I was scouring my website’s analytics this morning in search of some good topics to write about. One set of keywords I saw pop up several times in the logs was the “what is a good credit score“. People were finding one of my posts on google that talked about how to improve your credit score, and a commenter had asked the question of “what is a good credit score anyway?”. The question was asked, but I realized that I had never really answered the question of what a good credit score is.

Today I want to take a brief look at the question of how credit scores are created, what factors are taken into account and what exactly is defined as a good credit score.

Quick Navigation

A Good Credit Score Is..

There are several different credit scores floating around out there from different credit agencies, but the important one used by lenders is the FICO (Fair Isaac Corporation) score. FICO credit scores range from 300-850.

It’s generally agreed that a good FICO credit score is going to be anything above a score of 700-720. Average credit scores are going to be around the 680-700 range, depending on your source. You’ll be tagged as a poor credit risk if your score is 620 or below.

Here’s a table showing approximate credit score ranges (There is no universally accepted credit score range).

| Credit Score | Description |

|---|---|

| 750-850 | Excellent credit. |

| 680-749 | Good credit. |

| 620-679 | Average credit. |

| 560-619 | Poor credit |

| 300-559 | Bad credit. |

What Goes Into A Credit Score?

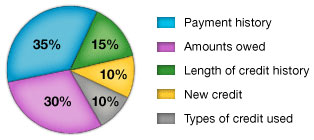

One thing that confuses a lot of people is just what goes into your credit score. I searched around and on MyFICO.com I found the following explanation of what factors go into your credit score, and how much they count towards your total score.

- Payment History (35%): They will look at your account payment information for different types of accounts, look for adverse public records, delinquency, paid accounts, number of past due items and more.

- Amounts Owed (30%): How much you owe on your accounts, number of accounts with balances, proportion of credit lines used, and more.

- Length of Credit History (15%): Time since accounts opened, and time since account opened by account type, time since activity on an account.

- New Credit (10%): Number of recently opened accounts, number of recent credit inquiries, time since credit inquiries, time since recent account openings, etc.

- Types of Credit Used (10%): Number of and different types of accounts.

For a more detailed explanation of how your credit score is determined, check out the post on MyFICO.com.

What Effect Does A Credit Score Have?

So the question is, what kind of an effect can a credit score have on what you pay for a home loan, an auto loan or other type of loan?

Home Loan Credit Score Effect

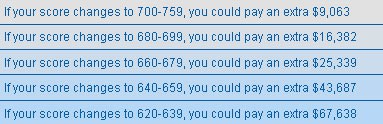

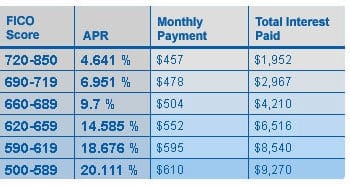

Here’s an example of what type of interest rate and payment you could expect to see depending on what your credit score range is. I created the following from a credit score calculator on MyFICO.com. It assumes a 30 year fixed loan for $200,000.

As you can see the total interest paid can vary pretty greatly depending on what your credit score range is. For example, someone with excellent credit can expect to pay $67,638 less in interest over the life of the loan than the person with poor credit. That’s a big price to pay for having poor credit! Here’s a look at how your payments would differ if your credit score were to drop from an excellent credit risk in our scenario above.

Auto Loan Credit Score Effect

For an auto loan, the effect is very similar. Here’s a look at a $20,000 48 month used auto loan.

So the difference in interest paid for someone who is at the top of the range and the bottom would be around $7,318 over the 4 year loan. That’s a big penalty for bad credit – it’s enough to buy another used car!

Get Your Credit Score

Find out how to get free credit scores from the big three credit agencies (TransUnion, Equifax, Experian) via this post: Free Credit Reports And Scores

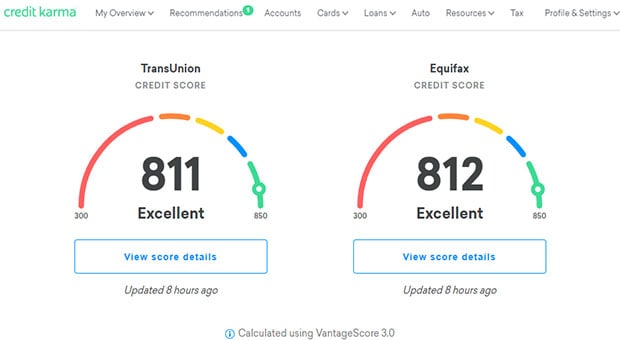

You can also find free non-FICO credit scores by using these free sites (with screenshots showing how your score will look):

- Credit Karma – TransUnion & Equifax Credit Score

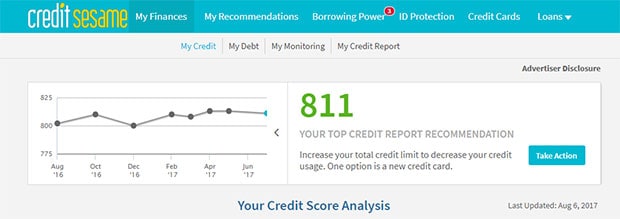

- Credit Sesame – TransUnion Credit Score

Get your actual FICO score (the one actually used by lenders) for free, or a one-time fee (It can be harder to find the FICO score for free):

- MyFICO: Free FICO score with a 10 day trial, just don’t forget to cancel!

Your Credit Score Is Important

Whether we like it or not we live in an age when having a good credit score is important. Having a good credit score can have an effect on whether you get a good loan, your insurance premiums are high or low, whether or not you can find a place to rent, whether you can get certain jobs, and whether or not you can sign up for certain services that require a certain credit score (cell, satellite, etc).

Whether or not you believe that credit scores are a good thing or not, the fact remains that they are becoming an integral part of our financial framework in this country. So you better know what you credit score is, especially if you want to get the best rates, the best job or a nice place to live.

Thanks for breaking this down!

Right now my credit score is average because of student loans, do you think I will have to pay off the majority of my loan balance in order to see my score go up? Or will paying the student loan consistently on time raise it even before I get most of it paid off?

It’s unfortunate the author didn’t take the opportunity to tell his readers that the credit scores offered by the individual credit reporting agencies, or anyone else besides Fair Issac are completly WORTHLESS and nothing more than a scam to get your money. No one looks at them and they can vary from agency to agency let alone what your REAL FICO score is. If you go to myfico.com you can get your REAL score as reported to lenders. Sure it’s not cheap or free but it’s REAL and it’s the only score that matters. Don’t be fooled!

I did mention up above that the one actually used by lenders is the FICO score, however, I don’t think the other scores are worthless. I’ve found that when I check them they’re essentially the same as my FICO score. While that may not always be the case, I do think those other scores from the other agencies have their place. Personally I prefer getting those ones for free via sites like Credit Karma or Credit Sesame. If you’re going to be taking out a big loan or something along those lines -it may pay to get your actual FICO score.

Tyler, your student loans have an impact but not the same as credit card debt. Loans such as house, car, student, even personal loans, are different. Not all debt is created equal. The bigger factor is your debt to available credit ratio. If you have 20,000 in student loans and $4000 in credit card debt on cards with a total credit line of $5000 the credit card debt, while much less than your student loans, will have a much greater negative impact on your score. Remember your score is a predictor of your ability to manage new debt. If you’re already maxed out on your credit cards to the algorithm FICO uses you are at risk of default. No idea what your situation is but just wanted to point out for others that it’s not as clear cut as your question may make it seem. Good luck!

Peter,

You had any dealings with http://www.ecredable.com/ ? I just heard of them the other day (not trying to plug them), just wondering if it is a real viable option for those without a credit score.

You asked the question “what is a good credit score” and you answered it well. Thanks for doing that and as far as you talking about where to get your credit score, you didn’t have too mention it at all because it was not the topic but you did touch on it a bit. Again thanks for sharing. I shared this post on my facebook fanpage. Again great post.

Great post! We’re trying to increase our score and right now they are both around 730.