When I first researched and wrote about Health Savings Accounts (HSA) it was because my day job, where I get my health insurance, was considering moving everyone in our office to a High Deductible Health Plan (HDHP) in conjunction with an HSA.

The main reason the company was deciding to go down that road was cost.

For years our health insurance premiums had been rising, in part because of rising insurance costs industry-wide, and in part because our company as a whole was pretty unhealthy. With a Health Savings Account they’ll be able to save money, and for many people who don’t use as much health care, it will mean savings as well.

In the past couple of years, the company also offered a traditional health plan for people who didn’t want to switch to the High Deductible Health Plan. Since my wife has had a lot of health issues it has made more sense for us to continue with a traditional plan. We no longer have that option as the company is dropping that option (too expensive in the new environment) and moving to put everyone onto a High Deductible Health Plan with a Health Savings Account component.

Since we’ll be moving to one whether we want to or not, I thought it would be a good time to do a quick review of Health Savings Accounts (HSA) and High Deductible Health Plans (HDHP) for the coming year.

Quick Navigation

Health Savings Account: Tax Advantage Healthcare Spending

Health Savings Accounts, or HSAs, are tax-advantaged savings or investment accounts where you can put money pre-tax that will be used to pay for current or future health care expenses. You just have to make sure that any expenses you pay from the account are eligible expenses, per guidelines put out by the IRS.

What types of things can you use your health savings account to pay for?

- Deductibles

- Co-insurance

- Health insurance premiums (only in some cases)

One reason why these accounts are so great is that they allow you to save on your year end tax bill. You’re putting money into the HSA before taxes, and as long as that money is spent on eligible expenses it isn’t taxed with the rest of your income.

Another interesting point is that unlike a Flexible Spending Account (FSA), which is also a tax advantaged health care expenses account, the HSA isn’t a use it or lose it proposition every year. The money you contribute to your HSA will continue to grow over time if you don’t use it. That means that your balance will grow from year to year and down the road your money can be used to pay for medical expenses with no taxes taken out.

The HSA is used in conjunction with a High Deductible Health Plan, so when you have one of those your premiums are usually going to be lower. You have lower premiums, but you’ll end up paying more of your health care costs up front. These types of plans are perfect if you’re young and healthy, or if you don’t have many health care costs. You can save money now on premiums and start socking away money in your HSA for the future when you might have a few more health care costs.

Who Can Open A HSA?

People who meet the following eligibility requirements can open a HSA:

- You must be covered by a High Deductible Health Plan (HDHP).

- You can’t be covered under another medical health plan that isn’t an HDHP.

- You can’t be entitled to Medicare benefits.

- You can’t be claimed on another person’s tax return.

- You can’t be eligible for Tricare or have received benefits from the Veteran’s administration in the past three months.

For most people, the main requirement from the above eligibility guidelines is that you must have a High Deductible Health Plan in order to have a Health Savings Account.

How Much Can I Contribute To My HSA This Year?

HSAs have a limit to how much you can contribute in a given year. The 2021 HSA annual contribution limits are:

- Individual Coverage Contribution Limit: $3,600

- Family Coverage Contribution Limit: $7,200

Individuals who are 55 or older may be eligible to make a catch-up contribution of $1,000 in 2021.

| Health Savings Account (HSA) Contribution Limits | 2019 | 2020 | 2021 |

|---|---|---|---|

| Individual Limit | $3,500 | $3,550 | $3,600 |

| Family Limit | $7,000 | $7,100 | $7,200 |

The maximum contribution amount for an individual in 2021 went up by $50 over the 2020 maximum, and for a family, it went up by $100.

Health Savings Accounts are used along with a High Deductible Health Plan as mentioned above. Let’s take a look at what constitutes a HDHP.

Basics Of A High Deductible Health Plan

A High Deductible Health Plan (HDHP) is basically an insurance plan that has a higher deductible, and higher maximum out of pocket cost than a traditional plan. With one of these plans you’re expected to cover more out of pocket costs up front, with the return of lower premiums and tax savings via HSAs. HDHP are basically there to cover catastrophic health events. The Treasury explains HDHP like this:

You must have an HDHP if you want to open an HSA. Sometimes referred to as a “catastrophic” health insurance plan, an HDHP is an inexpensive health insurance plan that generally doesn’t pay for the first several thousand dollars of health care expenses (i.e., your “deductible”) but will generally cover you after that. Of course, your HSA is available to help you pay for the expenses your plan does not cover.

The IRS issues yearly guidance on High Deductible Health Plans in regards to an annual deductible minimum (amount you must pay before insurance kicks in), and a maximum out of pocket cost.

For the calendar years of 2021, the minimum deductibles and out of pocket maximums for a HDHP are as follows:

| High Deductible Health Plan Requirements | 2019 | 2020 | 2021 |

|---|---|---|---|

| Minimum Annual Deductible Individual | $1,350 | $1,400 | $1,400 |

| Minimum Annual Deductible Family | $2,700 | $2,800 | $2,800 |

| Maximum Annual Out Of Pocket Individual | $6,750 | $6,900 | $7,000 |

| Maximum Annual Out Of Pocket Family | $13,500 | $13,800 | $14,000 |

So in other words, in order to have insurance coverage kick in, an individual must pay at least a minimum of the first $1,400 in costs, or for a family – $2,800. After that, there will be co-insurance up to the maximums of $7,000 for individuals and $14,000 for families.

Your individual plan may have higher minimums, and lower maximums.

How Do You Withdraw Money From Your Health Savings Account?

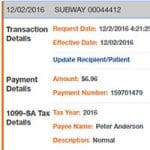

When you withdraw money from your HSA the withdrawals are tax-free as long as they’re for eligible medical expenses. You can usually withdraw your money in one of the following ways:

- Debit card: Some HSA accounts will have a debit card to use to pay directly for medical expenses.

- Check: Some have checks, where you can write yourself a check for eligible expenses as they come up.

- File paperwork: Some accounts will require you to file paperwork in order to be reimbursed, similar to some FSA accounts.

Penalties For Non-Eligible Withdrawals

If you make a withdrawal from your account for anything other than approved medical expenses you will pay a penalty.

- You will be taxed at your regular tax rate.

- You will have to pay a 20% tax penalty.

There is a caveat on having to pay a penalty on non-eligible withdrawals. If you have reached the age of 65 or are disabled, there is no penalty and the money is yours to use as needed. Because of this some folks use the HSA as back door way to save for retirement, similar to an IRA.

Conclusion

So the amount you can contribute to a HSA is going up slightly over last year, as are the maximum out of pocket costs for a High Deductible Health Plan.

For us, the HSA in conjunction with an HDHP will mean we’ll probably pay a bit more this year. We’re unfortunately high users of health care, and as such these plans aren’t ideal for us. On the other hand, at least we still have employer-provided insurance – unlike a lot of people, right?

We’ll just have to make the best of it, be careful about our health care spending and do our best to save up the money in our account for current and future expenses.

Have you used a HSA? How has it worked out for you?

Just to add another tidbit of information to this conversation, my husband and I are also signing up for an HSA health plan this year for the first time. We have always had a copay plan with a high deductible that was not HSA eligible. When we ran the numbers, we found that because the savings in premiums is $400+, and our deductible is only increasing by $2000, there is almost no way, mathematically, that we would pay more with the HSA, even if we hit our deductible. Yes, we pay more for doctors visits and prescription drugs, but all goes towards the deductible and the $400 per month savings more then makes up for that. You just have to run the numbers on your particular plan(s) to see how it will affect you.

I am currently in a HDHP with my employer and established an HSA years back. In 2019, I may need to purchase my own private insurance for my family through the exchange (i.e., healthcare.gov). What is the thinking behind a cap on out of pocket maximums to be eligible for an HSA? For instance, there are plenty of private plans available through the exchange with high deductibles such as $3,000 individual/$6,000 family(above the HSA threshold), but the out of pocket maximums are above $6,750/$13,500; therefore, the plans are ineligible for an HSA. This makes no sense to me. The insured seems to get penalized for being in a plan where he/she will owe too much out of pocket in a given year. None of the plans I am eligible for through the exchange qualify for an HSA. Any insight on the matter? Thanks.