As I mentioned in a previous posting on high yield savings accounts, lately I’ve been looking for a new online bank where we can put our money. Our current savings account is with the same company as our mortgage (Bank of America), and I decided that I wanted our savings to be at a different bank.

For quite a while now I’ve been hearing great things from other personal finance bloggers about ING Direct’s Orange Savings Account. They talk about the great variety of features and benefits of having an account, and to some degree they talk about ING as if it was something they couldn’t live without. (It’s almost a cult!) I had to find out what all the hub-bub was all about. This week I decided to finally take the plunge and sign up.

ING Direct Is Now Capital One 360. Read The Full Review Here.

Signing Up For ING Direct Orange Savings Is Easy

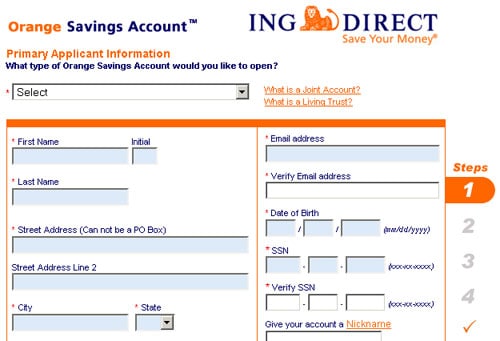

Signing up for an account with ING Direct is an easy process that will literally only take you a few minutes. Currently it’s a 4 step process where they’ll ask for your personal and contact information, linked checking routing and account numbers, and then ask you a few security questions in case you forget your password or sign into your account from a second computer. You can tell they take security seriously.

Once the initial sign-up process is done ING will make 2 small deposits into your linked checking account within a couple of days. You’ll need to login to your checking account, find out how much those small deposits are, and then verify the deposits in the ING Direct interface. Once you do that you’re ready to go!

Features Of The ING Direct Orange Savings Account

Once you’ve signed up you’ll discover that the ING Direct Orange Savings Account is one of the most full featured online high yield savings accounts that you can find. Here’s a quick rundown of some of the features that I’ll be taking advantage of.

- Good interest rate: While the interest rate isn’t currently the best in the industry, it is still certainly competitive.

- Ability to create budgeting sub-accounts: To me this is one of the main features, the ability to create budgeting sub-accounts, which allows you to set goal savings accounts. Have separate accounts for your vacation fund, your emergency fund, your property taxes and your year insurance bill. Set the accounts up, and then setup an automated transfers plan to fund those accounts.

- Ability to name sub-accounts: You can name your sub-accounts easily – calling them things like “Christmas Fund” or “Vacation”. That means it’ll be easier to remember what the accounts are for since descriptive names are so much better than “account # 232231422123”.

- Quick transfers to and from my local bank: Linking your bricks and mortar checking account is a snap, and the transfers between accounts are quick.

- Easy remote deposits via scanner or smartphone: You can make remote deposits by scanning in your checks or by taking a picture of them with the ING App.

- Automated transfers: You can setup automated transfers every month that will allow you to fund your different savings goal subaccounts that you’ve set up. It makes it super easy when you can set it and forget it!

- Security. ING’s security features are top-notch. They are consistently ranked among the top financial online banking institutions in security reviews, and you can tell when you sign up that they take it seriously.

Those are only a few of the many features that I’ve already found and loved with my new ING Direct Orange Savings Account. I think the addition of ING to my portfolio will be a great tool that will allow us to further improve our budget, and make saving for our goals that much easier. I highly recommend others sign up for ING as well and use it as part of their own path to financial freedom!

Already have an account with ING? How do you like it? What features are your favorite? What are some things that you think new account holders should be aware of?

ING Direct should honestly be paying me for how strongly I promote their products… but I gladly and willingly do it for free!

I am 33 years old and have always hated banking… until I signed up with ING Direct. They are the only bank that has ever seemed to truly have their customers best interests at heart.

Congrats on joining the club Pete!

Matt Jabs´s last blog ..Spending Filters – How I Save Money On Just About Everything

Wow. Step by step instructions. It’s like a manual. Maybe ING should send customers here.

David Leonhardt´s last blog ..Look who follows NoFollow links!

Know what’s great about them? Their customer service! Any time I’ve had to call them they have been extremely helpful. Their rates aren’t always the highest but their customer service keeps me as a customer!

FFB´s last blog ..9 Things Stress Can Prevent You From Accomplishing

Excellent review, Pete. You won’t be disappointed and you’ll slowly start moving your banking to them. They make it so easy. I keep a local bank though mainly for deposits.

PT Money´s last blog ..How to Effectively Use 0% Balance Transfer Credit Cards

That subaccount feature is definitely cool, my old credit union used to do the same thing, weighing them and Ally bank myself, maybe I’ll do both.

Paul @ Fiscalgeek´s last blog ..Make a Homemade Toy That Kids Will Want: The Grappling Hook

I’m thinking that I’ll use ING mainly for the subaccount and budgeting features, to help save up for certain short term savings goals. I’d like to open a second account with higher interest for our 8 month emergency fund that we’ve built up. Right now i’m leaning towards ally or discover bank. Check out my Best Bank Rates page for some of the highest rates.

The subaccount option is AMAZING! My wife and I have 9 different subaccounts which pull different amounts of cash from our checking account each week (some are bi-weekly). Our accounts range from the baby fund to a vacation fund!

LOVE IT!

My Journey´s last blog ..Strange Will Bequests and Estate Plans

I have been using ING Direct for about three years now. I am completely an ING Evangelist. Unfortunately, rates have plummeted for everyone so I’m not getting the 4.5% I once was. But all of the other features, the ease of use, and the mentality of the company can’t be beat.

Adam@RabbitFunds´s last blog ..Insurance Series: Home Owner’s and Renter’s Insurance

We’ve used ING for several years now as a place to park our emergency fund – or at least a large chunk of it. No complaints – just don’t lose your password. Security features make it a pain in the butt to reset, and then they mail it to you. I know that this is actually a good thing, just painfull to wait 3 days.

Mr. Not the Jet Set´s last blog ..Dresser Take Two

I’ve used ING Direct since 2003 and love it. Plus, their customer service is spectacular; I’d say better than companies like AMEX and Fidelity. Good luck with the Orange Dot!

I forgot to add that we also use ING for our brokerage account. It’s a simple way to buy and sell stocks; we don’t actually use the Sharebuilder functionality. Anyways, the two link together seemlessly.

Hi, this post is a little old by now, but I wanted to ask if you know we can do direct deposit into this account (so that I won’t have to deposit my whole paycheck into my checking and then transfer it to ING).

Is the $25 offer for opening a new account still available ? If so, can anyone send me the referral link or post here ? All the links I have tried are expired.

INGDIRECT saving and checking account are OK, but their easy orange mortgage is terrible. First of all, when I applied mortgage, the customer service gave me the wrong information. They said that when I relock my rate, the clock does not restart which means that no matter how many times I relock my rate, the prepayment penalty only applies to the 1st year from the initial refinance. But when I signed the paper work, I saw that I still need to stay with ING for another year to avoid the prepayment penalty. Then I called customer service, basically they said that I could get out of my loan now but I still had to pay $300. I went ahead sign the loan because I thought relocking the rate for $700 is still attractive which they advertise it. Then now I am ready to relock, they told me its two month mortgage or $2500 just to relock the rate. I will never use ING mortgage.

No minimums, no fees! And INGdirect.com means just that. I have banked with ING since August of 2006 and have NEVER been assessed a fee or had some kind of penalty for a balance that was below some “minimum”. They say what they mean and mean what they say…. a bank that’s consistent! No surprises.

Last I looked, though, my interest on savings was .80%, has it increased?

Sorry about the interest being off, the post was originally written a couple of years ago when interest was higher. Removed the specific rate mention from the post. You can find updated rates on my updated bank rates page.