated debt, preferred equity, or equity.

Read our full review of EquityMultiple.

FarmTogether

FarmTogether is also only for accredited investors. It’s a bit different from the others in that it allows you to invest specifically in farmland properties.

Based in San Francisco, California, the company is relatively new but already has over $1 billion invested in farmland through their platform.

Farmland is a true alternative investment, one that is an actual physical commodity and that is an uncorrelated asset. It often maintains it’s value while stocks, bonds and real estate show sharp drops. Since 1972 it has outperformed every other major asset class!

FarmTogether aims to have annual returns of between 8%-15%, including yearly cash payouts of between 3%-9%.

The investments in farmland have a minimum investment of anywhere from $10,000-$25,000.

Read our full FarmTogether review here.

For a more in-depth look at the subject of real estate crowdfunding, please read Kevin’s Ultimate Guide to Real Estate Crowdfunding.

| Crowdfunding Site | Fees | Account Minimum | Accredited Investor | Review |

|---|---|---|---|---|

| * Groundfloor | 0.25% | $100 | No | Review |

| * Fundrise | 1%/year | $10 | No | Review |

| * DiversyFund | None | $500 | No | Review |

| * RealtyMogul | 0.30% - 0.50%/year | $5,000 | No | Review |

| * stREITwise | 3% up front fee, 2% annual management fee. | $1,000 | No | Review |

| * FarmTogether | Intake fee of between 0.5% and 1.0%. 1% annual management fee. | $10,000 | Yes | Review |

| CrowdStreet | None | $10,000 | Yes | Review |

| Yieldstreet | 1-4%/year | $2500 | No | |

| Equity Multiple | 0.5% service charge + 10% of all profits | $5,000 | Yes | Review |

| PeerStreet | 0.25% - 1.0% setup fee | $1,000 | Yes | Review |

| Sharestates | 0-2% setup fee | $1,000 | Yes | |

| Patch of Land | 0-3% of loan total | $1,000 | Yes | |

| Cadre | Intake fee of between 1-3%. 1.5-2% annual management fee. | $25,000 | Yes | Review |

3. Mutual Funds And ETFs

While REITs invest in real estate, there are mutual funds and ETFs that invest in REITs, which essentially allows you to spread your investment across several different REITs.

Likewise, there are also ETFs that invest in REITs.

Because mutual funds and ETFs are quick and easy to buy and sell, this presents a very easy option for getting started quickly. If you already have account somewhere like Vanguard or Fidelity, you can easily find a number of options.

This article covers a number of the best real estate mutual funds, and this article covers the best real estate ETFs.

4. Invest In The Industry

The last option that we’ll look at is to invest in the industry. This may be considered an indirect way to invest in real estate, but it could be a good option, depending on your situation.

You can buy stock of business in construction and other real estate types of industries. It’s a different approach than investing in rental properties or commercial properties, but your investment will be influenced by the real estate market as a whole.

There Are Lots Of Real Estate Investing Opportunities

Real estate presents plenty of different investment opportunities.

If you’ve never really considered investing in real estate because you don’t want to own rental properties or be a landlord, you may want to look at these options discussed in this article.

The options listed can provide an excellent introduction to real estate without putting any extra burden or commitments on yourself.

Real estate can be such a great investment from a: cash flow, appreciation, and tax benefit perspective. However not everyone is able to have a rental property! I’ve invested with some REITs before, but now that LendingClub (peer to peer lending) is shutting down, I may look to move some of that money into a crowdfunding site that you mentioned!