There’s an investment you’re probably not familiar with – but you need to be.

Farmland has been one of the top performing asset classes of the past half-century. What’s more, it’s provided stable returns in all types of market conditions and economic environments.

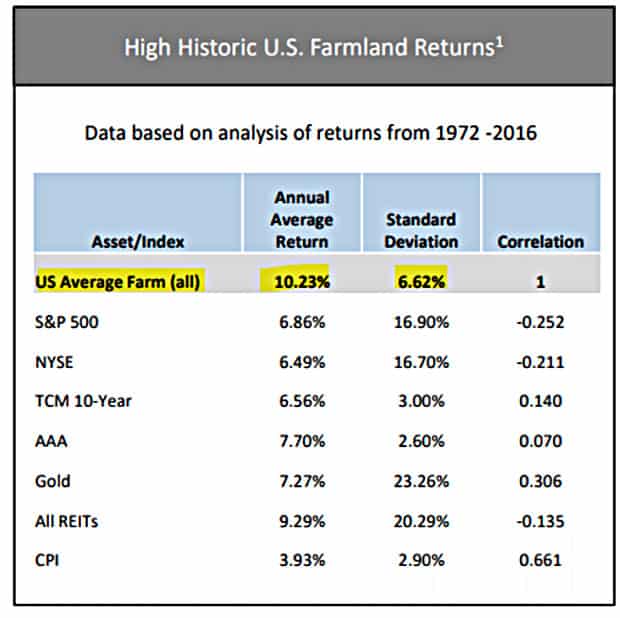

That makes it a true uncorrelated investment, and a perfect alternative asset class to add to a well-balanced portfolio of stocks and bonds.

Fortunately, investing in farmland is easier than you ever imagined.

FarmTogether is a real estate crowdfunding platform that enables you to invest in farmland for as little as $10,000. Your investment will provide both ongoing annual income, as well as long-term capital appreciation. And best of all, you don’t need to know anything about farming to participate. That’s because you’ll be investing in farmland, and not the farm that’s operating on it. The entire investment will be professionally managed for you – your only requirement will be to invest money.

And in times like these, when the financial markets are misbehaving, adding a true alternative investment to your portfolio mix can go a long way toward stabilizing your returns.

What is FarmTogether?

Based in San Francisco, California, FarmTogether is an online real estate crowdfunding platform that allows you to invest specifically in farmland properties. The company has been in operation for 2+ years now, but the team as well as advisors and partners have more than 70 years of combined experience having deployed more than $1B into farmland. You don’t take direct ownership of those properties, but rather you invest in shares of the entity that owns the land. That is, you’ll be investing in shares of the limited liability company that owns the farmland directly, becoming a fractional owner in the process.

FarmTogether targets average annual returns between 8% and 15%, including yearly cash payouts of between 3% and 9%. Those are potentially lucrative returns, especially when the financial markets begin misbehaving. Farmland is, after all, a true alternative investment that doesn’t track the performance of the financial markets.

To invest with FarmTogether you do need to be an accredited investor, which limits participation to those who are either high income, high net worth, or both.

FarmTogether should not be confused with real estate investment trusts (REITs). REITs are essentially funds that invest in a portfolio of properties. When you invest in a REIT you have no control over the individual investments within it. As a real estate crowdfunding platform, FarmTogether allows you to choose the specific properties you will be investing in.

Farmland? Why Invest in Farmland?

Since so few investors are familiar with the virtues of investing in farmland, this is a good place to start. Why invest in farmland?

Let’s start with the most basic reason: farmland is the primary source of the world’s food supply. Sure, some food production is harvested out of the oceans, lakes, and rivers of the world. And a small percentage is grown in greenhouses and other indoor settings. But the vast majority is produced on farmland. Put another way, food is an absolute necessity, and the world can’t survive without its farms. Especially farms in the U.S.

That need is growing every day.

Despite the fact that the availability of farmland is finite, particularly as increasing land area is given over to urbanization, the number of mouths to feed is growing rapidly. The world’s population, now at about 7.7 billion, is projected to add another 2 billion by 2050. All will need to be fed, and most of their food will come from farms.

Farmland is also a “hard asset”. While the supply of financial assets could grow to infinity, there’s only a fixed amount of farmland available in the world, and even that’s declining gradually. As the number of dollars in circulation continues to increase – particularly in light of the recent coronavirus stimulation efforts – the net effect will be more money chasing a limited amount of farmland. Over the long term at least, farmland stands to benefit from the inflation that’s built into the economic system.

It’s also a real alternative investment, since it’s a physical commodity. It’s possible farmland can grow in value even when financial assets are collapsing, if only because the demand for the food continues to increase no matter what’s happening on Wall Street.

The Investment Track Record of Farmland

As what is perhaps the most under-rated advantage of owning farmland, this factor deserves a separate discussion.

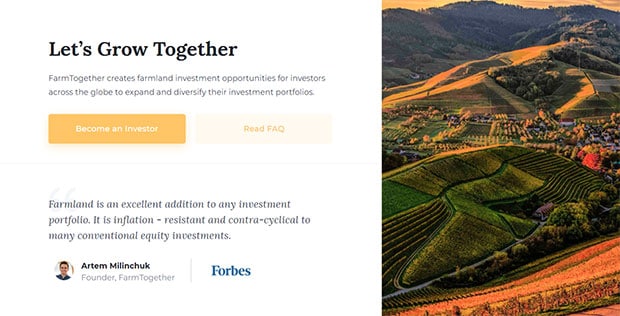

Unknown to most investors, farmland has outperformed other asset classes over the past 50 years.

Seeking Alpha disclosed in a recent article that farmland has outperformed every other major asset class – including stocks – since 1972:

Since the return of 10.23% covers a 44-year time span, it should not be dismissed lightly. During that time, we’ve experienced booms and busts, inflation and deflation, wars and even political upheavals.

Farmland has even performed well during the times of crisis. According to the NCREIF (farmland) Index, between Q4 2007 – Q1 2010 – the 2.5 years that roughly correspond with the Financial Meltdown that routed so many other investments – farmland continued to produce positive returns every quarter. In fact, since 1991, farmland has only had 1 negative quarter (2001 Q1) where it delivered -0.01%. While US stocks dropped 52% during the 2008 crisis, farmland showed growth throughout that entire year, even producing a return of 7.33% in the fourth quarter of that year.

Farmland’s performance during the last financial crisis demonstrates its value as an uncorrelated asset. While stocks, bonds and real estate experienced sharp selloffs, farmland continued to maintain its value and provide consistent investment returns.

Now that we’ve established the value of farmland as an investment, let’s look at how FarmTogether can help you take advantage of those returns.

How FarmTogether Works

As noted earlier, FarmTogether is a real estate crowdfunding platform. If you’re familiar with other real estate crowdfunding platforms, like Peerstreet, EquityMultiple and Rich Uncles, you already understand the basic way FarmTogether works. The main difference however is that FarmTogether is a real estate crowdfunding platform that specializes specifically in farmland, while the others are involved in commercial real estate.

When we say that FarmTogether is an investment in farmland, the emphasis is on the second part of that word – land. That’s because you’re not investing in the business of farming itself, which is vitally important to anyone who isn’t intimately familiar with farming.

Instead, you’re investing in the land the farms sit on. The land is owned by an LLC which is owned by FarmTogether. The farm operation rents that land for production. The farmer pays rent to the LLC, some of which is passed on to the shareholders in the LLC. The typical farmer is a large agricultural operator, rather than a small, independent individual.

Meanwhile, as the value of the underlying land rises over time, it will eventually be sold. When that happens, shareholders will participate in the capital appreciation generated upon sale. Generally speaking, the company expects to sell each piece of property in about seven to 10 years.

That gives the investor two sources of income from a FarmTogether investment:

- Rent income in the short-term, and

- Capital appreciation in the long-term.

Investor Requirements

One of the disadvantages to FarmTogether is that not just anyone can invest – you must meet certain financial requirements to participate. That’s because investing in farmland is an unconventional activity, reserved for those who have the financial wherewithal to withstand potential losses. Virtually all investment activities hold the potential to lose money, but farmland is considered to be higher risk since it’s not liquid and it’s also less well understood by the average investor.

Accredited investor requirement. To be eligible to invest with FarmTogether you must be an accredited investor. Requirements to be an accredited investor include meeting at least one of the following:

- You must have an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years, with a reasonable expectation of reaching the same income level in the current year, OR

- An individual net worth, or joint net worth with that person’s spouse, in excess of $1 million not including your primary residence.

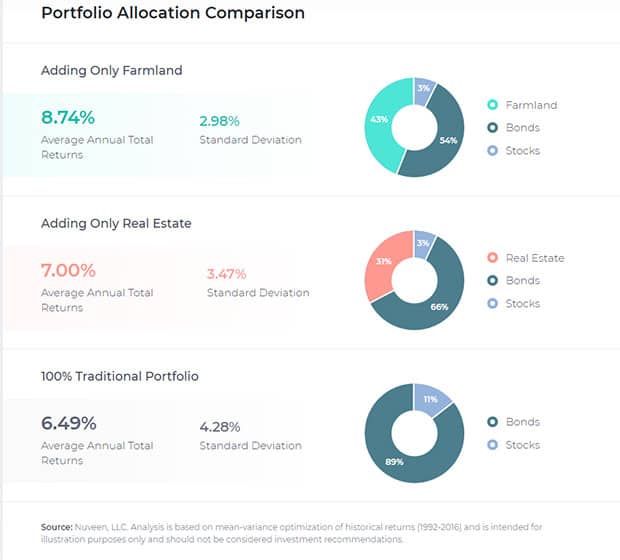

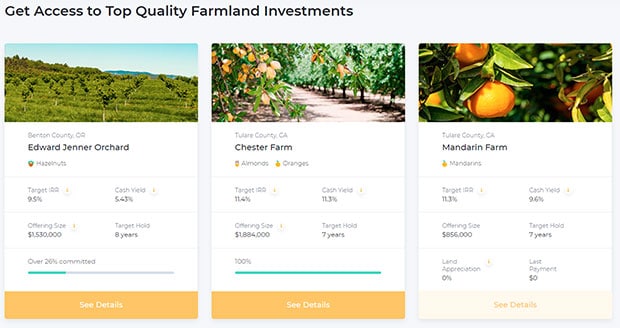

FarmTogether Investments

When you invest through FarmTogether you don’t need extensive knowledge of farming. The company provides both the due diligence in vetting each property, as well as the ongoing management of the investment. Each investment includes project information, a private placement memorandum, an operating agreement and a subscription agreement.

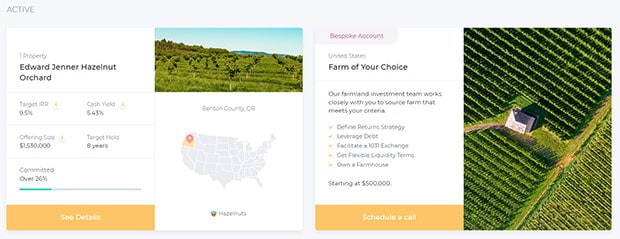

The platform may offer multiple investments at any time, with each structured as a limited liability company (LLC) that directly owns the farmland. Each investment you make will be in a single property. As an investor, you will own shares in the LLC, enabling you to participate in distributions of rental income and capital appreciation upon sale.

FarmTogether targets specific farm investments:

- US row crop farmland – focusing on locations with the highest crop yield, productivity growth, the best relative value, and fragmented, restricted ownership.

- Properties with the potential to increase tillable acres and rental rates through drainage tile, tree or acreage removal, and pooled leasing.

- Premium crops – including organics, fruits, vegetables and nut trees.

One of the advantages – and assurances – of investing through FarmTogether is that the company principals have an equity stake in each investment offered. That means they have a vested interest in managing the investment profitably. This is very different from an arrangement in which the manager simply collects fees to manage the investment, without any risk of loss if the investment loses money.

FarmTogether Features and Benefits

Minimum investment. The range is between $10,000 and $50,000 per investment with $25,000 being the most typical.

Eligible investors. You can invest in FarmTogether as an individual, an LLC, a limited partnership (LP) or a trust. Investors can be either US citizens or residents, or foreign citizens. Investments can be held in a self-directed IRA or 401(k) through AltoIRA.

Investment term. As described above, the typical farmland investment is expected to be held for at least seven to 10 years. But it’s important to understand that the primary purpose of the platform is to invest in properties that will provide steady rent income, with the eventual sale of the land as a secondary consideration.

Investment liquidity. You’ll generally be expected to retain your investment until the property is sold and the proceeds distributed – this is a major reason for the accredited investor requirement. However, if you choose to liquidate your position before that occurs, the company will make a best effort to locate a buyer to purchase your interest. Should that be the case, the principal amount of your investment may be discounted and transaction fees will apply.

Income distributions. Income from rent payments can be made quarterly, semiannually or annually, and are automatically deposited into your bank account.

Tax considerations. At year-end, income distribution information will be disclosed using IRS Form K-1. Rent distributions, net of expenses, will be taxable in the year earned. Capital gains will be taxed in the year the property is sold, subject to capital gains tax. You’ll be able to download any financial documentation related to your investment on the FarmTogether website.

As to tax advantages, there may be some pass-through depreciation and other tax deductions you can take against your annual rent income. And as a long-term investment, gains on the sale will generally be subject to reduced long-term capital gains tax rates.

FarmTogether Fees. The company charges and intake fee upon initial investment, typically ranging between 0.5% and 1.0% of your investment. There’s also a 1% annual management fee charged for the administration of the investment. However, FarmTogether does not charge any fees upon the disposition of the property.

Customer support. Available by both email and by phone. Limited to regular business hours, Monday through Friday, unless scheduled otherwise.

How to Sign Up with FarmTogether

As previously discussed, to invest with FarmTogether you must qualify as an accredited investor. You can be either a US citizen or resident, or a foreign investor. You can also invest as an individual, an LLC, a trust or limited partnership, or hold your investments in a self-directed IRA/401(k) account with FarmTogether’s retirement plan partner, AltoIRA.

FarmTogether does not have an online application on its website, so you will need to schedule a phone call to arrange your application.

To sign up to invest, you will need to provide the following information:

- Your date of birth – you must be at least 18 years old.

- Provide your contact information (phone number and email address).

- Provide information for identity verification purposes.

- Certify that you are an accredited investor, including providing verification information and investor financial information.

- Complete IRS form W-9, including Social Security number, for US citizens and residents only.

- Other information as required, which may include tax documentation supporting your claim as an accredited investor.

To fund your investment account you will need to provide information linking your bank account for funds transferred either through ACH or wire transfers.

FarmTogether Pros & Cons

Pros:

- FarmTogether provides an opportunity to invest in farmland, which has been one of the best and most reliable investments over the past 50 years.

- The company targets annual returns of between 8% and 15%, through a combination of rents and capital appreciation.

- Farmland is a true alternative investment, one that can provide positive returns even when more traditional paper investments, like stocks and bonds, are misbehaving.

- Your investment will provide both regular income from rents, as well as the potential for capital appreciation upon the ultimate sale of the underlying farmland.

- FarmTogether investments can be held in a self-directed IRA or 401(k) account.

- Investing is open to both US and foreign residents.

- The minimum investment can be as low as $10,000.

- Investment managers have their own money invested in each property, providing a higher assurance your investments will be well-managed.

- Unlike most paper investments, which are no better than a general lien on the issuer’s assets, FarmTogether investments are fully secured by the underlying property.

Cons:

- You must be an accredited investor to participate, requiring either a high income, high net worth, or both.

- The minimum investment of $10,000 could be steep for small investors.

- Farmland is a long-term investment, and you will need to maintain your position for 7 years or longer to realize full returns.

- Farmland investments are not liquid. Though the company may help you to sell your shares early, you may not recover your full investment.

Should You Invest in Farmland through FarmTogether

Given the accredited investor requirement, FarmTogether investments are not available to small investors. However, that’s absolutely necessary given that investments in farmland are long term in nature and will require you to commit your investment for several years.

If you do qualify as an accredited investor, FarmTogether can be the perfect alternative investment for your portfolio. You probably already hold the majority of your portfolio in paper assets, like stocks and bonds. But by adding farmland to the mix, you’ll be including a true uncorrelated investment, one unlikely to go through the boom and bust cycles common to paper assets. That will not only stabilize your portfolio, but also has the potential to provide predictable returns during uncertain times.

By investing in farmland, you’re also taking a position in one of the most fundamental asset classes possible. There’s no human endeavor more basic than farming. And with the rapid growth of global population – in combination with the increasingly limited amount of land available for farming – farmland is an excellent long-term investment.

FarmTogether makes investing in farmland easy. You don’t even have to have any knowledge of farming itself. Your investment is based on the farmland itself, and not the operation of the farm. Your return comes in the form of rents from the farm operation, as well as from long-term capital appreciation once the land is sold.

This makes FarmTogether investments similar to growth and income stocks. You’ll have the prospect of long-term capital growth, with steady rent income in the meantime. That kind of investment may work especially well in a retirement plan.

If the idea of investing in farmland interest you, FarmTogether is one of the best platforms to do it with.

If you’d like more information, or you’d like to make an investment, visit the FarmTogether website.FarmTogether

Pros

- Annualized investment returns between 8% and 15%

- Farmland has been one of the best asset classes for the past 50 years

- Earn annual rent income plus capital apprectiation

- Available for self-directed IRAs and 401(k)s

- Alternative investment not correlated with the financial markets

Cons

- Accredited investors only

- $10,000 minimum investment

- Long-term investment, 7 years+

- Investment is not liquid

Share Your Thoughts: