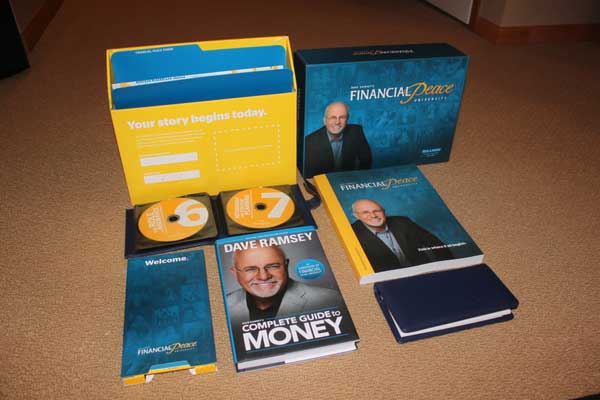

A few days ago I did an unboxing post with photos and video of the newly released 2012 Financial Peace University Membership Kit.

The kit was jut released within the last few weeks, and goes along with the newly revised Financial Peace University (FPU) program.

FPU has been around in one form or another since 1994 when Ramsey, and his lead financial counselor Russ Carroll, started teaching the classes in person on overhead projectors.

The class started small but has evolved into a complete set of video lessons, activity workbook, class discussions and practical applications. Here’s how Ramsey’s website describes the class:

We all need a plan for our money. Financial Peace University (FPU) is that plan! It teaches God’s ways of handling money. Through video teaching, class discussions and interactive small group activities, FPU presents biblical, practical steps to get from where you are to where you’ve dreamed you could be. This plan will show you how to get rid of debt, manage your money, spend and save wisely, and much more!

The New Financial Peace University

The new FPU program is a carefully thought out revision of the previous program. The previous iteration has been released for quite a few years now, and based on their experience I believe the folks at Lampo Group realized that parts of the program could be condensed, and other parts removed or relegated to the online resources portion of the program. Still other parts are completely new.

Here’s what’s included in the new program’s membership kit now:

- Book: The “Dave Ramsey’s Complete Guide To Money” book replaces the previous handbook for FPU, “Financial Peace Revisited“. I haven’t read it yet, but in browsing through the book it appears to be mainly a revision of the previous handbook within the framework of the new class.

- Member workbook: The workbook looks similar to what was in the class previously. The workbook includes weekly lessons to be filled out, budget forms, cash flow planning sheets and more. Obviously with the class being shorter it will be slimmed down a bit as well.

- Audio CDs & case: There are 9 new video lessons (not included in the member kit) that you watch in class, and each member kit includes the audio of each lesson on CD. There is also a 10th CD that has Dave’s testimonial and his personal financial story.

- Envelope system: The class teaches what is called the cash envelope system, a great way to cut back on household spending. Included in the packet is a nice faux leather cash envelope wallet.

- Budget forms folder: They include a folder with your packet where you can stash your budget and cash flow plans once you’ve filled them out.

- Progress poster: The packet includes a poster (old one didn’t have this) that will help you track your progress through the class, how much debt you’ve eliminated as well as a look at Dave Ramsey’s 7 Baby Steps and where you are in the process.

Revised Financial Peace University Lessons

One of the biggest changes in the new FPU class is the fact that it is going from 13 weeks down to 9, essentially cutting a full month off of the class. In some respects I think that may be a good thing as it will mean the commitment to the class will be less intimidating at just over 2 months, instead of just over 3.

- Lesson 1 – Super Saving: Dave goes over the Seven Baby Steps and talks about the importance of saving.

- Lesson 2 – Relating With Money: Learning about the importance of communication and money, especially between spouses. Also explores topics of money and relationships for singles, and parents.

- Lesson 3 – Cash Flow Planning: Developing a budget and cash flow plan.

- Lesson 4 – Dumping Debt: Figuring out how to dump your debt, and debunking credit myths.

- Lesson 5 – Buyer Beware; The Power of Marketing on Your Buying Decisions: Understanding how marketing works so that you can overcome and avoid spending money you don’t need to!

- Lesson 6 – The Role of Insurance: What kinds of insurance to buy, and what kinds to avoid.

- Lesson 7 – Retirement and College Planning: Retirement planning and saving for your kids’ college.

- Lesson 8 – Real Estate and Mortgages: The ins and outs of mortgages, and buying and selling your home.

- Lesson 9 – The Great Misunderstanding; Unleashing the Power of Generous Giving: The power of giving and why it’s so important for our lives. A complete wrap up of the class and talking about why we’re getting out of debt, to give more to others.

As far as I can tell the lessons that were left out of the classroom instruction in the new version include:

- Credit Sharks in Suits: The lesson in the previous FPU talked in depth about the credit bureaus, your credit report, and dealing with debt collectors – and what they can and can’t do. I’m assuming a lot of the information has been incorporated into other lessons.

- That’s Not Good Enough: The lesson went into the art of negotiating and getting the best deal for everything that you buy. Not sure if it was completely removed or if they just felt it wasn’t as necessary in a class more focused on getting rid of debt.

- Of Mice and Mutual Funds & From Fruition to Tuition: I believe these two lessons have been merged into one lesson in lesson 7 above.

- Working in Your Strengths: This lesson was focused on finding a career that you love, finding a job and finding extra part time work to do while you’re getting out of debt. I got the least out of this lesson when I took the class I think, and I can see why it was removed, it felt like too much of a tangent from the class.

In checking the book included in the kit, the lessons that are no longer taught in the classroom, are in fact still showing in the book, so you can still get all that material if you’re interested.

Beyond the lessons that are no longer in the class or merged into other lessons, the class looks like it remains essentially the same. Having been through the previous FPU class, I think that’s mostly a good thing.

Is Financial Peace University Worth The Cost?

The Financial Peace University class and kit currently has a price of $129.99, which for a 9 week class comes out to about $14.44 per week, or about $7.22/hr based on approximately 2 hour classes. So is the class worth the cost?

Personally I think it is more than worth it to buy the membership kit and attend the FPU class. Thirteen dollars per week is a small price to pay for what you’re getting. You get the book, the workbook, audio CDs, the envelope system and all 9 weeks of class instruction for the cost of what some people pay for one month of cell phone service.

UPDATE: The Ramsey Solutions team has reached out and told us that due to the COVID-19 crisis, for the first time ever, they are now offering a free 14-day trial of Financial Peace University online. Check out the details here: FPU Online free trial.

The class will help you to get back on a solid financial footing, get rid of debt, and pave the way for a better financial future where you’ll have more money to to be able to do what you want and give what you’re led to, down the road.

Have you been through Dave Ramsey’s Financial Peace University, either the new or the old version? Tell us your thoughts on the class in the comments!

The boyfriend and I are very close to making things official and this course is on our ToDo list as we move forward with our lives.

Ooo, exciting! I hope I win it. For some reason I’m really intrigued on learning what marketing tactics are used on shoppers and how to avoid falling for them.

I’m very curious. I’ve never actually read any of Dave Ramsey’s stuff, but I hear a lot about FPU. So it would be a very interesting thing to have.

We’ve been wanting to do FPU but have had a hard time spending money to learn how to save money. This would be great!

I would love to be able to give it to a friend or family member who would commit to attend that is struggling with their finances.

As a newly wed, I would love to win this kit in order to go through the class. I graduated with over $60k in student loans, not thinking they were going to ruin anything. After considering where our lives are going within the next 5 years, we decided that the best for our future family is for me to be a stay-at-home mom while the kids are little. However, we can’t make this happen realistically until we get out of debt. My loans are preventing us from having babies in the timeline we would’ve preferred, so this class would get us closer to our life goals and finally being able to have children.

Our church has just started their first FPU course. I’ve been a reader and listener of Dave Ramsey’s for years, and would love to go to the class. Hubby isn’t as interested, so I don’t think we’ll spend the money on it unless we can get it for free. Oh, I hope I win!!!

Thanks for the review Peter. I’m curious if the videos have been updated or if it was the same as the original. I agree with the changes and think that getting an organization to host and for people to attend will become easier with the nine week course. Also, if you attend, typically you can go through the church or organization that is hosting and get the course for $98.95.

Good to know that you can get it through your church or organization for $98.95, I didn’t know that.

Yes, I believe the videos have all been re-shot, and in some of them they have other people besides Ramsey teaching, like in the Real Estate portion I believe. I haven’t had a chance to view more than a snippet of some of the new videos, however.