If you want to improve your financial health, a budget is a must have.

A budget, however, is not just something that’s written down and forgotten about.

To make the most of your budget, you need to continue to track your spending and ensure that your costs don’t exceed the budget amounts allocated.

Many people struggle to manage their budget unfortunately, but there are some great tools on the market to help you get your financial house in order.

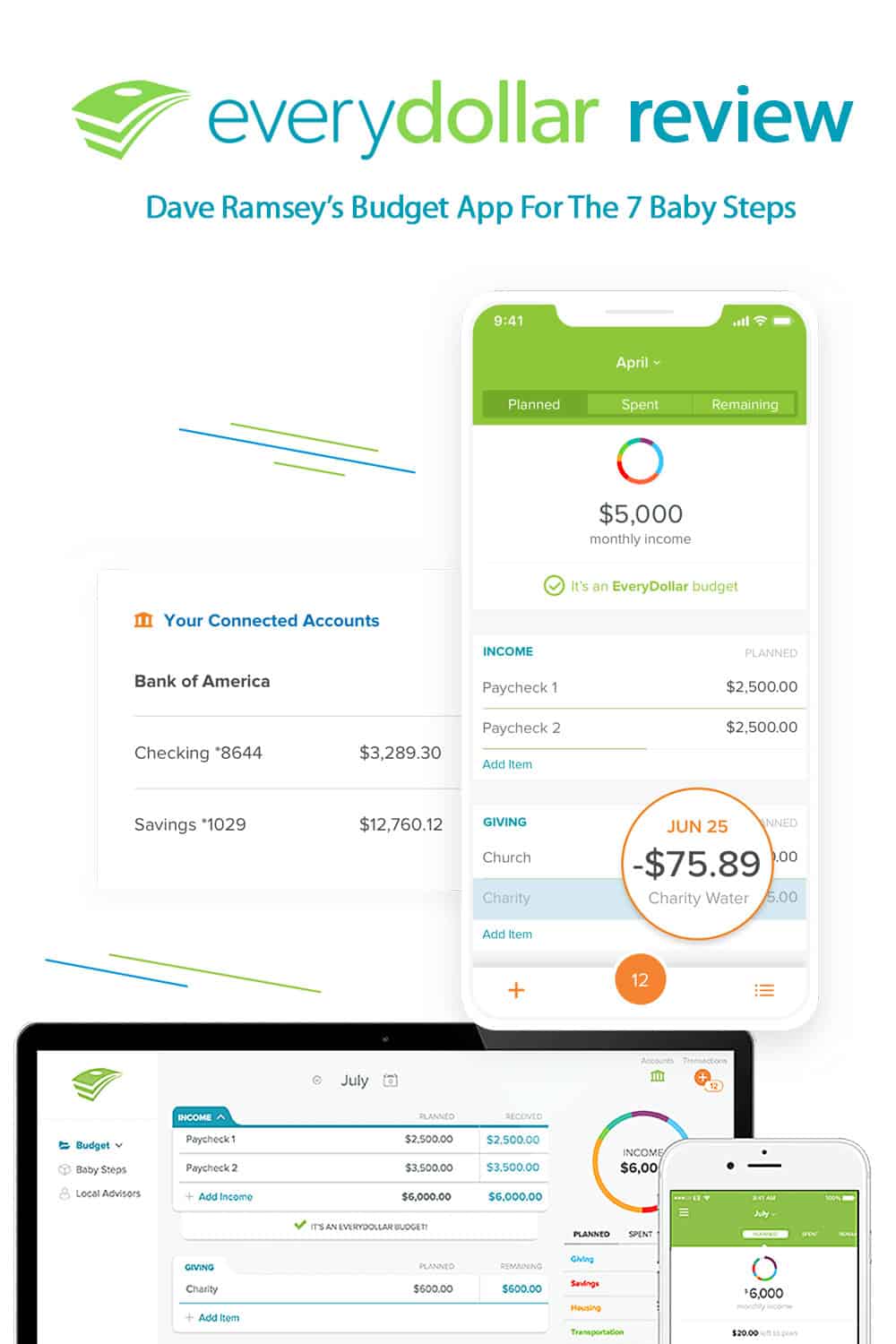

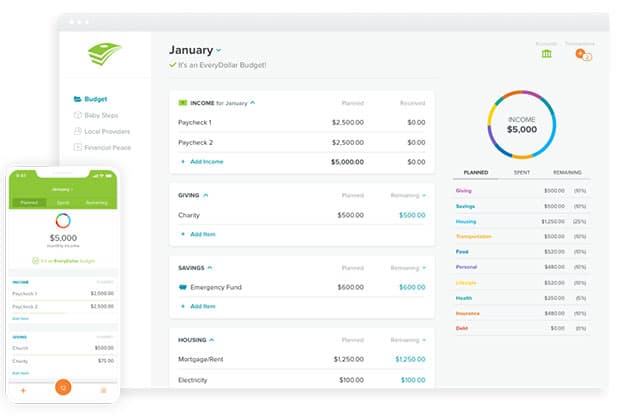

Today we’ll look at one of the most popular budgeting apps, EveryDollar. We’ll explore how Dave Ramsey’s budgeting software can help you to change your financial life and start getting ahead on the 7 Baby Steps.

What Is EveryDollar?

Every Dollar is a budgeting app that works on the budget principles of Dave Ramsey's Financial Peace University and his 7 Baby Steps. It was created by the personal finance guru to help make budgeting easier for users, so they can achieve financial freedom.

While it does have features similar to Mint, YNAB, Empower, and other budget apps, it does have some unique features that make it worth some serious consideration.

The software follows the principles of a zero based budget with an aim to ensure that everything is accounted for, and you “give every dollar a job.”

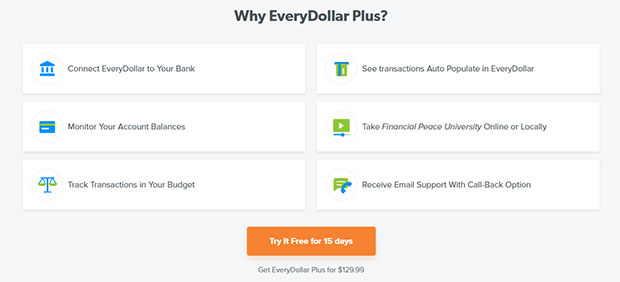

There is both a free version and paid version; you can even enjoy a 15 day trial of the paid version, so you can try it out before you buy.

In our Every Dollar review, we’ll explore these principles and features in more detail to help you to determine if this software could assist you.

How Does EveryDollar Work?

EveryDollar employs the zero based budgeting system, which involves assigning each dollar to a category. This is a more sophisticated version of envelope budgeting, but you don’t need to carry the cash around with you, as you can still use your bank accounts.

You will need to input your income and plan out the spending for your entire month ahead of time. You can then set up different budgeting categories and allocate income to each of the categories.

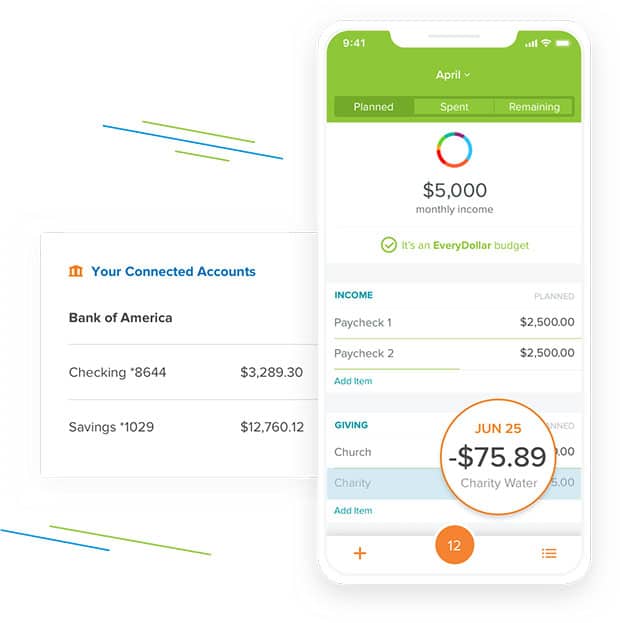

Once this is all set up for the month, you can use the EveryDollar app to monitor your spending each day. With the free app, you need to enter each transaction manually, but if you opt for the paid EveryDollar Plus app, you will be able to link your accounts, so it can automatically pull transaction data for greater accuracy.

Setting The Software Up

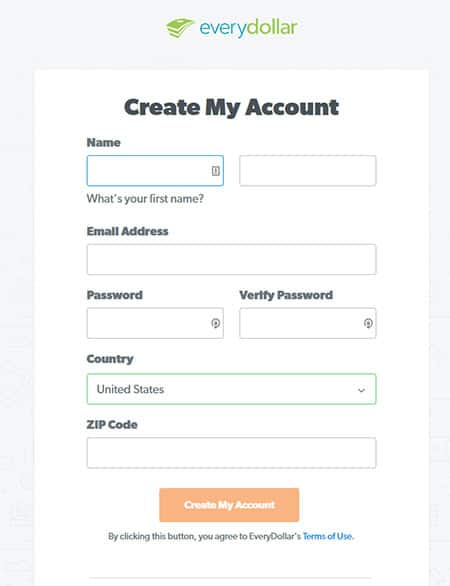

The first thing you need to do is create an account on the website. You’ll need to enter your name, email address, postal address, and create a password. You will need to provide your state and zip code, so currently, this platform is not available for anyone outside the U.S or Canada.

Once you have entered all your details, EveryDollar will send you a confirmation email, and the initial set up is complete.

When setting up the software initially it will walk you through entering all of your important financial details.

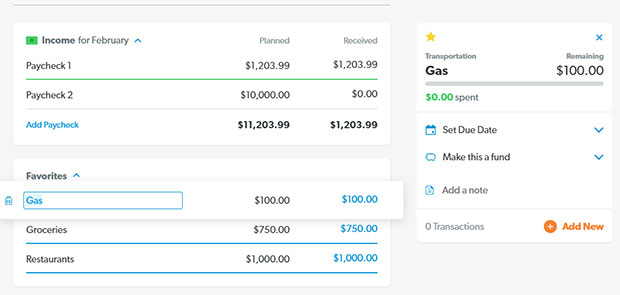

First, it will ask you for your planned income for the month. Just enter the paychecks (or other income) you are expecting for the month, and then when those paychecks or deposits are made, it will show you how much you've received, and tell you how much income you have left to budget for spending, giving and savings categories.

Next it will ask you for planned giving amounts. You can enter charity giving, tithing and any other charitable giving you plan on doing.

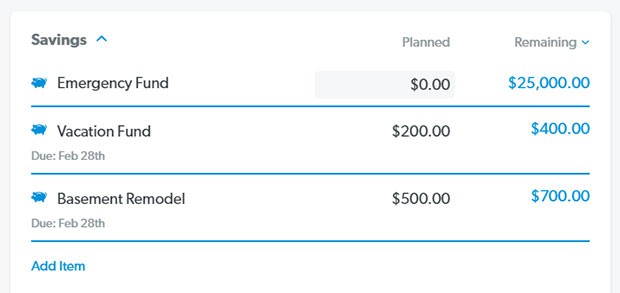

Setting up savings accounts and savings goals is next. By default you are asked to set up an emergency fund (which the 7 baby steps talk about doing). If you want, you can also add other savings goals like a vacation fund, college savings fund or any other savings fund to help you work towards achieving your financial goals. If you have spending categories that occur less frequently, you can also turn them into a "fund" and save for that expense throughout the year, so that when it comes due you'll have the money available.

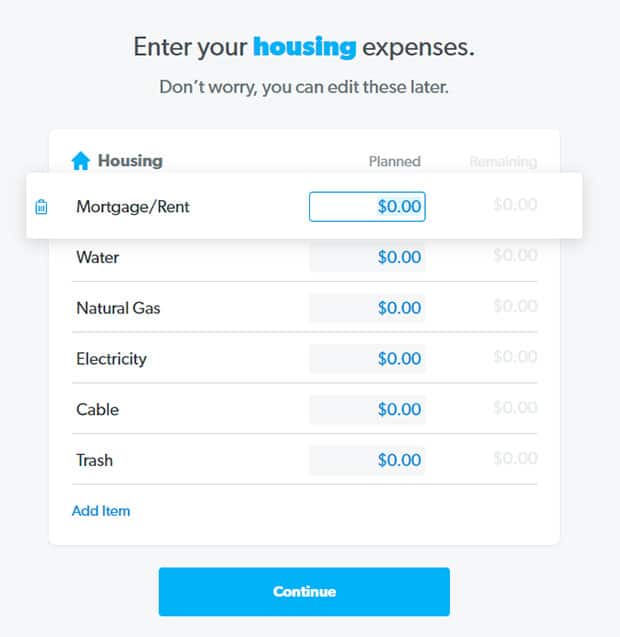

Spending categories are next. There are eight default spending categories inside the EveryDollar software, but you can also create custom categories.

The default categories are housing, transportation, food, personal, lifestyle, health, insurance and debt. When setting up the software it will ask you to enter planned expenses for each category. For example, see the housing category below.

Next to each category line item, there is a space for the planned budget amount. For savings funds, you can also input a current balance and a savings goal. Within the categories, it is also possible to create notes or track your transactions.

Categories can also be marked as a “favorite”. That will make it easier to manage frequently updated categories as it will always show at the top of your screen.

Next to the “planned” column for each spending category, you’ll see a “remaining” column. This is how you will keep track of your budget. You'll be able to see how much money is left to spend every month in each category. It is also possible to switch from a “remaining” dollar amount, to view the “spent” amount. This will give you an idea of how much you've already spent in each category.

Once Setup, You'll Need To Add Transactions Regularly

Once you’ve set up the software, it will require regular updating in order to keep things on track.

With the paid version, you can automatically sync your accounts with your bank making it much easier.That will allow all of the savings goals and spending categories to be automatically updated without your intervention.

If you’re using the free app, however, all of this updating will need to be done manually. Each time you pay a bill or make a purchase, you’ll need to go into the app and enter it.

No matter how it is entered, manually or automatically, as your data comes through, EveryDollar highlights whether your spending is on track. You’ll be able to see graphs and displays that show just how your budget is doing.

How EveryDollar Integrates The 7 Baby Steps

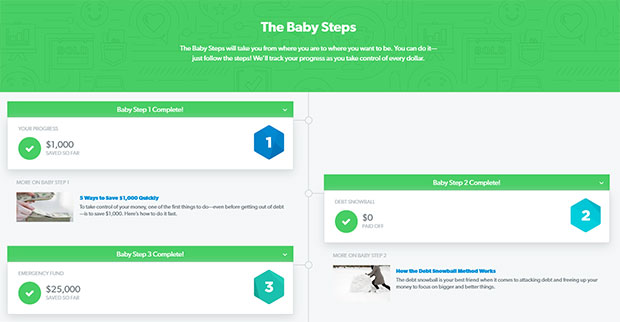

Dave Ramsey is known for the “7 Baby Steps,” and the EveryDollar platform integrates them into the program.

The Baby Steps are a set of seven steps that are intended to help you to not only get out of debt, but start to build wealth. The Baby Steps are:

- Save a $1,000 emergency fund: This is setting up an emergency fund for any unexpected expenses. Whether this is your car breaking down, losing your job or an unexpected pregnancy, your emergency fund will allow you to bridge the gap, so you can get back on track.

- Use the Snowball Method to pay off all debt: The Snowball Method involves listing all of your debts in order excluding your mortgage. You then pay them off smallest to largest without considering the interest rate, unless there are two payoffs of the same amount. In this scenario, you’ll pay off the one with the higher rate of interest first.

- Have a reserve for 3-6 months of expenses: Like your emergency fund, this is designed to provide a buffer in case of something unexpected. If you lose your job or are unable to work, this fund will give you several months to get back on track, while still covering all of your usual expenses.

- Save 15% for your retirement: No one likes to think about getting older, but starting to plan for your retirement is an excellent idea. Most experts agree that 15% is an optimum amount to ensure that you have sufficient income to maintain your lifestyle during retirement.

- Start a college fund for your kids: Most of us appreciate that college can be expensive, so even if your children are young or you’ve not finished completing your family, getting started on a college fund for the kids is a great idea.

- Pay off your home: Paying off your mortgage is a great way to experience financial freedom. If you can pay off your home early, you’ll not only pay less interest but just imagine what you can do with that extra money each month.

- Build wealth and give: Finally, you can start to build wealth and give even more. It is important to realize that giving to other people can make you happier than simply sitting on a pile of money. So, while it is important that you’re financially secure, don’t forget the importance of helping others.

Once you’ve set up the software, you will have an option to assess at what point you are in the baby steps journey through the link in the sidebar. This is not only a great way to keep your priorities in check, but also help you to maintain focus on one goal at a time. All the steps are designed to help you get out and stay out of debt, but they take it further to help you to develop a strong financial footing for your future.

The app allows you to start at step one, and once you’ve completed it, it will automatically move you to the next step. This is all done via a simple interface, and it can be motivating to see that big green checkmark as you complete each step.

What Is The Cost Of EveryDollar?

As we touched on above, there are two tiers to the EveryDollar platform; Free and Plus.

There are obviously differences between the two, but here we’ll explore what these are to help you to determine which plan is best for you.

EveryDollar Free Vs. EveryDollar Plus

EveryDollar Plus is priced at $129.99, and it is billed annually. ?

So what do you get for this premium price compared to the free plan?

While the free plan does offer practically everything offered with Plus, there are a few crucial differences. Automation, customer support and Financial Peace University.

The free plan allows you to create a monthly budget and plan your expenses. The customizable template makes it easy to track your spending as you create transactions and monitor your budget. You can sync the program across your devices with an Android App or iOS. This means that you can track your spending on the go and check your figures at your desktop without needing to download or copy anything.

The paid version, EveryDollar Plus, allows you to automate your EveryDollar budget. You can link your bank accounts, so your transactions auto-populate inside EveryDollar. You can also use the platform to monitor your account balances. While this may not seem like much, it eliminates the guesswork from your budget. You don’t need to worry about inputting everything you buy, and once you start to use this feature, you’ll see that even those easy to forget small transactions can really add up.

EveryDollar Plus also provides email support with a call back option and the ability to take the Financial Peace University course locally or online. The Financial Peace University course typically costs $129.99 to take on it's own, so the fact that it's included is a great value!

EveryDollar Alternatives

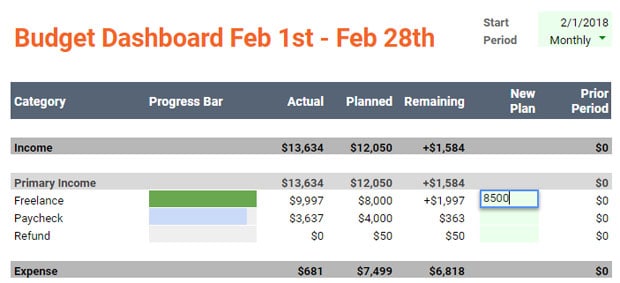

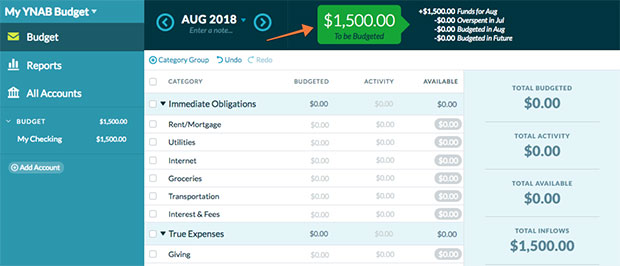

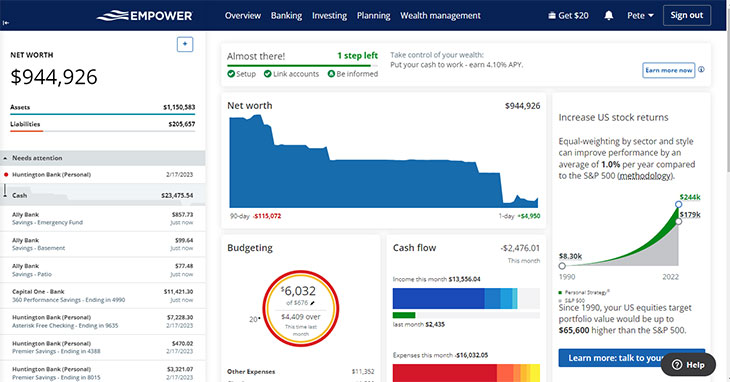

Of course, there are alternatives to EveryDollar. Some of the best in our view are Tiller Money, YNAB, Mint and Empower Personal Dashboard.

Mint vs. YNAB vs. Empower vs. Tiller Money vs. EveryDollar

Let's take a look at how these programs stack up as EveryDollar alternatives.

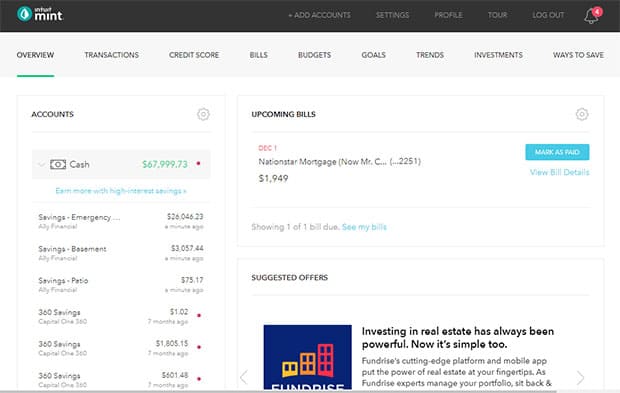

Mint: If you’re looking for budget tracking but want free transaction downloads, Mint is a good option. This platform is ad supported, so you can expect a far more cluttered interface, and you should expect to see pitches throughout your budgeting experience for bank accounts, investment accounts, etc. Another key difference between Mint and EveryDollar is that Mint does not use zero based budgeting. While you can set goals and track spending, you’re not forced to zero out the budget.

Tiller Money: Tiller is a site that that allows you to create spreadsheets and budgets in Google Sheets or Excel. They have a variety of easy to use templates that you can use to setup your budget. In addition, their tools allow you to link your bank accounts through their site, which will then allow you to automatically sync your spreadsheets with your online accounts. Tiller will download your transactions and insert them into your spreadsheet automatically, and your budget will be updated like magic! The strength of this system is that you can do pretty much any budget system that you want to, and the service is flexible enough to do what you want. Or you can just use one of their pre-made templates. Tiller Money costs $59/annually.

YNAB: You Need a Budget is perhaps the closest alternative as it also features a zero based budgeting system. However, YNAB has a steeper learning curve to get the most out of the tools offered. It costs $11.99 a month, but you can save by paying annually at the cost of $84. YNAB does offer great support, and there is access to a community of platform users, so you can get honest feedback and answers to queries from the people using the platform.

Empower Personal Dashboard: This platform does allow basic budgeting and expense tracking, but it is designed primarily to assist with investment tracking. There are automatic transaction downloads and budgeting tools, but it may be a little sophisticated for those new to budgeting. However, as your finances develop and you start to plan for the future, Empower does offer free tools to help you to ensure that your investments are performing as you anticipated. The platform is free, but you will likely get marketing calls to use Empower's wealth management service.

Take Control Of Your Finances With EveryDollar

If you want to benefit from the financial expertise of Dave Ramsey and you’re a fan of his money management approach, then EveryDollar is likely the budgeting tool you’ve been looking for.

The platform is easy to use and intuitive with a clean interface. While it lacks some of the bells and whistles offered with some of the alternatives, that is part of the appeal of EveryDollar. It keeps the focus on your monthly spending, saving and debt reduction.

It is quick to set up and free for the basic account. You can even enjoy a free trial of EveryDollar Plus to see if it fits your needs, and if so you can then pay the annual fee.

While the free version doesn’t provide automated transaction syncing, forcing you to enter your transactions manually, it may be better suited to those who want to take a more hands on approach to their spending. Of course, if you struggle to keep track of your accounts and purchases, the Plus plan will provide one place to monitor all of your expenses and spending, so you can ensure that you stay on track.

If you’re looking for a more comprehensive picture of your finances and investments than EveryDollar can offer, you’re likely to be better off choosing one of the listed alternatives.

Have you tried EveryDollar, or are you currently using it? Tell us your thoughts in the comments!

I am trying out EveryuDollar free version. I have been using an Excel for many years and an trying to make a leap into the 21st century!

I have not yet completed my first month yet. Am waiting to see how ED handles month end. Carrying forward balances, etc.

Another feature I cannot find is reporting. Are there any features to print out summaries? My wife is used to seeing monthly printouts of our excel budget.

Other than that, ED is a great program. Have to wait and see how monthend goes, however.

thanks.

I think the reporting functionality was somewhat limited, although now that I go in there and look there is a new “insights” tab that I believe has some reporting/graphs/etc for EveryDollar Plus users. I’m not currently paying for that so I can’t tell you for sure. Good luck!