Home mortgage rates are lower than they’ve ever been right now.

A lot of people are thinking about refinancing their home in hopes of dropping their rate and payment significantly.

I’m one of those people.

If you’re in the middle of the process of trying to find a good rate on a mortgage, one thing you’re probably doing is staying on top of your credit score. If you want to get the best rate possible it’s important to keep tabs on your credit score and make sure that it’s as high as possible because if it’s not, it can cost you thousands of dollars in interest via a higher rate.

Not sure what a good credit score is?

To get the best possible rate you’ll most likely need somewhere in the range of a 750-850 credit score.

Quick Navigation

Use The Credit Sesame App To Check Your Credit Score

There are several ways to check your credit score for free right now, and one of my favorites is Credit Sesame.

I wrote a review of Credit Sesame a while back where I gave several reasons why I like using their site, including:

- Free credit score! You can get your Experian credit score for free once a month. Better than paying to get your FICO score!

- You can check your score regularly: Since they update your score every month, you can check it every month and see how your credit trends using their pretty graphs.

- Better mortgage options: Credit Sesame will look at your loans and search for better deals. You can apply for a new mortgage or a refinance right through their site.

Now with the new Android credit score app from Credit Sesame, it’s easier than ever to stay on top of your credit score.

Credit Sesame Mobile Credit Score App

The new Android Credit Sesame credit score app is a great way to stay on top of your credit while on the go (The iOS version has been released for a while).

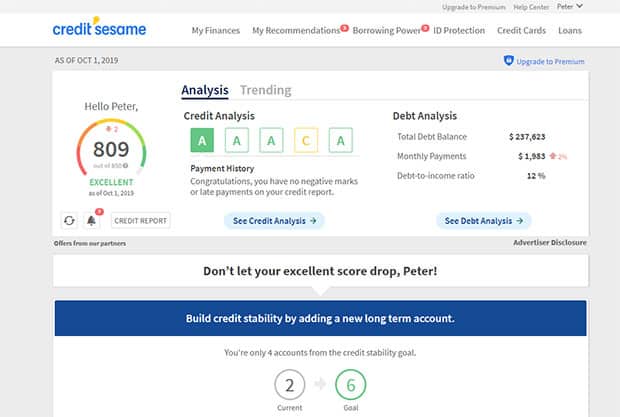

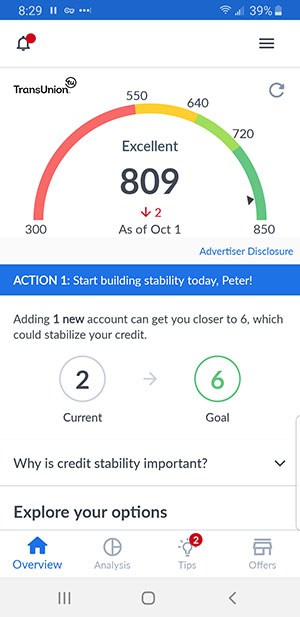

If you’re in the middle of trying to refinance like we are, it’s an easy 2-3 click process to check your credit score before you send in a mortgage application. Here’s a quick look at the app itself on my Android phone:

So what are some things you can do within the app? Let’s take a look.

Check Your Credit Score On The Go

The first and main thing you can do with the app is check your credit score on the go.

You just open the app, login with your 4 digit pin or fingerprint login, and then click on the “credit score” button.

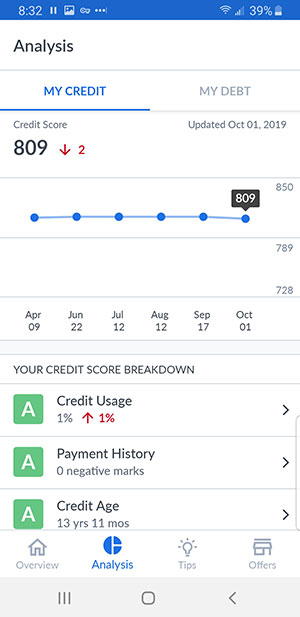

Within the app you’ll see what your credit score is, the last time your credit score was updated (it updates once per month), and then it will show you a trending graph showing you how your credit score has trended the last few months.

If you’ve been making changes to try and improve your score, this would be a good place to go and see if the changes are having an effect.

The credit score section will also show you how much of your credit you’re utilizing, and show you the trend on that as well so you know how much you’ve used over time.

Check Your Credit And Total Debt

The second page in the app is the “Analysis” section where you can view your “My Credit” tab, or your “My Debt” tab.

In the “My Credit” section you’ll see your credit history, and a credit score breakdown.

The “My Debt” tab will show all your loans and debt that you currently have. It will show your credit cards, your home loans and any other debt that you’ve incurred.

In addition to the total debt number shown it will also give you an indication if your debt is going up or down.

Within the total debt section there is also a “total monthly payment” screen where it will show you your total monthly minimum payments on your debt. For me that mainly just includes our home mortgage. For others that have credit card debt, student loans and more it will show one large number for all of those, and then break it down by the individual debts. Nice way to keep track of your debts and stay on top of them.

Home Value And Equity

The third tab in the app is for the “home value” section. When you click into that screen it will show you the value of your home, based on an automated valuation pulled from DataQuick.com. If you’ve entered your own manual home value within the Credit Sesame website (or from within the app) that will show here as well. I entered my own value as I felt the estimate was off by a good $30,000. You can then also see the trend of your home’s value over time. Ours unfortunately has gone down quite a bit.

In the second section of the home value tab you’ll find the “home equity” area. This will show you how much equity you’ve built up in your home since you bought it. Our number is pretty low since values in our area have dropped significantly since we bought.

Offers & Savings Advice

The last section in the app that we’ll mention is the “savings advice” tab. While I think you’re better suited to check out this information on the full website, it’s pretty simple to see here in the app as well.

Credit Sesame will look at your current financial situation and find ways for you to optimize and save money. If you have a home loan it will give you refinance offers that you can take advantage of, and you can even apply for the loans from the app. Simple.

Conclusion

I love Credit Sesame’s website and service because they make it free and accessible for most people to get a peak at their TransUnion credit score. That makes the process of searching out and finding a home mortgage or refinance that much less stressful.

Now that they’ve also got a mobile app for Android in addition to their iOS apps, it’s that much easier.

I’d highly recommend everyone to check it out, especially since it’s free. Sign up through the link below!

Get Your Free Credit Sesame Account And Mobile Credit Score App!

What are your thoughts on the app? Have you tried it, and did you like it? What things could they add to it?

Congrats on the 835 credit score! You are in a great position to refinance.

I’ve been a Credit Karma user for years. Credit Sesame looks like a worth contender though. I’ll have to try it out and compare. Which do you prefer?

I like both of them Zach because one is giving you a free Experian credit score, and the other is giving you a free Transunion credit score. It’s good to compare and contrast.

The Credit Sesame and Credit Karma apps are both simplified versions of the website features. Preference was easier developed for me through use of the full sites. As you mentioned for the “savings advice” tab, most of the added features can be better viewed on the full site as well.

I echo what Zach said about the 835 score! I’ve been dealing lately with the question of developing a credit score for a first home purchase. 720-740 is usually mentioned as a desired range, but patiently building to an even better score has even more benefits!

Thanks Mac, that 835 of ours is going to come in handy if/when we finally decide to build our new home. :)

Yeah, I think the app is good for just a quick glance for your credit score, or to remind you of what your loan balance is, but the full websites for Credit Sesame and Credit Karma are better.