Though much of the investment attention is focused on the stock market, real estate investing has produced comparable returns over the long-term. Some of the highest returns have come in commercial real estate, but until recently, those deals were only available to institutional investors.

But all that’s changed with the development and evolution of real estate crowdfunding platforms, like CrowdStreet. Through the platform, you can invest in a variety of commercial real estate deals, or even do so through managed options, like funds.

Crowdfunding has democratized commercial real estate investing, and CrowdStreet has emerged as one of the top platforms in the space.

Who Is CrowdStreet?

As we’ve already discussed, CrowdStreet is a real estate crowdfunding platform. That’s an investment service where multiple investors come together and pool their funds to invest in specific real estate deals. In the case of CrowdStreet, those deals include commercial real estate.

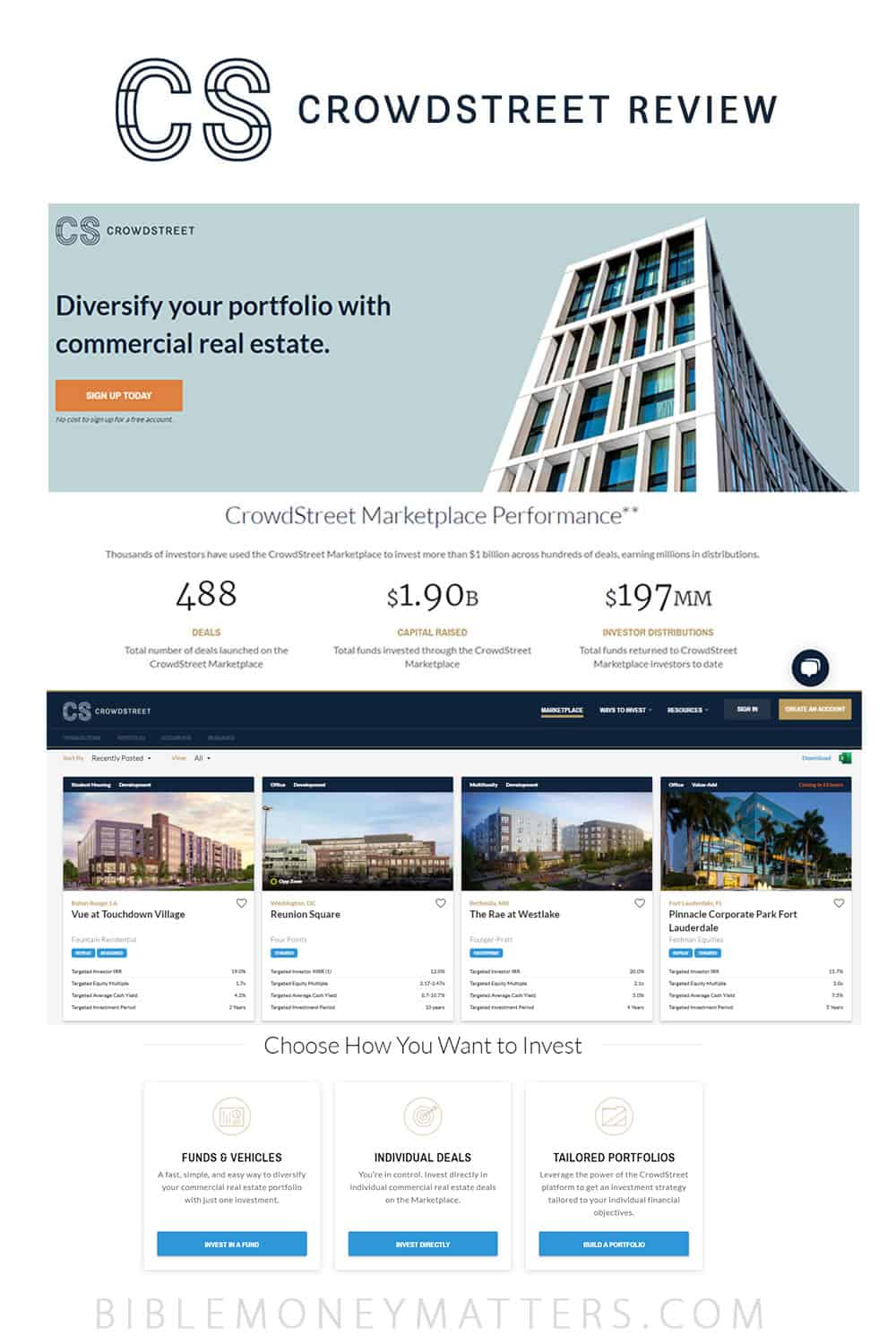

Founded in 2014, CrowdStreet has raised $1.9 billion in capital for investments in 488 commercial real estate deals. 40% of those deals have been “fully realized” (paid out). Along the way, $197 million in funds have been returned to investors, with an internal rate of return (IRR) of 18%.

As an investor on the platform, you’ll be investing in either individual commercial properties, or funds that invest in the same. You’ll buy shares in each property or fund. During the time your investment is in place, the return on your capital will come in two forms: cash flow generated by the properties owned, and proceeds when each property is sold.

How To Invest With CrowdStreet

So what are the requirements to invest with CrowdStreet?

Accredited Investor Requirement

To be eligible to invest with CrowdStreet you need to qualify as an accredited investor. This is a common requirement with real estate crowdfunding investing, though some platforms are offering investment options for both accredited and nonaccredited investors.

There are specific requirements for accredited investor qualification. You must meet the following:

- Have earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expect the same for the current year, OR

- Have a net worth over $1 million, either alone or together with your spouse (excluding the value of your primary residence).

You’ll need to prove accredited investor status at the time you open your account, and CrowdStreet will verify that you are. That will require either having your status certified by an independent professional, like an attorney, financial advisor or certified public accountant, or by providing written documentation.

That documentation will require supplying tax documents to verify income. These can include W-2s, 1099s, Schedule K-1 from Form 1065, or your 1040. For net worth, bank or brokerage statements, or certificates of deposit will be required. Investment real estate can be verified through property tax assessments or independent appraisals. For liabilities, you’ll need to supply a credit report from one of the three major credit bureaus (Experian, Equifax or TransUnion).

Investments Offered

CrowdStreet offers three investment options:

- Individual deals

- Diversified funds and vehicles

- Tailored Portfolio

Individual Deals

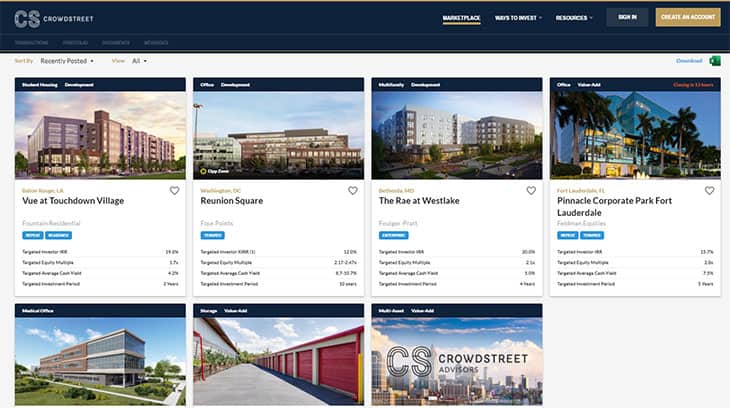

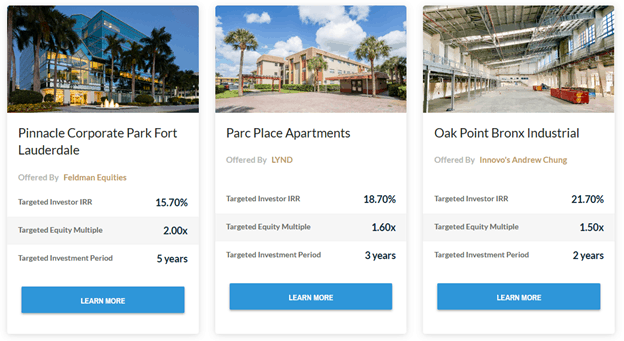

As the name implies, this option gives you the ability to invest in individual properties. Multiple individual deals are available at any time from the CrowdStreet Marketplace, and you can select the one(s) that will work best for you. You’ll be participating in each deal with other investors, so your investment will represent only a slice of the total project.

Each deal is vetted so it will meet CrowdStreet’s investment criteria. As you can tell from the screenshot above, three primary parameters are considered:

- Targeted investor IRR, which is the expected average annual return on investment over the life of the deal.

- Targeted equity multiple, is the total dollar amount you’re expected to receive by the end of the investment. Includes both ongoing returns and your return of principal. A ratio of 1.5 means you can expect a total dollar return of $75,000 on a $50,000 initial investment.

- Targeted investment period is how long the deal is expected to last, between making the initial investment and selling the property.

The minimum investment is $25,000, though it can be higher on certain deals. Typically, individual deals are expected to run between two years and 10 years. For that reason, you’ll need to be committed to the investment for the long-term.

Diversified Funds and Vehicles

If you’re not interested in investing in individual deals, CrowdStreet offers professionally managed commercial real estate funds. This will give you the ability to spread your investment across multiple commercial properties, providing greater diversification. You’ll immediately have diversification across multiple properties, which is something that will take much more capital to do with individual deals.

Two types of funds are offered. Single-sponsor funds are managed by a third-party real estate firm, focusing on their own investment specialty. That can include investing in a certain region of the country, or in a specific commercial real estate sector, like retail, office space, warehouses, or large, multifamily projects.

Alternatively, you can invest in CrowdStreet funds. These funds are managed directly by CrowdStreet, and invested in multiple commercial real estate sectors, and offered by a variety of property sponsors.

Tailored Portfolio

If you’d like a professionally managed real estate portfolio this will be the option for you. CrowdStreet will put their many years of real estate investment experience to work managing your portfolio. That portfolio will be comprised of individual deals selected from the CrowdSource Marketplace.

Your portfolio will be constructed based on your investment goals and risk tolerance profile. You’ll be assigned a dedicated representative for contact purposes, and you’ll be able to track the performance of your investments online.

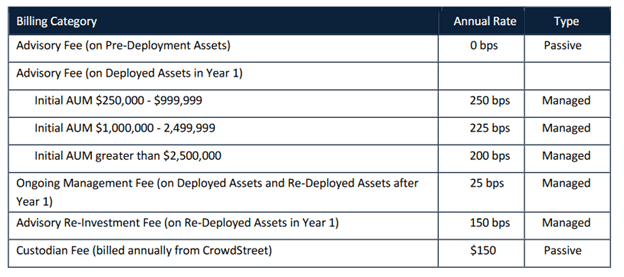

This investment option requires a minimum of $250,000 to participate. Account fees will vary depending on the size of your investment, as well as the timing (higher fees apply in the first year of investment than in subsequent years).

The fee schedule is as follows:

CrowdStreet Investment Methodology

As a real estate crowdfunding platform, CrowdStreet functions as a marketplace where real estate sponsors offer property deals, and investors invest their money in those deals.

Those deals will appear on the CrowdStreet Marketplace where you can choose the properties you want to invest in.

CrowdStreet scans the commercial real estate market across the country for best-in-class sponsors with institutional quality deals. Once they locate them, they subject each sponsor and specific property deal to a rigorous set of vetting criteria. Only about five of every 100 deals reviewed makes it to the CrowdStreet Marketplace.

The vetting process includes evaluating the sponsoring firm. That includes a background check on both the firm and its principles. They also review the sponsor’s track record. The sponsor must have a demonstrated history of successful projects. CrowdStreet then assigns each sponsor a designation. That can be emerging, seasoned, tenured and enterprise.

Next, they evaluate the property deal itself. That includes determining if the project is within the core competency of the sponsor, that the project demonstrates professionalism and conforms to industry standards, and if the deal assumptions are supported by objective market data. Finally, each project is evaluated to determine it will match CrowdStreet investor preferences in terms of asset type, projected returns and location.

Only once a project and its sponsors clear the vetting process will be deal be made available on the CrowdStreet Marketplace.

CrowdStreet Features and Benefits

Minimum initial investment: $25,000 (or more) on individual deals; minimum $250,000 for a Tailored Portfolio.

Available account types: Taxable investment accounts, trusts, LLCs, as well as IRAs set up through a Self-directed IRA (SD-IRA). These are IRA accounts set up through trustees who specialize in SD-IRA accounts. You won’t be able to invest in CrowdStreet through better known IRA sponsors, which is typical with real estate crowdfunding investing.

Dividend reinvestment: Not offered.

Customer service: Available by onsite email contact. You can also make direct contact with project sponsors by email. This can be done both when you are assessing a perspective offer, or even after you’ve made your investment.

Platform security: The CrowdStreet web platform maintains customer facing systems exclusively hosted by Amazon Web Services. Investments are not protected by investment coverage like FDIC or the Securities Investor Protection Corporation (SIPC), which is typical for real estate crowdfunding investments.

How To Sign Up With CrowdStreet

You can browse the investment offerings in the CrowdStreet Marketplace free of charge, and you don’t even need to sign up to have access. But if you do sign up, there are no fees connected with doing so.

The sign-up process starts on the CrowdStreet website. You’ll enter your email address, and your first and last name, then create a unique password. However, you can also sign in with LinkedIn or Google, if you have an account established with either.

As described above, you’ll need to certify that you are an accredited investor. Once again, that will require either verification provided by a financial professional (CPA, attorney, or financial advisor), or by submitting income tax and savings/investment documents, as well as a recent copy of your credit report from one of the three major credit bureaus. You can also take advantage of a third-party service, VerifyInvestor, to certify your accredited investor status.

You’ll need to provide the following information:

- Your full name.

- Indicate the account type – taxable investment account, or IRA.

- Your Social Security number or tax identification number (for trusts or LLCs).

- Your mailing address.

- The names of any individuals who will participate in the investment process with you as co-investors, fiduciaries, advisors or proxies.

- Additional documents if required by the property sponsor, which can include trust formation documents or LLC agreements and formation documents.

- Bank and ACH or wire instructions where you want to receive distribution payments.

Once the above information has been submitted, you can submit your application and make an offer on an individual deal. You’ll be able to fund your investment through the bank account information you submitted. Expect funds to be processed in between two and five days, and for the sponsor to confirm that they’ve been received.

CrowdStreet Pros & Cons

There are lots of pros of investing with CrowdStreet, as well as a few cons to be aware of.

Pros

- The CrowdStreet Marketplace is free to use at any time, and there is no cost to sign up with the service.

- Invest in commercial real estate, without getting your hands dirty. There’s no need to visit properties, renovate them, find tenants, collect rents or pay expenses.

- You’ll have a choice to invest in individual deals, professionally managed funds or a tailored portfolio.

- High investment returns – some individual deals have projected returns in excess of 20% per year.

- Investment returns are generated from two directions, from profit on cash flow and appreciation upon sale of the underlying property deal.

- If you invest in funds, you’ll be able to choose specific commercial real estate sectors, as well as geographic locations.

Cons

- Requires accredited investor status, which will eliminate small and medium-size investors.

- The minimum investment is $25,000 on individual deals and $250,000 on a Tailored Portfolio.

- Your investment will be tied up for several years, even as long as10 years. However, this is typical of commercial real estate and real estate crowdfunding investing.

- Investments don’t carry FDIC or SIPC insurance, which is also typical of real estate crowdfunding investing.

- Customer contact is limited to email only.

Should You Sign Up With CrowdStreet?

Plenty of investors are looking to diversify away from a portfolio constructed entirely of stocks and bonds. Both have had a good run in recent decades, but high valuations and volatility can be unnerving. That makes alternative investments more valuable than ever.

One of the best alternative investments to a portfolio of all financial assets is real estate. And one of the best forms of real estate is commercial real estate. Whether it’s office buildings, retail space, or large multi-unit apartment complexes, commercial real estate has the advantage of generating a regular cash flow as well as capital appreciation upon sale of the property.

If you find the concept of real estate crowdfunding appealing, CrowdStreet is one of the best choices in the space. They offer no fewer than three ways to invest in commercial real estate, including the ability to invest in individual properties. You can even invest in several properties, and build your own commercial real estate portfolio.

The firm offers only properties that have been fully vetted, and offer the potential cash flow and property appreciation investors are looking for.

An investment in commercial real estate equal to only a few percentage points of your total portfolio could provide the type of diversification you’re looking for. It will give you a tangible asset class, to go along with a portfolio dominated with financial assets.

If you’d like more information, or you’d like to sign up for the service, check out the CrowdStreet website.

Real Estate Crowdfunding Services To Check Out

Company Website | Fees | Account Minimum | Accredited Investor | Review | |

|---|---|---|---|---|---|

None | $5 | No | |||

0.25% | $100 | No | |||

None | $500 | No | |||

1%/year | $500 | No | |||

0.30% - 0.50%/year | $1,000 | No | |||

2% annual management fee. | $5,000 | No | |||

Intake fee of between 0.5% and 1.0%. 1% annual management fee. | $10,000 | Yes | |||

Intake fee of between 2.0%. 0.75% annual management fee. | $3,000 -$10,000 | Yes | |||

| $5,000 | Yes | |||

| $1,000 | Yes | |||

| $1,000 | Yes | |||

| $1,000 | Yes | |||

Typically 0.50% to 2.5% | $25,000 | Yes | |||

None | $5,000 | Yes | |||

Intake fee of between 1-3%. 1.5-2% annual management fee. | $25,000 | Yes |

CrowdStreet

Pros

- Free to use the CrowdStreet Marketplace

- Invest in commercial real estate without getting your hands dirty

- Invididual deals, funds and Tailored Portfolio options

- HIgh investment returns

- Investment returns from cash flow and capital gains

Cons

- You must be an accredited investor

- MInimum investment $25,000

- Long investment time horizon

- No FDIC/SIPC coverage

Share Your Thoughts: